Monitoring Hungary: Economy in a pressure-cooker

In our latest update, we reassess our Hungarian economic and market forecasts to see what is boiling in the economy's pressure-cooker. In addition to the previous ingredients of war and sanctions, now we have new spices: a supermajority election win and the launch of a rule-of-law mechanism, creating more complications for decision-makers

Hungary: At a glance

- We downgrade our 2022 GDP growth forecast again on the war, sanctions and upcoming policy decisions, despite hard data showing a vivid economic activity in January and February.

- A long-time not seen downside surprise in inflation in March did not alter our inflation outlook as upside risks are still ruling the landscape.

- The National Bank of Hungary has maintained its calmness despite risk premium increases in local assets.

- Deteriorating terms of trade due to energy and supply chain shocks will take its toll on external balances in 2022.

- In fiscal policy, “wait-and-see” remains the name of the game, while rising financing needs might be covered via new FX debt issuance.

- Fidesz-KDNP's surprising supermajority win doesn't affect the repository of possible economic policy responses to the trinity of challenges and in our view won't jeopardize an agreement with the European Commission on the rule-of-law debate.

- Forint remains under pressure in the short run with elevated risk premium on election results and rule-of-law procedure, but we envision better days ahead.

- Local yield curve inversion to continue with the short end leading the move.

Quarterly forecasts

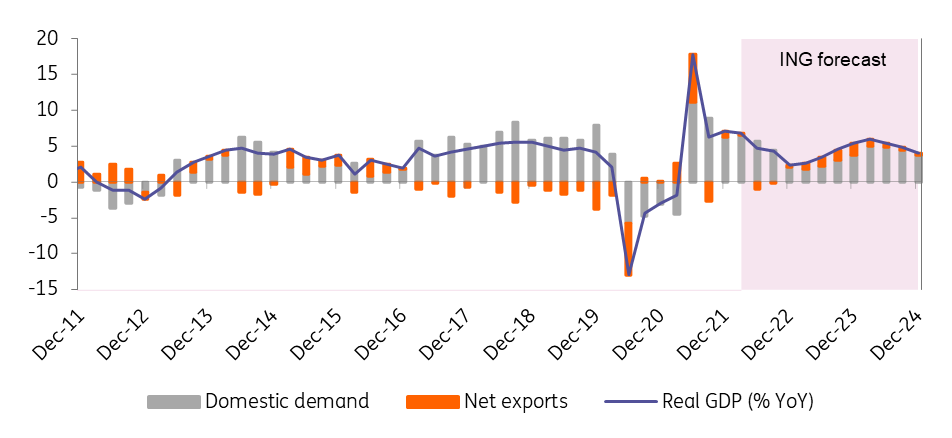

A downgrade in GDP outlook yet again

Compared to a month ago, not much clarity has been brought to the table when it comes to economic activity regarding this year. We are still waiting for the first set of data which are affected by the war to be released. Until these arrive, we can cheer about the strong January and February high frequency data, which would have predestined Hungary to another strong GDP growth in 2022. But the longer the war in Ukraine lasts and with more rounds of sanctions, growth prospects are increasingly declining. Thus, we again cut our 2022 GDP forecast to 4.5%, with risks clearly tilted to the downside with looming fiscal tightening, rising inflation and continued supply chain disruptions.

Real GDP (% YoY) and contributions (ppt)

Industry faces a slowdown after a strong start

Industry's growth in February exceeded expectations once again. Production rose by 1.6% month-on-month, translating into a 4.5% year-on-year growth. Most of the manufacturing sub-sectors were able to contribute to the sector’s growth, with food industry registering a double-digit yearly performance. On the contrary, car manufacturing decreased slightly (-0.8% YoY), again, as it seems that the sub-sector was already restrained by the war-created supply issues during late February. But the very strong expansion in January-February in industry is water under the bridge now. In the short term, we see a significant slowdown in production, although there is some light at the end of the tunnel. Industrial companies are exploring alternative sources of spare parts and some production lines have been restarted in Ukraine as well. So, we can be hopeful about a rebound later this year, when/if shortages will ease as the stock of orders grew by 26% year-on-year in February.

Industrial production (IP) and Purchasing Manager Index (PMI)

One-off shocks boost retail sales

Retail sales turnover rose by 9.8% on a yearly basis in February, showing an above-consensus growth. Part of this strong performance comes from the low base, but the 1.5% month-on-month increase suggests that there is more behind this rise. The strong retail performance comes from several one-off sources, in our view. Non-food sales was boosted by government transfers to households (13th month pension, tax refund for families, etc). With fuel prices being capped at a low level, fuel tourism arose near the borders, while the refugee crisis might have its positive impact on fuel sales with transfers within and across Hungary. Food sales showed a strong month as well, probably showing the impact of the Hungarian households increased purchases to send aid packages for refugees. Looking ahead, these one-offs may have some further positive implications on retail sales in the coming months.

Retail sales and consumer confidence

Inflation outlook remains unchanged despite March surprise

In March, inflation brought a long-time not seen downside surprise. The 1% month-on-month increase and the 8.5% year-on-year price change was lower than the market expected. But the good news pretty much ends here. Core inflation moved to 9.1% YoY, the highest rate since summer of 2001. Around 40% of the consumer basket measures a double-digit inflation print, which shows a widespread and strong price pressure at the same time. The main reasons behind the acceleration of price growth were food, services and durables. With a lower-than-expected reading in March, the chance for a double-digit print is reduced somewhat, but with the risks still tilted to the upside, we maintain our inflation outlook. We see an above 9.0% average inflation with further upside risks in 2022. Regarding next year, we foresee 4.5-5.0% inflation on average with the central bank's inflation target being reached by 2024 in a sustainable manner.

Inflation and policy rate

The central bank still has work ahead

The central bank has remained calm after the latest risk premium shock in Hungarian assets triggered by the outcome of the general election and the European Commision’s decision to start the rule-of-law mechanism. This means that the 1-week deposit rate has remained unchanged at 6.15% despite EUR/HUF moving in a higher range compared to pre-election weeks. In this respect, we don't see another change in the effective rate up until the next rate setting meeting (26 April). As risks to inflation have remained on the upside despite the lower-than-expected March figure, we expect the central bank to continue the tightening cycle. In our view, April (and May) moves will mimic the March decision, thus we see a 100bp move in the base rate and a 30bp hike in the 1-week deposit rate. When it comes to the top of the rate hike cycle, we still believe that only a positive real interest rate environment will be able to boost HUF, limit the surge in aggregate demand and thus ease the underlying inflation pressure. In this regard, we see both the 1-week deposit rate and the base rate peaking at 8.25% in August and remain at that level at least until the first quarter of next year.

Real rates (%)

With industry gaining traction again in early 2022, external trade showed an improvement, which we believe will be short-lived. The value of imports grew by 29% year-on-year on strong domestic demand and rising prices. Exports rose by 18% year-on-year as supply shortages eased during January and February, so value growth stems both from surging prices and rising volumes. The year-to-date trade deficit came in at €0.34bn during the first two months in 2022, in contrast with a surplus of €1.7bn in the same period of 2021. The war and the sanctions will limit exports, while booming commodity prices will keep imports more expensive, deteriorating Hungary’s terms of trade. In this regard, the trade and current account balances could show a deterioration during 2022. The risks are tilted to the downside as in our base case scenario we expect the government to carry out fiscal tightening and reach a compromise with the European Commission in the rule-of-law procedure. Thus we believe the capital account will see a significant inflow of EU transfers during the second half of this year.

Trade balance (3-month moving average)

Maintaining the deficit target becomes a challenge

After an extraordinary monthly deficit in February, March didn’t bring any relief in the budgetary situation. With the cash-flow based deficit sitting at HUF2,309bn, which equals 73% of the full-year target, the government needs to review the budget, in our view. We see two different paths in front of policymakers. The easiest path would be to let the original deficit target (4.9% of GDP) go and amend the budget to reflect the new situation. With upwardly revised fiscal targets, we see an increased chance for a negative outlook regarding Hungary's sovereign credit ratings, while we don’t think that an immediate downgrade is on the cards. The other way would be to carry out austerity measures (first spending cuts then revenue boosters via sectoral/special taxes) reflecting the budget slippage. As a rough estimation, we see it at HUF500bn or around 1% of GDP in 2022. But we see the government and the Debt Management Agency operating in a “business as usual” mode in the coming months. In case of rising financing needs, we see the debt agency raising extra funding via a new round of FX bond issuance.

Budget performance (year-to-date, HUFbn)

Another two-thirds majority win for Fidesz-KDNP

Not the base case, but the most probable risk scenario was realized in the outcome of the 2022 general election. Prime Minister Viktor Orbán was re-elected for the fourth time and his party won a supermajority again. We see the initial market reaction (elevated risk premium in Hungarian assets) as exaggerated, as this outcome means a no-change scenario from a political perspective compared to the previous term. What also doesn't change with this outcome is the "what to do" list. We see three challenges: high inflation, external and fiscal imbalances. A common denominator here could be fiscal tightening in 2022-2023, especially with the rule-of-law mechanism triggered by European Commission, which jeopardise a significant inflow of EU money,and thus creates a hole in the cash-flow based budget. The next important milestone is the Convergence Programme, which will be revealed in late April and will give us a sneak peak into next year's economic policies. In our view, we will get to know the magnitude and manner of the expected budgetary adjustment for this year and next.

The composition of the Hungarian Parliament after the 2022 election

FX: HUF remains under pressure in the short run

After its all-time high at 400, EUR/HUF eased back into the 370-375 range for the second half of March and early April. The move was supported both by higher interest rates and an improving risk environment. However, the forint has been underperforming since the elections (combination of a surprising two-third majority and rule-of-law case) and the new anchor seems to be 380 in EUR/HUF. We expect news about fiscal tightening and some promising developments regarding the rule-of-law mechanism to trigger a shift back to 370 late in the second quarter. The central bank’s double pledge to maintain tighter monetary conditions for a longer period, and to be flexible with its 1-week deposit rate decisions if money market moves warrant it, can provide further support for the forint. The hope of a de-escalation in Ukraine and our call to have a positive real interest rate environment by the year-end in Hungary could be able to push EUR/HUF back to the 355-360 area during the second half of 2022. Recent speculative positioning could support this as we expect a run on closing HUF short positions on positive news.

FX performance vs EUR (1 Feb = 100%)

Yield curve to invert further

There is an increased volatility in the local debt and rates market. We see the recent drop both in government bond yields, interest rate swaps and forward rate agreements as a signficant correction. This follows the pick-up in risk premium in the aftermath of the election. The situation remains fragile in several aspects. The market needs to deal with uncertainties regarding core market monetary policies, scope and magnitude of local fiscal tightening, sources of extra financing needs, inflation risks, rule-of-law debate, war and sanction policies just to name a few. Against this backdrop, our two high conviction calls are that 1) the central bank needs to continue its tightening cycle with the effective and base rates heading toward 8.25%. 2) The Government Debt Management Agency will prefer FX bond issuance combined with a possible tweak to ramp up retail bond demand to bring some relief on the longer dated government bond yields. In this respect, we expect bear flattening in the Hungarian yield curve with further inversion fuelled by moves on the short end.

Hungarian sovereign curve

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more