Monitoring Hungary: Inflation in the spotlight

In our latest update, we reassess our Hungarian economic and market forecasts at a time when rising inflation is bringing back bad memories from not so long ago. In the absence of convincing positive stories, only the stability of the forint stands out – but even that isn't pulling us into the optimistic camp

Hungary: At a glance

- We have made only minor changes to our GDP forecast for 2025, which we see at 1.9%, but the structure has been substantially revised.

- High-frequency data has shown a mixed start to the year for Hungary, with the overall tone tending towards softness. Industry may continue to be a drag on growth while rising inflation threatens to change the fortunes of retail sales.

- The nervousness in business confidence has led us to revise up our unemployment rate forecast. This may also lead to weaker-than-expected wage growth, with the risk of a downgrade in the outlook for real wage growth.

- External balances are holding up well, but this is due more to still-weak domestic demand. We see the current account running a surplus of 2% in the coming years.

- February brought another upside surprise on inflation. While the government has taken targeted measures to tame inflation, this will have more of an impact on perceived inflation. We have revised our 2025 inflation forecast to 5.6%.

- We don’t see room for conventional easing in 2025, with the policy rate at 6.50% throughout the year. We do, however, expect some liquidity injection with the rollover of some maturing balance sheet items in the second half of this year.

- We still see a small slippage in the deficit target, projected at around 4% of GDP, while the new measures introduce further vulnerabilities in the longer term.

- In the short-term horizon, the Hungarian forint remains supported by global events, but we later expect the local story to drive EUR/HUF above 410 again.

- The short end of the curve remains anchored by the National Bank of Hungary's hawkish policy while the long end of the IRS and HGBs curve looks attractive after the recent sell-off.

Quarterly forecasts

A lower 2025 GDP forecast and structural shift

In light of more detailed fourth-quarter data, we have made a few changes to our GDP forecast for 2025 as a whole to 1.9% year-on-year. The revision in the number isn't too significant, but the change to the structure is. We expect stronger consumption, weaker investment activity and a slightly less negative impact from net exports.

The detailed data shows that consumption continues to grow, and the stronger-than-expected fourth quarter figure provides a better carry-over effect. Worsening consumer confidence, however, suggests some risks. A turnaround in investment may still be some way off, and net exports are likely to remain a drag on GDP growth.

So while Hungary has now emerged from a technical recession, its recovery remains far from strong. And with this kind of inflation outlook, there is a possibility of another negative surprise in GDP growth.

Real GDP (% YoY) and contributions (ppt)

Industry still a drag

Industry deteriorated further in January and is now 3.9% below last year’s level. Industrial production is also 5.7% behind the average monthly output in 2021. Transportation and electrical equipment – the two dominant sectors – continued their downward slide in January and this time, the food industry also joined in. Among the major sectors, only electronics showed signs of improvement.

As a result of this data, some domestic manufacturing plants will soon begin to make substantial changes to their labour forces. Looking ahead, the tariff war could mean a temporary recovery, as manufacturers would likely try to speed up production and imports before tariffs against the EU are implemented. In the longer term, the new capacities (BMW, BYD, CATL, etc.) will have a positive effect – although this has grown likely to materialise in 2025 as pushbacks have occurred.

Industrial production (IP) and Purchasing Manager Index (PMI)

Retail sales start the year on a positive note

Retail sales started the year on a particularly positive note, growing by 4.7% from last year’s low base and with sales volumes almost 2% above the monthly average of 2021. Looking at the details, a general recovery is unfolding, with all major sub-sectors showing an improvement. Many of these one-month gains have followed a weak December. It also seems that some of the retail bond-related payments have also appeared in the sector.

Looking ahead, this strong start is promising and one-off factors could also provide a boost. Still, this could fade later this year due to rising inflation and lower-than-expected wage growth. Government measures could provide some boost to consumption and retail sales – but this is still uncertain, and we'll have to wait months to gauge their impact.

Retail sales (RS) and consumer confidence

Higher inflation lowers unemployment rate

The unemployment rate fell to 4.3% from November to January, a positive surprise as the usual seasonal rise in unemployment was absent. People may have returned to the labour market because of rising inflation. The current processes are similar to those during the cost of living crisis – but back then, it was easier to find a job. The potential labour reserve remains low, keeping the labour market tight, which could be maintained by new production capacity coming onstream this year (or next).

Weakening confidence indicators, however, suggest that companies may have to streamline their workforces. Against this backdrop, we're revising our estimates for the average unemployment rate up to 4.5% in 2025. The lack of business confidence may also lead to lower-than-expected corporate wage growth, with the risk of much weaker real wage growth.

Historical trends in the Hungarian labour market (%)

Turnaround in external balances still to come

In euro terms, the value of exports rose by 3.8% in the first month of the year, while the value of imports increased by 0.8%. The goods balance improved by EUR343m year-on-year in January, and energy exports provided a boost to a surprisingly strong export performance.

Looking ahead to 2025, we expect new production capacity to support exports and boost import activity. However, these are increasingly being delayed; they're now less likely to start this year and we think it's more probable that this will be a 2026 story. In turn, the momentum here could be lost.

In our view, if there isn't a significant turnaround in the external environment, net exports could have a negative impact on the economy this year. On the other hand, if the EU starts to increase its defence spending, this could have some pro-export effects via the Hungarian arms industry, while we hardly see any boost to local spending.

Trade balance (3-month moving average)

We raise our inflation forecast for 2025 once again

Inflation has risen this year, reaching 5.6% YoY in February. The main reason for the strong monthly increase (0.8%) was the continued sharp rise in food prices. Food price increases in the last two months are a repricing rate reminiscent of the period of the cost of living crisis, while services inflation also rose.

Durable consumer goods ticked up on a monthly basis too, despite the more pronounced appreciation of the forint in February. On the other hand, household energy, fuel and clothing prices dragged down inflation. The picture of perceived inflation continues to deteriorate, undermining consumer confidence. In response, the government has announced some anti-inflationary measures, but their overall impact is questionable. Looking ahead, we have again revised our forecast for 2025 and now see average inflation at 5.6%.

Inflation and policy rate

Upside risks to inflation keeps the base rate unchanged

The National Bank of Hungary kept its base rate unchanged at 6.50% in February, at the last meeting headed by NBH Governor György Matolcsy. The main reason behind the hold was the inflation picture, its magnitude and structure. The need for a stability-oriented, patient and prudent monetary policy was underlined, i.e., that tight monetary conditions are necessary for sustainably achieving price stability.

The central bank's forward guidance was virtually unchanged from last month when it closed the door to easing. Incoming governor Mihály Varga has already spoken publicly, also sending hawkish messages. Looking ahead, price expectations and the looming tariff war point to further upside risks to inflation. We therefore expect the policy rate to remain at 6.50% for the rest of the year, but there could be some balance sheet-related easing in some form of loan and/or bond-buying programmes.

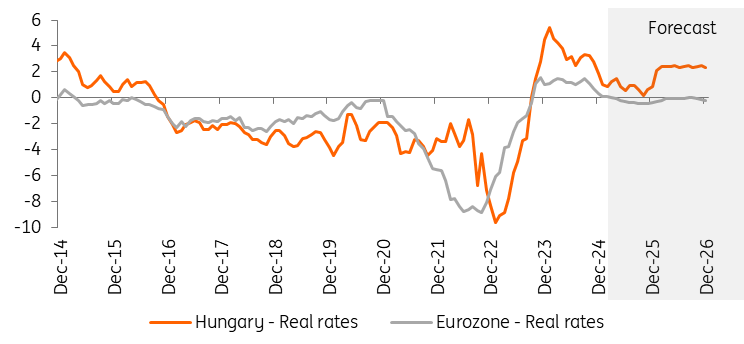

Real rates (%)

High budget deficit at the start of the year, but nothing to worry yet

The budget deficit in the first two months of the year reached HUF1722.8bn, 41% of the cash-flow budget plan for 2025. While this figure may seem daunting at first glance, it is actually in line with the trend we've seen since 2020. If we take into account the interest payments on retail government bonds in the first two months, the 13th-month pension (which is also paid in February), and the seasonality in VAT refunds, the high February figure is reasonable. That's why we don't think the 2025 budget plan is impossible to achieve – but given that we expect weaker economic activity and probably a tad lower nominal growth versus the government plan, we project a 4.0-4.2% deficit.

Budget performance (year-to-date, HUFbn)

Forint market as a global playground but the local story is still here

The Hungarian forint remains a playing field for geopolitical events at the moment, in particular German fiscal expansion and negotiations between Ukraine and Russia, but also potential US tariffs. Recent weeks have seen the HUF heading towards stronger levels, which may also be the case for the very short-term horizon given several events on the calendar. A continuation of the NBH's hawkish rhetoric following the change of governor in March is also supportive.

CEE FX performance vs EUR (29 December 2023 = 100%)

However, the medium-term overall picture for Hungary remains largely unchanged. A weak economic performance, inflation and fiscal risk should keep the HUF on the weaker side. Overall, we may see some support due to global events in the short term but we expect local factors to drive FX weaker again later on, with EUR/HUF around – and possibly even above – 410 in the second half of the year in our forecast.

The short end is anchored by NBH policy while the long end looks cheap

Since the beginning of the year, the Hungarian rates market has been going through phases of selling off after inflation numbers surprised to the upside in the last two months, and a rally driven by cheap valuations and the global story in between. Repricing after the February inflation number lifted the curve to near-yearly highs and well above 3M BUBOR.

At this point, the market is expecting one NBH rate cut this year and a second rate cut next year. It seems increasingly likely that we will not see any monetary easing this year, but we cannot assume that the market has priced out all probabilities. We therefore believe that the short end of the IRS curve will remain anchored by NBH policy. However, the belly and long end of the curve should head lower given that we see NBH rate hikes as unlikely in the current environment and that current valuations are not justified in the context of our inflation forecast and global story.

Hungarian sovereign yield curve (end of period)

Similarly, Hungarian government bonds (HGBs) look attractive to us in the belly and long-end curves. The debt agency has covered roughly 26.5% of all projected HGBs including our slightly higher budget deficit this year, according to our calculations. We also see strong issuance in retail, benefiting from both tax incentives and strong redemptions coming back into the system. Asset spreads vs IRS have reached widened levels since roughly last October due to strong supply. Overall, cheap valuations and the global story should keep demand strong in the bond market in our view, painting a positive picture for bonds as well.

Forecast summary

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article