More renewables mean more metals

Under all our scenarios we see a boost for metals demand from the power sector. This is driven by a combination of growth in global power demand, along with the expectation that we see a growing share of renewables in the energy mix

The renewables boost

The share of renewables is set to grow in the global power mix, and this will be predominantly driven by wind and solar. In our 'Wait-and-See' scenario, we see the combined share of these two growing from 9% to 23% by 2040, while under our 'Fast Forward' scenario we see this share growing to 55% by the end of the period. This growth in variable renewable energy will mean a growing need for energy storage. Even under our most pessimistic scenario we would see average annual growth of around 12% in stationary energy storage, while under our most aggressive scenario, average annual growth in energy storage would be around 23%. Admittedly, we are starting with a low base when it comes to stationary energy storage.

Let’s not forget that as we see more electrification, there will need to be further investment and expansion in distribution and transmission lines. The total distance of these lines is currently around 79m km according to the IEA, and could reach more than 112m km under our 'Fast Forward' scenario.

How much additional metals demand could we see?

Before we dive into the potential demand growth for each segment within the power sector, we will summarise the aggregate numbers by scenario:

- Wait-and-See: Copper demand from the power sector grows from an estimated 3.6mt per year in 2020 to almost 4.7mt per year by 2040, which is equivalent to an annual growth rate of around 1.3%. Aluminium demand under this scenario increases from 5.7mt to around 7.2mt per year by 2040. Nickel, cobalt and lithium see stronger demand growth under this scenario, growing by around 7.5%, 2.5% and 8%, respectively per year, but the base is much lower for these metals as well as the absolute demand growth.

- Likely Tech: Our middle of the road scenario sees higher growth for all metals. Copper demand is expected to increase at an annual growth rate of 3.2% per year to total around 6.8mt by 2040. Aluminium demand totals 10mt by the end of the period, growing at 2.8% per year. While nickel, cobalt and lithium grow at an annual rate of 13.9%, 8.7% and 14.5%, respectively.

- Fast Forward: For our most aggressive scenario, annual copper demand could grow to as much as 7.8mt by 2040, while aluminium demand is expected to reach around 10.8mt by 2040. Unsurprisingly, nickel, cobalt and lithium see the strongest percentage growth under this scenario.

Power sector metals demand by scenario (k tonnes)

Aluminium and copper make up the bulk of metals demand from the power sector. The dominance of these metals is driven by transmission and distribution, with this subsector making up 86% and 80% of aluminium and copper demand, respectively. Solar and wind are the next largest contributors to aluminium and copper demand from the sector. For energy storage, nickel, cobalt and lithium dominate metals demand when it comes to stationary energy storage. Copper and aluminium play an insignificant role in energy storage.

Metals demand split by subsector (%)

Transmission & distribution lines supportive for aluminium and copper

The energy transition will drive a stronger move towards electrification which means we will need to see significant investment in the power grid. We see strong growth in power demand for all scenarios. In addition, more but smaller renewable projects (relative to fossil fuel power plants) will require connections to the grid. The total length of transmission and distribution lines is estimated at 79m km, according to the IEA. The bulk of this will be made up of distribution lines, with transmission lines making up only around 7m km. By the end of 2040, we are assuming that this infrastructure grows to around 108km under our 'Likely Tech' scenario. Our pessimistic scenario sees transmission and distribution growing to almost 102m km while our 'Fast Forward' scenario sees this grow to a little over 112m km. On top of an expansion in transmission and distribution lines, we also factor in the upgrade and replacement of aging infrastructure.

The key metals which stand to benefit from an expansion of the grid are copper and aluminium. While aluminium only has about 61% of the conductivity of copper, it is cheaper and lighter and therefore still makes sense to use, particularly for overhead lines. How much each stands to benefit will depend on the trends we see in the type of distribution and transmission lines used. Overhead lines predominantly use aluminium for both transmission and distribution. However, copper is more commonly used in underground and subsea cables, particularly for transmission lines. We assume underground distribution lines will be predominantly aluminium. The differences do not stop there, much will also depend on whether we see more AC or HVDC lines. AC lines are made up of three conductors, while HVDC are generally made up of two. There has been a trend of increasingly using HVDC, which reduces the amount of metal needed in power lines.

Under our 'Wait and See' scenario, aluminium demand from transmission and distribution lines grows from an estimated 4.9mt in 2020 to 5.7mt in 2040. While the 'Likely Tech' and 'Fast Forward' scenarios see aluminium demand hitting 6.6mt and 7.2mt, respectively by 2040.

As for copper, demand is estimated at around 2.9mt in 2020. Under our three scenarios, 'Wait and See', 'Likely Tech' and 'Fast Forward', these are set to grow to 3.2mt, 3.7mt and 4.1mt, respectively by 2040.

Expansion in transmission and distribution lines boosts metals demand

Growing share of solar in the power mix to benefit metals

Solar PVs use a whole raft of metals, including copper and aluminium. Copper is used in the modules, inverters and balance of system. Aluminium is used in panel frames, while it can also be used for mounting systems and a substitute for copper in inverters. Solar PVs use very little nickel, cobalt or lithium although clearly, if stainless steel is used in the production, this will be indirectly beneficial for nickel as nickel is used to make stainless steel.

Under our three scenarios, we see significant growth in the share of solar in the global power mix. Under 'Wait and See,' the share of solar grows from around 3% to 10%, our 'Likely Tech' scenario sees this share growing to 17% by 2040, while under 'Fast Forward' we see solar making up 25% of the global power mix.

Given the relatively low capacity factor for solar, a significant buildup will be required. The current capacity factor is in the region of 18%. However, one would expect this to trend higher over time. This improvement would be driven by increased installations in higher irradiation regions, along with technology improvements. Over the last decade, the average capacity factor has already increased from around 14%. We assume that by 2040, the capacity factor would have increased to around 25%. This improvement suggests the need for less metal per unit of solar energy produced.

Under our different scenarios, we expect upside for copper and aluminium demand from the solar industry. Given the expectation that we see a swifter pickup in the move to renewables under 'Fast Forward', annual metals demand will peak sooner than 2040, with growth in solar deployment slowing towards the end of the period. This leaves annual demand under our 'Likely Tech' scenario higher than 'Fast Forward' by the time we get to 2040.

Metals demand from solar

Wind to be the largest share of the power mix under 'Fast Forward'

Wind power will be crucial for the energy transition, and under our 'Likely Tech' and 'Fast Forward' scenarios will hold the largest share of the power mix by 2040. We are assuming that wind holds a 30% share of the mix by the end of the period under our most aggressive scenario, and a share of 22% under 'Likely Tech'.

Aluminium and copper are also set to benefit from this growing share of wind power. Aluminium is used in components such as the tower, housing for the drive train and other components. Copper is used in coil windings, conductors, transformer coils and earthing. Given the use of stainless steel in wind turbines, nickel demand will indirectly benefit as well.

There are a number of different types of wind turbines but geared wind turbines continue to make up the bulk of the market. Geared turbines are generally cheaper than the alternative, direct drive systems. However, as direct drive systems have fewer components, they may make more sense for offshore installations. Offshore installations usually require higher maintenance and so reducing the amount of components reduces the potential frequency of servicing.

Under our scenarios, we have taken into consideration the use of both offshore and onshore wind. Currently, onshore is the most prevalent. Somewhere in the region of 95% of wind capacity is onshore. Not only is this due to lower installation costs relative to offshore, but also lower maintenance costs. Still, the share of offshore wind will likely grow over the period and we are assuming that offshore makes up around 14% of total wind capacity by 2040.

Wind power has a higher capacity factor than solar. Onshore wind has a capacity factor in the region of 35% compared to offshore wind which is in the region of 43%. This is one reason why we would expect to see the share of offshore wind grow. Through until 2040, we would also expect to see an improvement in capacity factors, and by the end of the period we expect onshore and offshore to grow to around 44% and 49%, respectively. These efficiency gains would mean that over time, less metal would be needed per unit of energy produced.

In addition to the deployment of new capacity, we must also take into account the replacement of ageing capacity.

Our 'Likely Tech' and 'Fast Forward' scenarios suggest sizeable upside in copper and aluminium demand with the buildup of wind capacity.

Metals demand from wind

Growing share of renewables will increase need for energy storage

Growth in variable renewable energy will require further short-term energy storage solutions, given the intermittent nature of renewables. We assume this will be predominantly lithium-ion batteries. We estimate current capacity to be in the region of 15GW.

Under our most pessimistic scenario, we forecast that stationary battery storage capacity will grow to almost 152GW by 2040. While under our 'Likely Tech' and 'Fast Forward' scenarios, we see capacity growing to 466GW and 964GW, respectively by the end of the period.

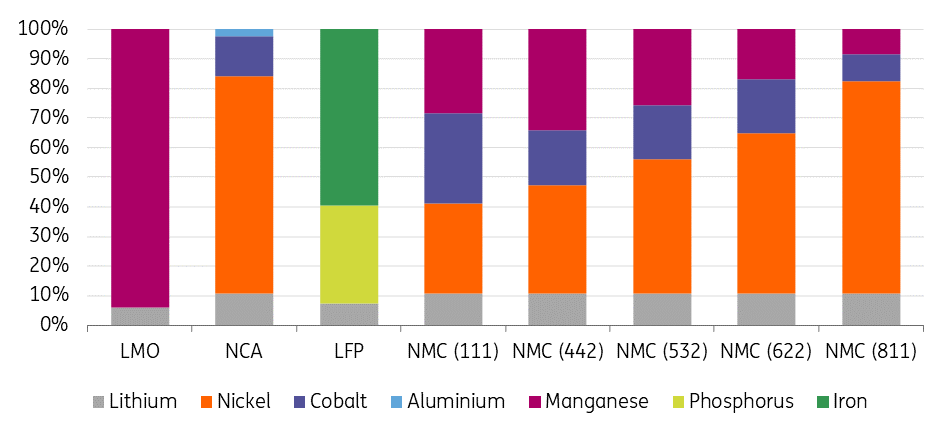

Forecasting metals demand for energy storage is a challenge given the number of different battery chemistries available. In addition, it is likely that some current chemistries may cease to exist altogether, driven out by new and more efficient batteries. However, we will take into consideration the different lithium-ion chemistries currently available. We assume that lithium iron phosphate (LFP) batteries will dominate the stationary battery storage market through until 2040, despite nickel manganese cobalt (NMC) batteries currently making up the bulk of lithium-ion storage. LFP are generally more cost competitive compared to NMC batteries and so should drive higher usage of LFP batteries. In addition, LFP batteries have a lower energy density compared to NMC batteries and given the greater need for higher energy density batteries in electric vehicles, it is likely that we see NMC batteries used mostly in EVs, while stationary storage adopts LFPs.

In addition to the cathode, there are also other components to the battery. There is the anode, foils, binders, separator and the casing & terminals. Copper and aluminium are used in the foil and casing & terminals.

Given the expected dominance of LFP batteries in stationary storage, the demand boost for nickel and cobalt is much more limited than if the industry were to focus on other battery chemistries, such as NMCs. The clear upside risk to nickel and cobalt demand is if the industry continues to favour NMC batteries over LFP batteries.

Lithium-ion battery cathode composition (%)

Copper and aluminium see the strongest demand from stationary energy storage under all our scenarios. However, it is important to remember that the absolute demand increase for metals from stationary storage is a fraction of what is expected from electric vehicles.

Energy storage metals demand (k tonnes)

In the next two articles, we shift from looking at different demand scenarios to focusing more on the metals and mining industry. This will include decarbonisation and disclosure within the sector, as well as green investment.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

13 October 2021

Energy transition: Metals demand set to take off This bundle contains 7 Articles