Monitoring Hungary: Waiting for more clarity

In our latest update, we reassess our Hungarian economic and market forecasts at a time when uncertainty remains high. The extent of the economic recovery is still undetermined, as is the fiscal outlook. Monetary policy enters a new phase in the second quarter as two rounds of reflation are ahead of us

Hungary: At a glance

- After disappointing fourth-quarter data, the government revised its expectations for this year’s GDP growth to a range of 2-3%, which is now closer to our forecast of 2.1%.

- Although the recent retail sales performance looks promising, industrial production has continuously disappointed, as risks are mounting in terms of the export outlook.

- The very tight labour market has eased recently, which is likely to put downward pressure on wage growth, while the government plans to boost labour supply.

- Although the trade balance has improved somewhat, the current account hasn’t caught up. Both are exposed to downside risks, stemming from external demand.

- Inflation is back in the central bank’s tolerance band, however, it would be too early to declare victory as we expect two rounds of reflation this year.

- The central bank erred on the side of caution in March and was as hawkish as expected, flagging an upcoming slowdown in the easing cycle.

- February brought an exceptionally high monthly budget deficit, but it’s hard to put this in context, as we’re still waiting for an official update to this year’s ESA-based deficit target, moving it to 4.5% of GDP.

- We are likely to see higher volatility in EUR/HUF in the coming months than in the first quarter, with our forecast of 405 for the end of the first half of the year.

- We find the long end of the IRS and HGB curves attractive and believe that once things calm down, market interest will return given the levels relative to CEE peers and core rates.

Quarterly forecasts

Waiting for the first quarter GDP data to come in

A few weeks ago we lowered our full-year GDP forecast for 2024 from 3.1% to 2.1% on the back of a much weaker carry-over effect. That said, the government's recent communication of 2-3% GDP growth suggests that they are getting closer to our own estimate. In the absence of new data, there is considerable uncertainty surrounding the economic outlook.

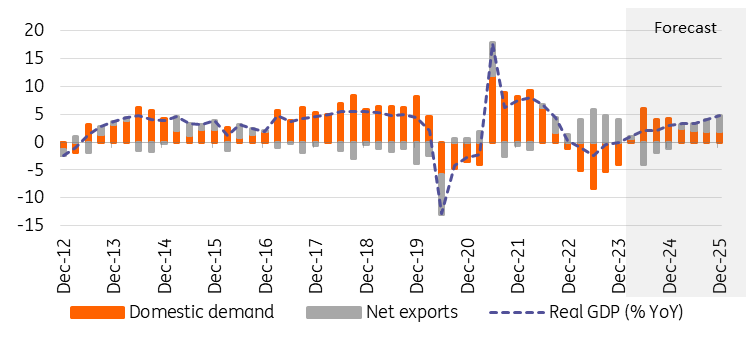

What's more, due to a methodological update, GDP releases will be brought forward (1Q24 data are due on 30 April). This means that the information base of forecasting will shrink this year, as we'll see one less data point from both retail sales and industrial production before the new GDP print. However, what has already been visible is a structural shift in the growth structure. Last year, growth relied on net exports, while this year domestic demand looks to be the main driver.

Real GDP (% YoY) and contributions (ppt)

Disappointing order books for export-oriented companies are worrying

Industrial production continued its downward trend in January, as production volumes fell by 1.1% month-on-month (MoM), contributing to a fall in output of 4.1% year-on-year (YoY) on a working-day basis. Volumes have contracted in the two most important sub-sectors, namely electrical and transport equipment. This isn't surprising given that external demand has become increasingly subdued, weighing on both industry and the country's trade balance.

The outlook is also uncertain as the stock of both export and domestic orders fell by 16.3% and 13.4% YoY, respectively. In our view, we may see an earlier rebound in companies' domestic order books as local demand is expected to gradually recover this year. However, there is a lot of uncertainty surrounding the export outlook, as global manufacturing is still digesting the inventory overhang.

Industrial production (IP) and Purchasing Manager Index (PMI)

It’s too early to call for a stable trend in retail sales

Retail sales ended a 13-month streak of negative year-on-year performance as the volume of sales rose by 0.6% YoY in January. However, on a monthly basis, sales volumes, adjusted for seasonal and working day effects, were flat considering all sectors. At the component level, food sales were also flat on a monthly basis, while turnover of non-food shops increased. At the same time, fuel retailing saw a sharp fall of 3.6% on a monthly basis, but this was fully expected as a result of the excise duty hike.

We believe that retail sales will gradually recover this year, but this trend will remain fragile. At the same time, we have already seen small increases in consumer confidence, which, together with positive real wage growth, will gradually reduce vulnerability and keep consumption on a gradual recovery path.

Retail sales (RS) and consumer confidence

Labour market tightness continues to ease

Recently, we have seen a further deterioration in the labour market statistics, with the three-month (Dec-Feb) unemployment rate rising to 4.7%. Meanwhile, anecdotal evidence points to a further reduction in job vacancies as companies cut back on hiring. As the tightness in the labour market continues to ease, this is putting downward pressure on wage growth, limiting the chances of consumption-led reflation.

However, this marked slowdown won't be reflected in incoming wage data until late spring, when last year's substantial wage increases (10-15% to compensate for the inflationary shock) will be incorporated into the base and offset this year's lower increase in compensation packages (5-10%). It is also an indication of the incipient difficulties in the labour market that the government is already planning a package of supply-side measures (first of all to help young people enter the labour market), financed by EU funds, to increase the overall participation rate.

Historical trends in the Hungarian labour market (%)

The export outlook remains uncertain

Throughout 2023, the trade balance improved markedly as domestic demand collapsed, reducing the need for imports, while export sales held up. In December, however, the trade balance surprised to the downside with a deficit of HUF 188bn, as external demand weakened markedly. The trade balance returned to surplus in January, but the current account hasn't followed suit.

As the export outlook remains much more uncertain than a year ago, we expect the trade and current account balances to post smaller gains but are likely to remain in positive territory. On the other hand, the country's import bill depends on the extent of the recovery in domestic demand and the import share of both consumption and investment activity, which used to be high in Hungary.

Trade balance (3-month moving average)

Buckle up for two rounds of reflation in 2024

Headline inflation is back within the central bank's tolerance band, as the year-on-year rate fell to 3.7% in February. The deceleration was mainly due to base effects, as the monthly inflation rate remains relatively high at 0.7%. At the component level, prices of durable goods fell on a monthly basis, while food, fuel, household energy and services prices increased. The latter component explains 71% of total inflation in terms of annual headline inflation.

In the coming months, we expect headline inflation to remain below the upper limit of the central bank's tolerance band, but from May we see a slight reflation driven by base effects. In this context, another round of reflation will emerge towards the end of the year, hence our call for year-end inflation in the range of 5.5-6.0%. However, the pricing power of companies will depend very much on the state of the economic recovery, posing a two-sided risk, for now.

Inflation and policy rate

Central bank scales back the easing of monetary conditions

At the March meeting, the National Bank of Hungary (NBH) reduced the pace of rate cuts to 75bp, bringing the base rate to 8.25%, while maintaining the +/- 100bp symmetric interest rate corridor around the base rate. With this move, the central bank erred on the side of caution. In its new forward guidance, the central bank made several hawkish hints. Most importantly, it narrowed its expected range for the policy rate at the end of June from 6.00-7.00% to 6.50-7.00%. This is still in line with our baseline scenario of a 6.50% policy rate after the June rate-setting meeting, so we leave our interest rate forecast unchanged. If anything, as a result of the new forward guidance and the recent market stability issues, we raise the possibility of a 50bp move in April (as opposed to our base case of a 75bp rate cut), as noted in our latest NBH Review note.

Real rates (%)

We already see some risks to the new deficit target

The official ESA-based deficit target for 2024 remains at 2.9% of GDP, but neither the market nor we really believe this can be achieved. Hungarian ministers are openly talking about a new deficit target of 4.5% of GDP, which is likely to be officially amended in the spring parliamentary session. However, based on our technical projections, we can already see a slippage of around 1.0-1.5ppt even on the soon-to-be-updated deficit target.

In our view, this gap can be narrowed either by government measures or by a change in the structure of economic growth. Last year was a recessionary year, but agriculture’s positive 2.2ppt contribution to GDP growth covered a lot of ground, which didn't help the budget too much in terms of revenue collection. In contrast, if we see a services-led recovery in 2024, the structure of growth could boost revenues beyond our technical projection, significantly narrowing the estimated gap.

Budget performance (year-to-date, HUFbn)

Forint’s positive reaction to hawkish NBH might be only temporary

EUR/HUF is hovering around 395 after the March rate-setting meeting, which is lower than in pre-meeting days but still higher than the dip seen in March. The forint has been slowly but surely building strength, suggesting that the central bank's hawkish tone has finally reached the ears of market participants. However, we wouldn’t go so far as to say that HUF is out of the woods. A small hope for further minor appreciation comes from the rates space where we see the entire curve slightly higher, which if we see more repricing in the coming days could support FX. Otherwise, however, we are more likely to see a re-weakening back to the 397-398 EUR/HUF range as the dust settles after the latest rate-setting meeting.

Looking further out the picture doesn't look rosy for FX either, especially going into the second quarter with the looming uncertainty regarding the European Parliament’s lawsuit in relation to parts of the EU funds and the approaching EU and local elections. The National Bank of Hungary thus has to rely on the start of the global rate-cutting cycle to keep FX in check if it wants to cut rates further in the coming months. Thus, we are likely to see higher volatility in the coming months than in the first quarter with our forecast of 405 for the end of the first half of the year.

CEE FX performance vs EUR (29 December 2023 = 100%)

The long ends of the curves remain attractive

The rates space picture hasn't changed much after the March rate decision. The IRS curve has repriced up only slightly, however, looking at short-term expectations for this year we find the current market pricing fair with some likelihood of small cuts in the second half of the year. The market sell-off has gone too far in our view and the belly and long-end curves have moved too high pushing the long-term policy rate well above 6%. In particular, we find the long end of the curves attractive and believe that once things calm down, market interest will return given the levels relative to CEE peers and core rates.

In the IRS space, we see room for more flattening of the curve due to the narrative of a slowdown and pause in the cutting cycle now, but more rate cuts later and at the same time, a still attractive inflation profile within the CEE peers. Looking at 2s10s, we should see a flatter curve which also provides an attractive carry.

Hungarian sovereign yield curve (end of period)

In the Hungarian government bonds space, we have seen significant frontloading and buybacks in recent weeks, to prepare for the upcoming increase in this year's budget deficit. However, the auctions met with significant demand, almost the highest in the CEE region in bid-to-cover terms. With the assumption of 4.5% of GDP for this year's deficit, according to our calculations, roughly 40% of the total issuance of HGBs is covered, which provides sufficient comfort for the bond market in case of the risk of further fiscal slippage, which is one of the reasons why we are positive on HGBs at the moment, especially the long end of the curve.

Forecast summary

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article