Eurozone: Looking for the trough

With 0.2% growth quarter-on-quarter, third quarter eurozone GDP growth came in better than expected. However, the economy continues to decelerate and it looks as if the trough in the current slowdown might still be a few months away. With a new president at the helm at the ECB, monetary policy is unlikely to change over the forecasting period

Anticipating a turnaround

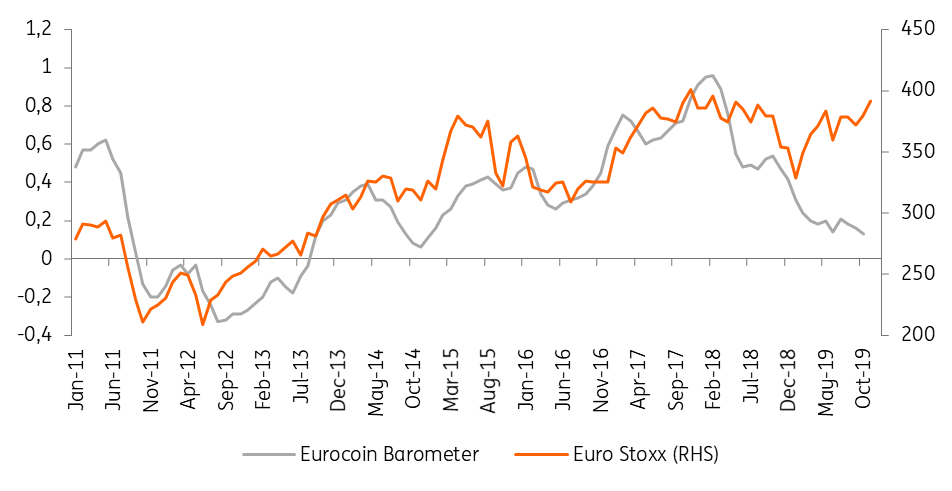

European stock markets have been rallying in October in the hope that some of the outside risks are diminishing and a turnaround in activity is around the corner. That said, the eurocoin indicator- a nowcasting tool for the eurozone, fell from 0.16 in September to 0.13 in October, continuing its downward trend.

The forward-looking indicators in the European Commission’s business and consumer survey don’t signal an imminent turnaround in the weakening trend either. Especially the manufacturing sector continues to suffer, with both the order books and the employment expectations component further declining. The falling capacity utilisation doesn’t bode well for business investment and it is clear that as long as there is not more certainty in terms of the trade war and Brexit, businesses will be reluctant to initiate new projects.

Stock market anticipates a turnaround

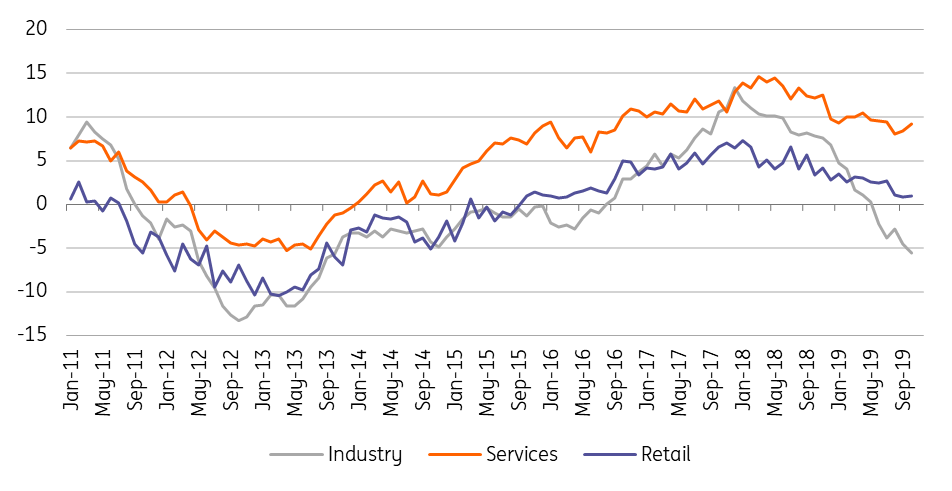

Contagion from weak manufacturing

The bad news is that services are also beginning to feel some impact of the slowdown in manufacturing, with the sentiment indicator now below its long-term average. But on the positive side, it must be noted that hiring intentions are still holding up. And that is important, as a strong labour market is supporting private consumption. The unemployment rate was unchanged at 7.5% in September, still the lowest level since July 2008. But consumer confidence is of course also important and here things start to look a bit shaky, too. Consumer confidence fell in October to the lowest point since December 2018 and is now also below its long term average.

Since the summer, households have started to become more concerned about the labour market. No wonder that the savings ratio has been creeping up and without any confidence-boosting event this trend is likely to continue, putting a brake on consumption growth. On the other hand, construction activity still seems to be holding up well, boosted by the very low level of interest rates. Both order books and employment perspectives actually went up in October in the construction sector.

Only gradual fiscal stimulus

The new ECB-president Christine Lagarde called upon countries, that have room for manoeuvre, to use their budget surpluses to fund public investments. While the Netherlands has already put in stimulus in the 2020 budget, the German government is unlikely to contemplate more stimulus, as long as there is no significant deterioration in the labour market. To be sure, the first signs that employment growth is over the top are popping up, but we might already be well advanced into 2020 before the German government decides on more stimulus.

Recession avoided

We still believe that the current downturn will not degenerate into an outright recession. The combination of easy monetary policy and some fiscal stimulus, together with a trade truce and a clean Brexit, will support a cyclical improvement in the course of 2020. Not enough to lift growth above 1% though (we expect 0.7%) and given the importance of an improvement in terms political uncertainty, the risks to the outlook are still downward.

Employment perspectives

Yield curve steepening

Eurozone inflation fell to 0.7% in October, however, this decline was mostly due to lower energy prices. Underlying inflation actually slightly increased to 1.1%, though this is still significantly below the ECB’s target. Given the growing dissent in the ECB’s Governing Council we hardly see a possibility for more stimulus and the overall feeling is that the marginal positive effect of more monetary easing would be annihilated by the growing negative side-effects. It also looks that a big review of the ECB’s strategy is underway, which is likely to dominate discussions within the Governing Council for some time to come, with monetary policy to remain on hold in the meantime.

While we believe that the yield curve is likely to steepen in 2020 on the back of the expected cyclical improvement, we wonder whether the recent increase in bond yields has not been a bit premature. Expect bond yields to bump close to their recent lows for a few more months before a weak upward trend might materialise.

Download

Download article

8 November 2019

November Economic Update: Trading the positives This bundle contains 9 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more