Monitoring Bulgaria: An economy coasting through the political saga

Faced with endless political turmoil and likely another snap election, the Bulgarian economy is largely on autopilot, tracking its trading partners in its own region and the West. Despite meeting almost all criteria, joining the eurozone is unlikely to happen without a stable government, and we’re shifting our estimate towards 1 January 2026

Main views and forecasts

- GDP growth is set to accelerate cautiously this year on the back of a rather strong private consumption. That said, net exports are set to weigh on output and the pace of investments remains uncertain

- The political gridlock is likely to continue to weigh on or delay projects, feeding into EU money delays as well. Still, the fact that this year’s budget has a clearer structure when it comes to investments will increase institutional accountability and mitigate some of the losses

- The trade balance deficit is set to worsen in the near term as we expect internal demand to outpace what external markets can absorb

- Nevertheless, through the medium term, the trade balance and foreign investment inflows should still benefit from broader regional projects like the Vertical Gas Corridor, NATO-led infrastructure upgrades and the Three Seas Initiative

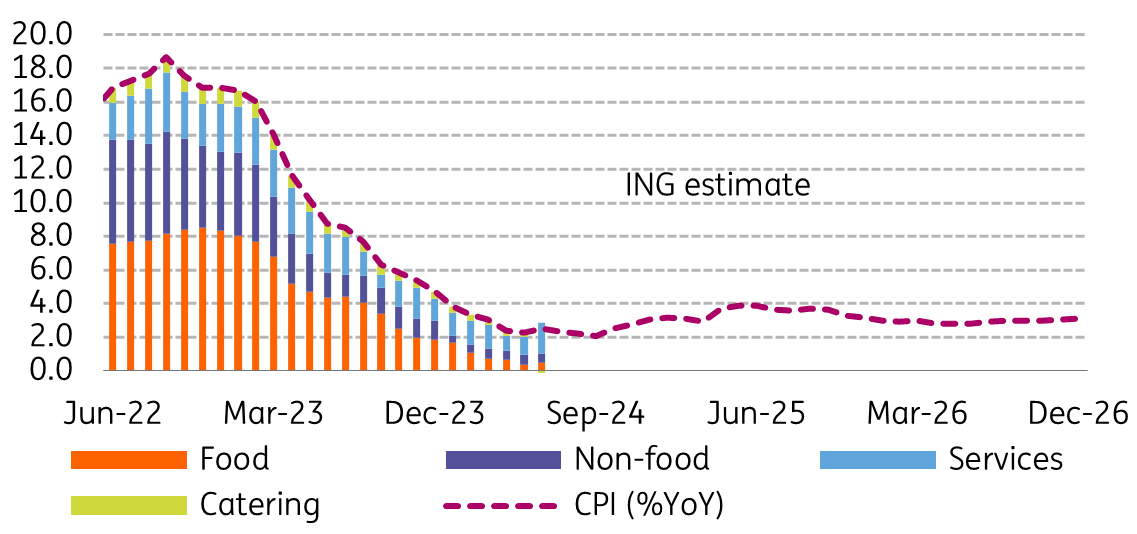

- We expect inflation to pick up slightly in the near term towards 3.0% and remain around these levels through 2025

- Fiscal-wise, the deficit is set to remain within the Maastricht criteria. Increased capital expenditures in the second half of the year after a rather weak first half would be a key positive turnaround

GDP growth: On an improvement path

Annual growth in Bulgaria halved in 2023 and reached 1.8%, before starting this year with a quarter of similar growth at 1.9%. Private consumption and investments had the largest positive contribution in the first quarter of the year. The economy still managed to benefit from a stable government up until March. As such, while private consumption is set to continue its momentum this year on the back of sharp wage growth, investments and reforms are rather unlikely to continue at the previous pace. This is also weighing on the country’s goal of joining the eurozone which, without a quick solution, we now think is more realistic for 1 January 2026.

That said, one important thing to consider here is that, unlike previous years, this year’s budget featured a detailed investment programme, meaning that each project had its own funding allocation and a designated state body to oversee it. This increased transparency should mitigate some of the negative impacts of the protracted political instability on investment and reforms more broadly. In the external sector, we have recently become slightly more optimistic about eurozone growth prospects, which bodes well for exports.

On the supply side of the economy, the positive drivers of annual growth in the first quarter of 2024 were the industrial, trade and private services sectors. Apart from a small decline in the construction sector, none of the sectors contracted but their contribution to growth was far more muted nevertheless. Apart from this, the current harsh wildfires and droughts are set to weigh on activity at the margin and add to downside risks as well.

All in all, we foresee a small GDP acceleration to 2.6% this year and 3.3% for next year.

In other news, there is a strong likelihood that the seventh snap election in three years will be organised. Over the medium to long term, a less tangible but important factor to consider here is to what extent the current voter fatigue (shown by the weak election turnout rates) could start to impact the whole political process – and by extension, the desired pace of progress at an institutional level, which ultimately feeds into the productive potential as well.

Growth set to accelerate cautiously this year and next

Key growth engines: Industry is still weak but tourism set to remain a strong contributor

Looking more closely into the recent industrial data, several things can be spotted. On the one hand, manufacturing regained some ground on the back of the small signs of life shown by the German and Romanian industrial sectors through spring. Sub-sectors that have performed well year-to-date are the manufacturing of basic metals, pharma products and printing output.

On the other hand, electrical equipment, machinery and computer production performed quite poorly. Industrial activity should improve somewhat this year on the back of stronger internal demand, and from external markets but to a smaller extent. Relatively muted upside prospects in the German industry and its ripple effect to Romania will limit the gains of the Bulgarian manufacturing sector. Both hard and soft data from the two key trading European trading partners point to downside risks in the near term.

Near-term downside risks for manufacturing remain, despite the recent signs of life

Tourist arrivals continued going up – building the recovery momentum further. In January-May, total arrivals went up 6.5% year-on-year, with visitors from Romania, Greece and Turkey (the most important markets) all growing in double digits or very close to double digits, boding well for activity.

Tourist arrivals set for another advance

Investments: Hand in hand with political stability

Looking at the past year, fixed investment annual growth slowed to a still robust 5.2%. What really stood out were investments related to public administration and services – which improved by a whopping 122% in 2023, reaching around EUR2.5bn, likely the result of the reforms needed to join the eurozone and probably some defence investments. At a broader level, public administration and public services investments are now taking the third spot in the total investments rankings dominated by industrial and trade sectors.

Looking at this year, the first quarter brought a significant decline in quarterly sequential terms, chiefly driven by much smaller investments in public administration and services. It was expected somehow given the very strong outturn of last year's fourth quarter. Nevertheless, the sequential declines in investments were broad-based across sectors. In annual terms, the picture was more mixed, and the overall outturn still grew 3.8% compared to the same quarter of last year.

Looking ahead, investments are rather unlikely to outperform the broader economy. The political gridlock is likely to continue to weigh on or delay projects, feeding into EU money delays as well. That said, the fact that this year’s budget has a clearer structure when it comes to investments will help mitigate some of the lost progress due to increased institutional accountability. Moreover, the external push via NATO for infrastructure investments that could help with the rapid deployment of the military will also likely have civilian utility to an extent, fuelling activity. On top of this, regional projects like the Vertical Corridor and Three Seas Initiative could also boost momentum somewhat.

Trade and the balance of payments: geopolitics continuing to play a major role

After improving by 30.7% in 2023, the trade deficit is rather set to reverse some of the gains made this year. Over January-April 2024, the deficit is 46% higher than the same period of last year and two things are particularly eye-catching. The rather negative one relates to the visible worsening of food and oils, which also represents an upside risk for food inflation. That said, lower imports of manufactured goods helped offset some of the negative trade developments.

When looking at the breakdown of trade by countries, what stands out is the visible worsening of Bulgaria’s trade balance with Romania, which was partially compensated for by an improving trade balance with Germany. A likely explanation could be a rearrangement of value chains. Moreover, there were significantly smaller imports from Russia, also partially a result of the recent oil import ban starting from 1 March 2024. Shortly on this, data for the rest of the year and ahead should show a significant growth of imports from Kazakhstan, which is set to become the primary oil supplier to Bulgaria, followed by Iraq and Libya. Norway also recently became an important source.

Looking ahead, the trade balance deficit is set to worsen this year. Firstly, our view on exports is rather gloomy – out of Bulgaria’s largest trading partners, only Romania’s economy is set to accelerate this year. As such, at least a partial reduction of this year’s trade deficit improvement is likely. Beyond this year, we continue to expect internal demand to outpace what external markets can absorb. Our view is that it will take time for the German economy to regain speed, weighing on Bulgaria’s external sector, all while the internal demand’s impact on imports is set to remain robust.

A mitigating factor (to an extent) could be the recent confirmation that Bulgaria will begin the construction of the Vertical Corridor network of gas pipelines which, in the years ahead, could start positively impacting exports through transit fees and other value-added services related to the regional gas flow like storage, blending and quality control. The whole project should be functional by 2026. Moreover, Bulgaria will be part of a bi-directional network of gas transmission across the participating countries, resulting in a diversification of gas sources and a shift from the historical dependence on Gazprom. All in all, this diversification should keep input costs competitive and bring more energy independence for the manufacturing sector, to the benefit of exports should this project unleash its full potential.

Turning to the current account more broadly, while healthy increases in tourist arrivals brought some tailwinds for the services sector last year, it was also a smaller deficit in goods trade which made it possible for the current account balance to get back into positive territory for after two years of small deficits.

In 2024, the current account should benefit from another likely increase in tourist levels. Strong real income gains in Romania will likely add a boost to the revenues of Bulgarian resorts while the quasi-stagnation of the European economy could, at the margin, lead more Western tourists towards cheaper holiday alternatives. As such, services exports gains should continue to at least partly offset some of the likely trade deficit increases foreseen ahead.

Concerning other BoP categories, secondary income and capital accounts are unlikely to benefit substantially from EU funding due to the re-emergence of the protracted political turmoil. Even if a new government comes into power, eventually internal frictions are unlikely to disappear in the near term and risks are still tilted to the downside. In principle, this should also limit up the true potential of FDI inflows. In year-to-date terms, FDIs fell to EUR591m in January-May 2024 compared to EUR1.6bn over the same period of last year, mainly due to falls in reinvested earnings. While the drop seems large, it’s true that part of the problem could also be related to the significant legislative changes brought by the recently adopted FDI screening regime as of February this year.

Overall, it is uncertain whether FDIs will rise at the desired pace in the near-to-medium term. However, broader regional projects in which Bulgaria is involved could act as tailwinds and partly offset this in the quarters ahead. Bulgaria, Romania and Greece are planning to create a defence-related mobility corridor, which involves major infrastructure upgrades (ports, railways, roads) that would enhance the connectivity between the cities of Constanta, Varna, Thessaloniki and Alexandropoulos. Moreover, positive momentum can also span from the Three Seas Initiative and the Vertical Corridor project over the coming years. All in all, this regional context should provide small tailwinds for FDIs and at least partially offset the negative impact of the political protracted blockage on reforms and state investments that would have placed Bulgaria higher on investors’ radars.

Inflation: Mild acceleration ahead but a balanced situation overall

We expect inflation to face some mild upside pressures in the near term on the back of the recent removal of VAT cuts, which are also coming in the context of accelerating retail sales growth and a very strong double-digit real wage growth. On top of this, the unemployment rate also fell from 5.80% at the beginning of the year to 5.30% in June, showing that the labour market continues to face tightening pressures, with demographic pressures likely being a background contributor as well. What’s more is that next year, services inflation will also face some upward pressure from the removal of VAT reductions for restaurants and catering services as of 31 December 2024. Also for the quarters ahead, the recent turn towards a food trade deficit is an upside risk for food inflation, while the current levels of wage growth are likely to keep services inflation outside the target range until 2026 at the earliest.

On the other hand, insufficient investments and a still-weak industrial sector, coupled with our view that export growth is unlikely to spin off, are set to temper some of the internal demand pressures mainly fuelled by private consumption, limiting the upside potential of prices, particularly non-food items. Moreover, the recently approved average decline of 8.47% for the heating prices of household consumers is also set to reduce price pressures, predominantly once the cold season starts. Our view is that oil prices are set to fall gradually over the coming quarters, keeping upside pressures in check.

A key factor to watch is also how the liberalisation of the electricity market will unfold – parliament has recently postponed it again for 1 July 2025. All told, we expect inflation to end this year at 3.0% and next year at 3.2%.

Inflation to inch up in the near term

Fiscal: remaining within the Maastricht criteria

So far in 2024, data until May shows a smaller deficit in the national budget compared to last year (BGN461m vs EUR 671m), as well as much stronger EU funds inflows (EUR536m vs EUR70m). As such, the consolidated budget now shows a small surplus of EUR74m vs last year’s May deficit of EUR601m. On the expenditure side, significantly smaller capital expenditures stood out. This helped out towards a smaller deficit but is not necessarily a good sign given the current investment needs of the country. In terms of financing the deficit, the government has turned towards the domestic market more heavily and reduced its net external financing at the same time.

For the rest of 2024, the dynamics of the budget should be driven by the extra revenues from the reinstatement of some pre-pandemic VAT rates and strong consumption overall, coupled with potentially still-weak capital expenditures. On the latter, only a very strong execution in the second part of the year could bring it from the year-to-date 0.5% of total expenditures close to last year’s overall 9.1%. Last year up to May, capital expenditures were already 4.4% of total expenditures. Overall though, likely robust defence spending coupled with higher public sector wages and pensions (the latter have increased as of July due to recent reforms) should still keep expenditures at healthy levels. On EU funds, the one-year delay from parliament of the electricity market liberalisation initially scheduled to take place in July 2024 makes it likely that the second Recovery and Resilience Facility (RRF) tranche of EUR724m will be delayed for next year. Bulgaria’s previous RRF tranche of EUR1.37bn was received in December 2022.

All in all, we have pencilled in a budget deficit of 2.8% in 2024 and 2.9% in 2025.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article