Monitoring Romania

With inflationary pressures apparently under control and GDP growth still resilient it might seem that Romania is successfully managing a slowdown of its economy. In 2023, EU funds absorption will be key to maintaining the good momentum in the fixed investments area and offset the likely slowdown in private consumption

A snapshot of Romania’s economy

- GDP: The 1.1% sequential expansion of the economy in the fourth quarter of 2022 came largely in line with expectations, taking full-year GDP growth to 4.8%. We maintain our 2.5% GDP growth estimate for 2023 and 3.7% for 2024.

- Inflation: We see the inflation peak as behind us at 16.8% in November. January 2023 CPI already touched 15.1% and we anticipate a gradual shift lower throughout the year. We estimate the year-end inflation at 7.4% with risks slightly to the downside. We do not envisage inflation back within the National Bank of Romania’s (NBR) target range of 1.5%-3.5% earlier than the two-year forecast horizon.

- EUR/RON and key rate: While not imminent, breaking above the 4.95 level seems less of a distant perspective. Once that happens, we see the 5.10 area as the next line in the sand for some time. The NBR is likely to keep the key rate at 7.00% for the rest of the year, though we do not completely rule out a modest cut towards the year-end.

- Twin deficits: For the third consecutive year, the current account deficit has been expanding while the budget deficit was shrinking. While we remain cautiously optimistic to see the later back below 3.0% of GDP next year, we are less hopeful on the current account side.

GDP growth: Slowing down but still resilient

The economy expanded in the fourth quarter of 2022 by 1.1% versus the previous quarter and by 4.6% when compared to the fourth quarter of 2021. This takes the full 2022 GDP growth to 4.8%, which is perhaps among the better figures that one could have hoped for.

Details of growth drivers for the fourth quarter (and by extension the full 2022) are due 8 March. The available high-frequency data suggests that it’s been a strong quarter for construction activity which expanded by 7.4% versus the third quarter. Services for companies were also around 2.0% higher while retail sales rose by 0.8%. Industrial production lagged at -2.1%.

GDP growth (YoY%)

Looking to 2023, our 2.5% GDP growth forecast was at the higher end of the estimates for a time, but now looks to be the consensus after many analysts and institutions revised their expectations higher as well. We maintain the current forecast and evaluate that risks are – dare we say – skewed to the upside! While a slowdown in private consumption could be visible in the first quarter of 2023, which might even bring the overall GDP growth close to zero, the strong momentum in investment activity (presumably related to EU-financed projects) should continue and more than offset that.

Industrial production

The industrial production contracted by 2.0% in 2022 and is still considerably below the pre-pandemic levels. Arguably the data is somewhat distorted by the large swings in the energy sector which has seen its output diminished by over 9.0% in 2022. The most important component of the industrial production – the manufacturing sector, which has around 80% weight in the overall index, has been in fact only 0.5% below the previous year. This result in the manufacturing sector has been distorted as well by the large declines in production in energy-intensive sectors, which had to reduce their activity throughout 2022 (e.g. chemical industry -21.6%, basic metals production -14.8%).

Industrial production by main groups

The latest confidence data is pointing towards a sluggish first quarter of 2023, with lower production expectations for the month ahead as the main driver for an overall fading confidence in industry.

Corroborating the above, we find relatively little reason to look for a robust 2023, though the room for further contraction looks limited as well. Lower energy prices and improved supply chains should support the recovery particularly in manufacturing, while the general economic growth slowdown could offset that via a softer external and internal demand.

Economic Sentiment Index - Industry

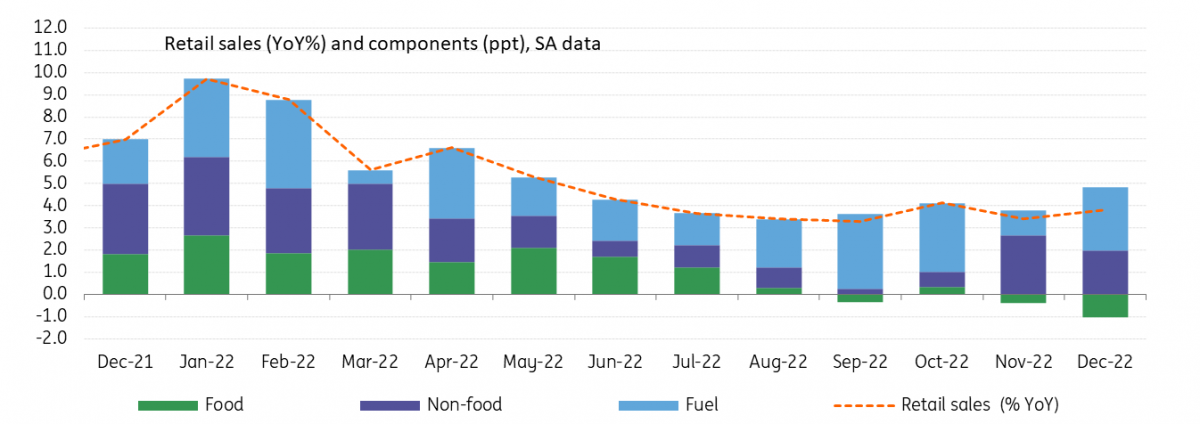

Retail sales

A 5.1% advance in retail sales in 2022 (adjusted for inflation) with a sequential acceleration in the last quarter, sounds about as good as it can get for the domestic consumption picture. With pent-up demand exhausted, consumers have settled into a sort of comfort zone which means lower but still steady increases in sales, with numbers steering clear from the contraction zone while not impressing on the upside either.

Breaking down the numbers, all main categories expanded in 2022, with food sales up by 2.9%, non-food by 4.7% and fuel by a relatively surprising 9.8%.

Retail sales flattening

Looking forward, we should start to see more pronounced effects of the 2022 negative real wage rates filtering into consumption. While for the full 2023 we might actually end-up with positive real wage growth, we believe that there will be lagged effects and it can take at least one to two quarters before consumers start feeling more comfortable spending. Meanwhile, prudence will predominate. It doesn’t necessarily mean a contraction in consumption, but at least in the first part of 2023 we might see numbers flirting with stagnation. This is consistent with latest surveys showing retailers anticipating lower sales over the next three months.

Real vs nominal wage

Construction sector

The construction sector has arguably provided one of the biggest positive surprises in 2022. It was already mid-2022 when we were still doubting whether the sector will stay in green or contract in 2022. What followed was two impressively strong quarters for both commercial and civil engineering construction, which led to an overall advance of the sector of 10.8% in 2022. The latter, especially, was rather long-awaited as it was most likely related to higher public infrastructure investment spending, facilitated by the EU’s Recovery and Resilience Facility.

Construction by main groups

After such an impressive second half of 2022, a slowdown to single-digit growth levels in the first half of 2023 might be normal to expect. By sector, the dynamics look somewhat foggier though. On the residential side, we still face the same context of higher interest rates and lower mortgage lending, which could keep residential construction subdued in 2023, despite the relative normalisation in the costs of the building materials.

Commercial constructions might still enjoy good momentum, but the real hope is still related to the civil engineering works, essentially meaning public infrastructure investments. The 2023 budget envisages public investments of around 7.2% of GDP which, if realised, would mark a new historical high. Coming from just above 5.0% of GDP in 2022, the 2023 investment plan looks genuinely ambitious and could provide a further boost to the construction sector.

Services

The service sector (services for companies) maintained a very strong momentum throughout 2022 and closed the year with a 27.2% higher turnover compared to 2021. In structure, the real estate services have advanced by a surprising 48.1%, but that’s also on account of a low comparable base from early 2021. IT services continued to outperform, advancing by 39% and basically doubling its size over the last 18 months.

Services rendered to companies

Turning to market services for the population, the picture looks slightly more nuanced. While the full-year turnover growth is very similar with the above (27.7%), the dynamic was slightly different. Essentially, we’ve had a very strong first half of 2022, followed by a gradual but visible growth deceleration towards lower double digits, as we approached the year-end.

Services for the population

Consistent with our prudent view for private consumption in the first part of 2023, we anticipate a slowdown in the service sector, but not a contraction. The shift lower is likely to be more pronounced in the retail space, though business-to-business activity is also likely to be impacted, with latest surveys indicating sharply lower demand over the recent months.

Trade balance and current account

The trade balance deficit reached quite an impressive EUR34.1bn in 2022, or approximately12.0% of GDP, after it widened by 44.0% in 2022 compared with 2021. Needless to say, the EUR34.1bn is the highest nominal deficit ever while the 12.0% of GDP is very close to the historical highs from 2007-2008. While we do recognize that the size of the economy is more than double nowadays and that particularly for 2022 some unfavourable (and presumably one-off) terms of trade applied, the continuous widening of the trade deficit over the last 8-9 years is troublesome to say the least.

Trade balance by main groups

As for the prospects of seeing an improvement in Romania’s trade balance, we remain rather sceptical. If anything, the improvement will be marginal and not materially change the overall weak picture. The relative normalisation in energy markets (and by extent of the external prices) will help to some degree, as well as the generally weaker economic picture, which should determine a better dynamic for exports compared to imports.

The unfavourable trade balance developments remain the root cause for the current account deficit, which has widened in 2022 to approximately 9.3% of GDP, from an already large 7.3% the year before. Blame it on supply chains in 2021, blame it on terms of trade in 2022, we remain seriously concerned about these developments.

Balance of payments by main categories (% of GDP)

For 2023 we do anticipate a correction of the current account deficit to around 8.0% of GDP, contingent on the stabilisation in the prices of commodities and – to a lesser extent though – the reduction of the budget deficit. On the latter, while we do recognize that the gradual adjustment towards the 3.0% of GDP target will help improve the current account as well, the relation might be weaker than expected. For more on this subject, we recommend an excellent IMF study from September 2022, dedicated partially to Romania’s current account imbalance.

Budget deficit

The multi-annual effort to bring back the budget deficit to below 3.0% of GDP is in full swing. To date, Romania ticked the intermediary milestones by reaching a 6.7% of GDP deficit in 2021 and 5.7% in 2022. So far so good we would say, but the most difficult part is to follow, as bringing the budget deficit from 9.7% in 2020 to 4.4% in 2023 is – somewhat counterintuitively – easier to do than bringing it from 4.4% to 3.0%. That is because we are now reaching the structural part of the deficit, the stickier one. Moreover, 2024 is an electoral year which usually doesn’t help with deficit reduction.

Budget gap (% of GDP)

That said, the commitment to the deficit reduction has so far been quite strong. Whether the fiscal consolidation will involve a complete rethink of the tax system, or a mild reshuffle of the current one is probably a matter for late 2024. Meanwhile, some patch work before elections could do the job. The publicly discussed one-off measures such as a solidarity tax for large companies apparently fits into this shorter-sighted policy framework compatible with electoral or pre-electoral years.

To sum-up, we expect the deficit target of 4.4% of GDP to be met this year. Going to 3.0% in 2024 will be challenging but it is clearly not out of the question.

Ratings

We remain of the opinion that Romania will maintain its investment grade for the foreseeable future. With fiscal consolidation underway, we think that agencies main attention point will shift from the budget gap to the external imbalances. While the issue is in many ways even trickier, we find it unlikely to be a game changer, at least for as long as Romania’s relation with the EU (and EU money) remains solid. We are reasonably optimistic that Fitch will change the rating outlook from negative to neutral in 2023. While more than that is difficult to be achieved before an electoral year, our expectations are slightly tilted to the upside, meaning that a positive outlook from S&P and/or Moody’s is not out of the question for this year.

Rating agencies

Inflation

We see the inflation peak as behind us at 16.8% in November. January 2022 CPI already touched 15.1% and we anticipate a gradual shift lower throughout 2023. We estimate the year-end inflation at 7.4% with risks slightly to the downside. The main factors acting to the downside are base effects, energy price caps, international energy and food prices stabilisation while acting to the upside are cost increases not yet fully passed-through, wage pressures and still negative real rates.

The NBR is likely to maintain the current course of its monetary policy, meaning the key rate should remain unchanged at 7.00% for the rest of the year. Shorter-term markets rates – which are more dependent on interbank liquidity situation – might have neared a bottom these days, though that doesn’t necessarily mean that an upward trajectory is to follow. In essence, we expect stability around current levels. The liquidity picture is more likely to remain accomodative, though the surplus could shrink to more manageable levels (say RON5bn-10bn). Should the inflation trajectory surprise (even mildly) to the downside, we wouldn't rule out a modest rate cut by the end of 2023.

Inflation (YoY%) and components (ppt)

FX and markets

Since the beginning of the year, EUR/RON has already made several trips deep below the 4.90 level and we expect this pattern to persist. On the global side, we see good conditions for the entire Central and Eastern European region. A weaker dollar later should support EM FX, while sentiment in Europe continues to improve and gas prices are falling. However, the main factor behind the EUR/RON move is likely to be record demand for Romanian government bonds (ROMGBs), with large buyer flows driving large volumes into the RON, thus creating downward pressure. So overall, we remain positive on RON. Moreover, the current levels above 4.90 may thus be interesting again for carry trades and waiting for another trip to lower levels. However, we expect that once inflation in Romania comes under control and is credibly on a downward trend, the NBR will shift its focus to the still high current account deficit and we will see a shift of the current 4.95 the line towards the 5.10 area for EUR/RON.

On the bond side, the Ministry of Finance massively frontloaded the supply of ROMGBs during January and February. By our calculations, MinFin has covered roughly 37% of its planned ROMGBs issuance since the beginning of the year, by far the most in the CEE region, putting MinFin in a very comfortable position. In terms of fundamentals, we see inflation as the first in the region to start heading lower, we expect fiscal and FX to remain under control and the macro picture is still the brightest in the region with stable relations with the EU. Overall, Romania is thus our favourite story within the region along with the Czech Republic.

On the market side, we have seen a global sell-off in recent weeks pushing the 10y yield of ROMGBs to 7.80% from this year's lows to 7.25%. We could probably still see slightly higher levels in the coming days driven by the move in core rates, however any approach to the 8.00% level would, in our view, start a new wave of buying in the market given that we believe ROMGBs remain a market favourite within CEE due to the aforementioned reasons, pushing yields down again.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article