National Bank of Hungary Preview: Committed to tackle inflation

The National Bank of Hungary will put more emphasis on the pro-inflationary impact of the war than on the negative economic activity impact. Thus, we see a hawkish 100bp hike in the base rate on 22 March followed by a 50bp move in the 1-week deposit rate. With advanced optimism ruling the markets, the forint could gain further

| +100bp |

ING's callChange in the base rate |

The rationale behind our call

The National Bank of Hungary lived up to its communication strategy of being flexible, as it hiked both the 1-week deposit rate and the overnight and 1-week repo rates in the past weeks. With some relative calmness on the FX markets the focus should be on the other mantra: stability/predictability. This motto would mean the continuation of the regular rate hike cycle.

In this respect, we see the central bank moving up the whole interest rate corridor and the base rate by 100bp. With that, the base rate would sit at 4.40%. To continue the pledged convergence between the base rate and the 1-week deposit rate, we see the latter raised by 50bp. The forward guidance should remain hawkish, suggesting further rate hikes and probably an implicit reference to a lengthier rate hike cycle with a higher terminal rate compared to the pre-war environment.

The main interest rates in Hungary (%)

This thinking will be reflected in the new staff projection in the March Inflation Report as well. The previous 4-5% GDP growth range in 2022 could remain roughly unchanged. Since the December projection the actual economic activity was much better (4Q21 and early 2022), but the war poses clear downside risks. Here, we foresee only a minor downgrade and probably an unchanged 2023 outlook (3.5-4.5%).

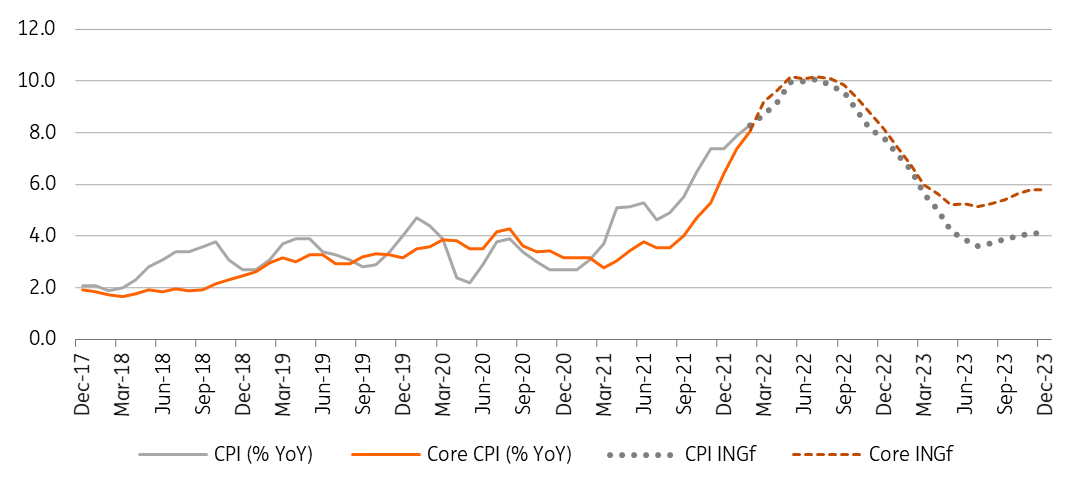

Headline and underlying inflation measures (% YoY)

When it comes to inflation, the previous 4.7-5.1% range is utterly outdated. We expect to see the central bank with a 7.5-8.5% reading, and hoping for some positive developments later in this year. In contrast, our base case scenario sees average inflation around 9% in 2022. The 2023 CPI outlook will move higher from 2.5-3.5% as well, maybe signalling a range not containing the 3% inflation target.

Inflation forecast of ING (% YoY)

When it comes to the risk assessment, we expect the focus to be on the significant upside risks in inflation, even in some cases when the growth outlook will be dampened by negative developments. In all, the NBH will emphasise further its flexible and predictable modus operandi during the continued tightening cycle.

What to expect in FX and rates markets

The monetary policy decision is expected to be orchestrated in a way to show the central bank’s unwavering commitment to tackle inflation. The hawkish hike could give further support to forint, which has shown a 7% gain versus EUR due to the relatively sanguine approach of markets regarding the peace talks. If the Ukraine conflict does not escalate further, we believe EUR/HUF will return to the 360-370 range thanks to NBH support, a near-record market interest rate differential and a decline in the risk premium. On the other hand, the Ukrainian conflict and the upcoming elections remain a risk to the HUF recovery.

Hungarian yield curve

With a better-looking HUF profile, the market has started pricing out some tightening (3x6 FRA at 7.52%). This might continue as the forint regains stability or strengthens further. However, in our view, the market is underestimating the inflation trajectory in the months ahead and the need for further interest rate hikes. We see headline inflation touching the double-digit territory in the coming months with a moderate deceleration in the second half of the year. Therefore, in the coming days, we see room for market expectations to move up (6x9, 9x12 FRA) closer to our expected terminal rate of 8.00-8.25%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article