Mexico: The weight of policy uncertainties

The decision to abandon the new Mexico City airport project, along with proposals by the Morena-controlled Congress, should have injected enough uncertainty into the local financial market to prompt the central bank to shift gears, again, and extend the hiking cycle. We now expect 50bp in additional hikes and the peso to consolidate in a weaker range

Mixed messages bring the honeymoon to an end

We wrote in our last report that the successful resolution of the NAFTA impasse had reduced FX uncertainties enough to give Mexico’s central bank (Banxico) the green-light to pause the hiking cycle and, finally, decouple from the US Fed.

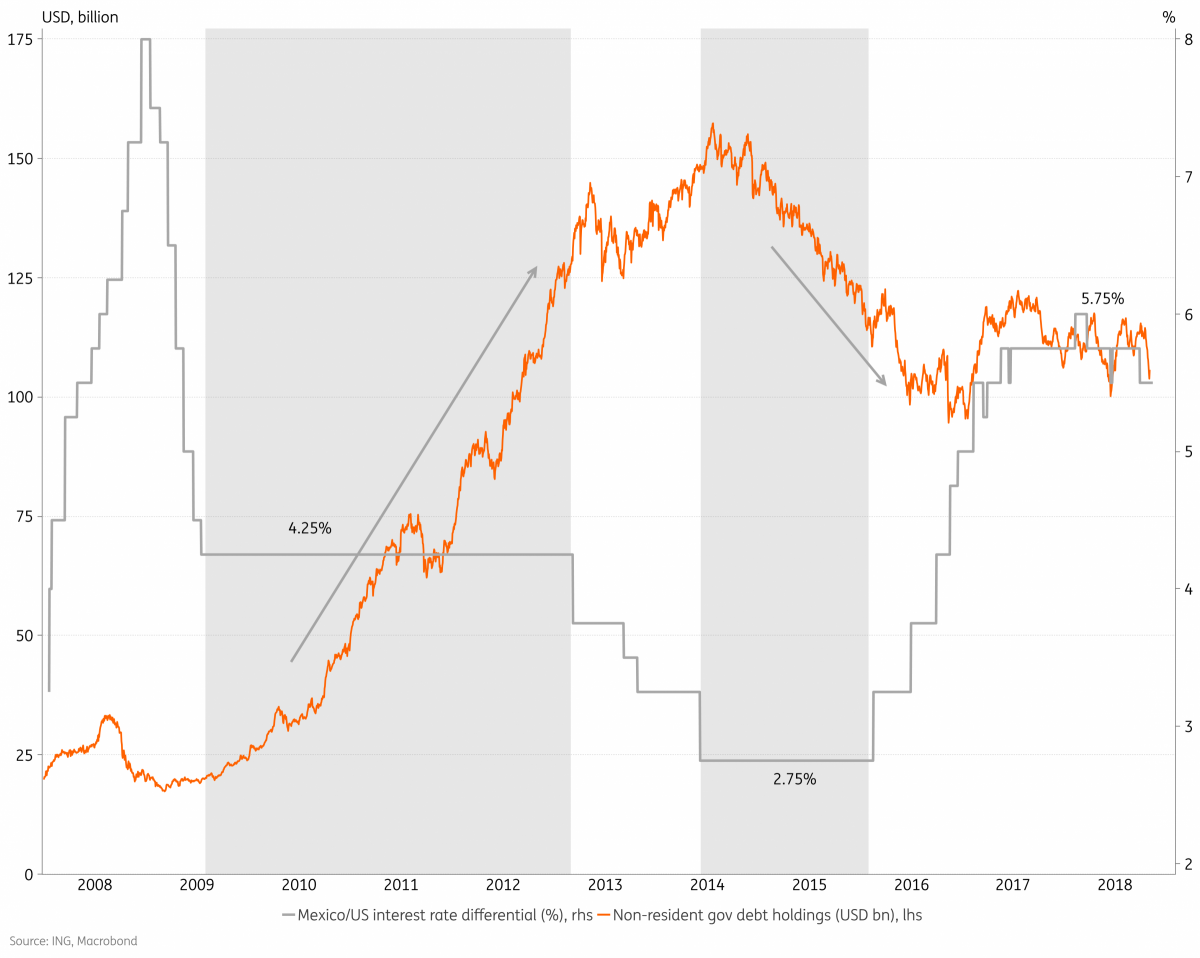

Banxico continues to list FX and US Fed decisions as primary drivers for its policy decisions and, apart from brief intervals in-between meetings, the policy rate spread between the two countries has remained steady, at 5.75%, since mid-2017. As the chart below shows, the high rate differential has helped ensure that foreign holdings of local debt have remained steady in the past year.

Since then, however, policy announcements by the incoming administration, which takes office on December 1, including the cancelation of the new Mexico city airport construction, and Congressional proposals to subordinate (currently independent) energy regulators to the Energy Ministry and proposals targeting the banking sector, have taken investors by surprise and triggered a sharp selloff in local assets. The FX weakness should be sufficient to push Banxico back into hiking mode.

With the Mexican peso weakening towards the stress-levels seen in the pre-election period, in June, past 20.5 now, while inflation remains above the targeted range, near 5% YoY, Banxico should have little choice but to hike the policy rate this Thursday, from 7.75% to 8.0%, and keep the door wide open to additional hikes over the next few months.

| 8.0% |

Banxico reference ratea hike to match consensus |

Mexican assets had already been underperforming over the past month, perhaps due to portfolio re-allocation decisions, with LATAM-dedicated funds shifting to Brazil. We see room for additional improvement in investor sentiment towards Brazil, while recent policy decisions in Mexico could intensify that shift, but the fact that, unlike Mexico, Brazil no longer has an investment grade should limit the impact of this factor.

A hawkish stance by Banxico is warranted also because recent announcements by the next administration call into question its commitment to fiscal prudence. A clearer assessment of the 2019 budget should be possible by mid-December but, in principle, revenue assumptions appear optimistic, while expenditure is bound to rise with renewed focus on boosting energy and infrastructure investment, and the creation of new social programs, which may result in a larger-than-expected fiscal deficit next year, and a more expansionary policy mix.

Higher rates should help anchor the Mexican peso.

The combination of an assertive stance by the US Fed, reduced risk appetite by investors and the heightened uncertainties about domestic policies should contribute to weigh on investor sentiment towards the country and extend the selloff in local assets.

The incoming administration could improve investor sentiment, for instance, by placating investor concerns that fiscal policy could become too loose, or by adopting a more business-friendly framework for the energy sector, but the mixed signals sent by the president-elect, his advisers and the Morena-controlled Congress suggest that the administration’s priorities may lie elsewhere.

An additional hike in December, or in the February meeting, to 8.25%, is also likely, assuming the US Fed hikes in December.

Prospects for rate cuts have meanwhile been pushed further down the horizon. This compares with our previous forecast of a steady rate of 7.75% until mid-2019, with the high likelihood of cuts later in 2019.

Beyond monetary policy, a cloudier outlook for private investment

The decision to cancel the airport construction project, following a poorly attended popular consultation, took investors by surprise and generated much apprehension in the business community. The rushed announcement and the lack of details regarding the costs associated with the decision and the process to be followed in the negotiations with the current stakeholders suggested a higher risk that ideology (and, perhaps, political calculation) may prevail over pragmatism in future decisions, dampening especially the outlook for the politically-targeted energy sector.

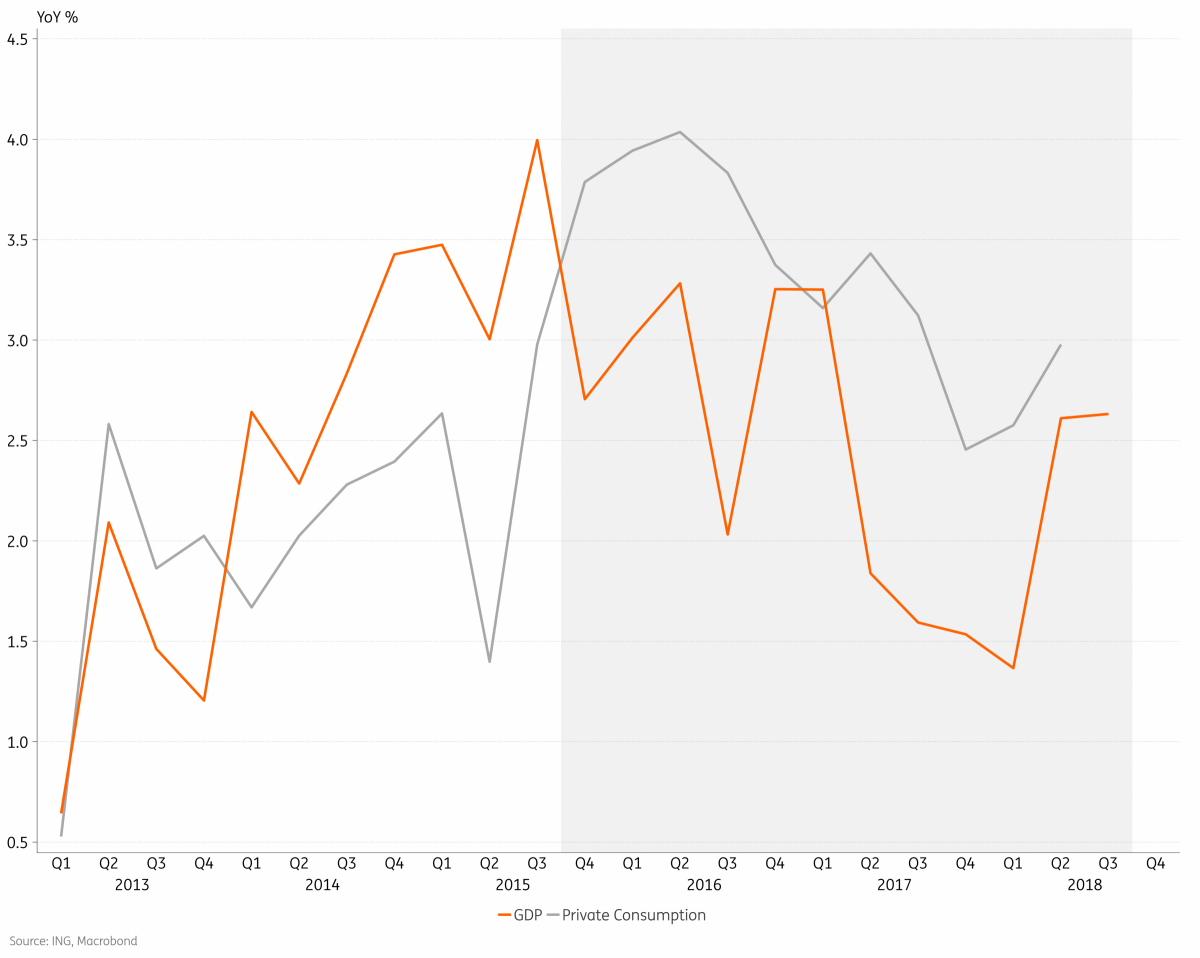

External trade has historically been an uneven source of GDP growth while domestic consumption has been the primary and most consistent source of growth in recent years, as seen in the chart below. But with the economy already operating at full employment, the best hope for consumption to continue to expand at a fast clip would be through credit growth, which could fail to materialize if policy uncertainty turns local banks more cautious.

In any case, with the outlook for the policy mix remaining relatively tight, given the high inflation, private investment remains, in our view, Mexico’s best hope to move beyond the low pace of growth seen in recent years.

And recent announcements raised doubts about the predictability of domestic policy decisions and highlighted the risk of heavy-handed intervention over private investment, which should have a chilling impact over business sentiment in the foreseeable future.

As we have written before, private energy investment is especially crucial because it affects all major aspects of Mexico’s macro outlook. Over the past five years, oil production has fallen 27%, output from its refineries have dropped by more than 40%, while the oil-sector external trade balance has deteriorated by almost US$30bn in annual terms, moving from a US$9bn surplus to a US$21bn deficit.

Without private sector investment in energy, (1) Mexico’s fiscal outlook should suffer, as it should add pressure on PEMEX to invest, complicating the company’s already challenging financial situation, (2) the economic activity outlook suffers (as seen by the enormous drag the oil complex has been for industrial activity this year) and (3) the outlook for external accounts suffers, both in terms of the ever-expanding trade deficit generated in the oil trade and because of the deterioration in the outlook for foreign direct investment.

Fitch had recently downgraded PEMEX’s credit rating outlook, from neutral to negative, while the company’s bonds sold off sharply since the airport news. The sovereign’s credit rating was, subsequently, also revised similarly, now incorporating a negative outlook.

Overall, investors are likely to proceed with great caution going forward.

The airport cancellation was a signature pledge of the campaign, and legitimate concerns may have emerged vis-à-vis the project’s viability and conception, so this may not be the defining template to examine Lopez Obrador’s decision-making process.

Having said that, the president-elect appears to be doubling down on his determination to make policy decisions through public consultations, announcing several initiatives that he intends to take depending on the result of another public consultation set for November 24-25. This includes the construction of a new refinery and pensions for the elderly. This governing style adds further policy uncertainty, with a skew towards greater state participation in the economy, and towards greater public sector spending.

In practice, recent decisions added material downside to Mexico’s economic growth outlook, and upside to inflation. An eventual confirmation of looser fiscal stance would add further upside risk to the inflation outlook, likely forcing Banxico to extend their hawkish monetary policy stance for a prolonged period of time.

Sharply expanding the state-presence in the economy would jeopardise Mexico’s fiscal and growth outlook, and cool investor sentiment. And without a vibrant private sector support, prospects for Mexico’s medium-term macro outlook should be much-diminished, marked by low growth and lingering vulnerabilities on the fiscal and external side. In the long-run, policy failure and ample political power, thanks in part to an electorate beholden to Morena-party social programs, could meanwhile pave the way for increasing experimentation and policy radicalization, as seen in Brazil during the PT years.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).