Singapore’s central bank faces tough balancing act

The Monetary Authority of Singapore meets next week to decide on policy amid high inflation and slowing growth

MAS faces tough balancing act next week

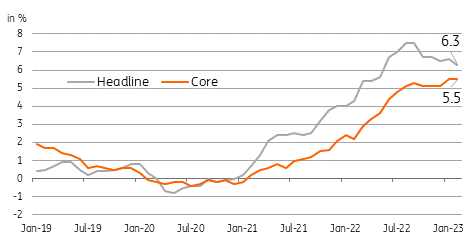

The Monetary Authority of Singapore (MAS) meets next week to discuss policy amid an environment of slowing growth and elevated price pressures. Although we’ve seen some relief in terms of moderating headline inflation, the core inflation measure was last reported (in February) at 5.5% year-on-year, well above the MAS target of just under 2%. Finance Minister Lawrence Wong believes that inflation will likely remain elevated for at least the first half of 2023 and the recent production cut announced by oil producers could translate into price pressures sticking around for just a bit longer.

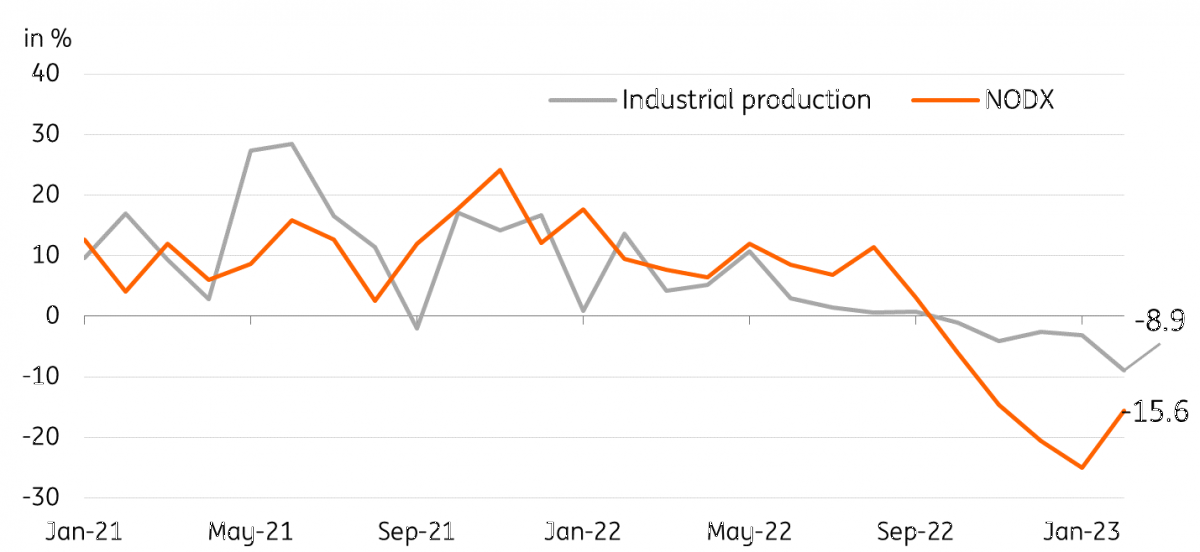

Meanwhile, the economy faces a challenging growth environment complicated by softening global trade as well as elevated domestic inflation. Signs of the strain from slowing trade have surfaced in the most recent non-oil domestic exports (NODX) report, which in turn has also weighed on industrial production. The twin challenges of elevated inflation and slowing growth will likely convince the MAS to perform a careful balancing act next week.

Inflation remains elevated despite easing of headline number

Contracting NODX impacts industrial production, weighing on first quarter GDP

MAS could retain hawkish bias but may remain cautious given growth challenges

In light of the twin challenges and the need to carry out a careful balancing act, we believe the MAS will opt to retain the slope, mid-point and width of the S$NEER policy band at its April meeting. The MAS has tightened policy five times since late 2021 in a bid to quell price pressures and we believe the central bank will rely on the follow-through impact of the string of tightening to bring inflation back closer to target.

The combination of slowing domestic demand, base effects and the cumulative impact of previous tightening are likely to sap price pressures over the course of the next few months. Meanwhile, the decision to retain its current hawkish stance without tightening further will afford the domestic economy some breathing room while also helping to support the struggling export sector amid lacklustre external demand.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article