Mexico: Banxico weighs a tactical rate hike

Focus on maintaining monetary policy synchronicity with the Federal Reserve could extend rate hikes into next year, with Banxico having scheduled its policy meetings, once again, following FOMC decisions

We expect Banxico’s new governor Diaz de Leon to inaugurate his tenure at the helm of the monetary authority with a rate hike. Authorities have grown more concerned with the inflation outlook in light of the greater inflationary persistence seen recently and prospects for FX weakness in the coming months, amid NAFTA and electoral uncertainties. Banxico’s board has also become more concerned about keeping the US/Mexico interest differential intact. Lastly, burnishing Banxico’s inflation-targeting credentials, after Carstens departure, is another tactical consideration that may play an important role in the bank’s decision-making this week.

A hike to anchor FX dynamics, and enhance the hawkish credentials of the new governor

Mexico’s central bank (Banxico) is likely to validate the shift in market sentiment regarding this week’s monetary policy decision and hike the policy rate by 25bp, to 7.25%. A hike would follow three consecutive pauses, since the June hike that brought the policy tightening to a (temporary) closure, following a total increase in the policy rate of 400bp, since December 2015.

The relatively abrupt shift in market expectations followed the more hawkish guidance provided by the new governor Alejandro Diaz de Leon, and was further consolidated by last week’s inflation data, which again surprised coming higher than expected. According to Banxico’s latest forecasts, inflation will drop sharply starting next month and reach the 3% target by yearend, down from 6.6% now. But the more cautious policy guidance suggests that comfort around that forecast appears to have diminished, while other tactical factors may also be play an important role in the bank’s near-term policy decisions.

In particular, the hike is also likely to be justified by the expected hike by the FOMC on Wednesday. Banxico’s last hike of this cycle, in June, also followed an FOMC rate increase. However, at that meeting, the bank indicated a willingness to decouple from the Fed, presumably because the aggressive frontloading in Mexico (400bp in hikes vs. 100bp in the US) would provide sufficient room to maneuver for Mexico to conduct monetary policy independently from the Fed. Banxico signaled that change by altering its reaction function guidance, downgrading its sensitivity to US rate hikes from second place to third, and ranking the FX passthrough and the output gap ahead of Fed moves.

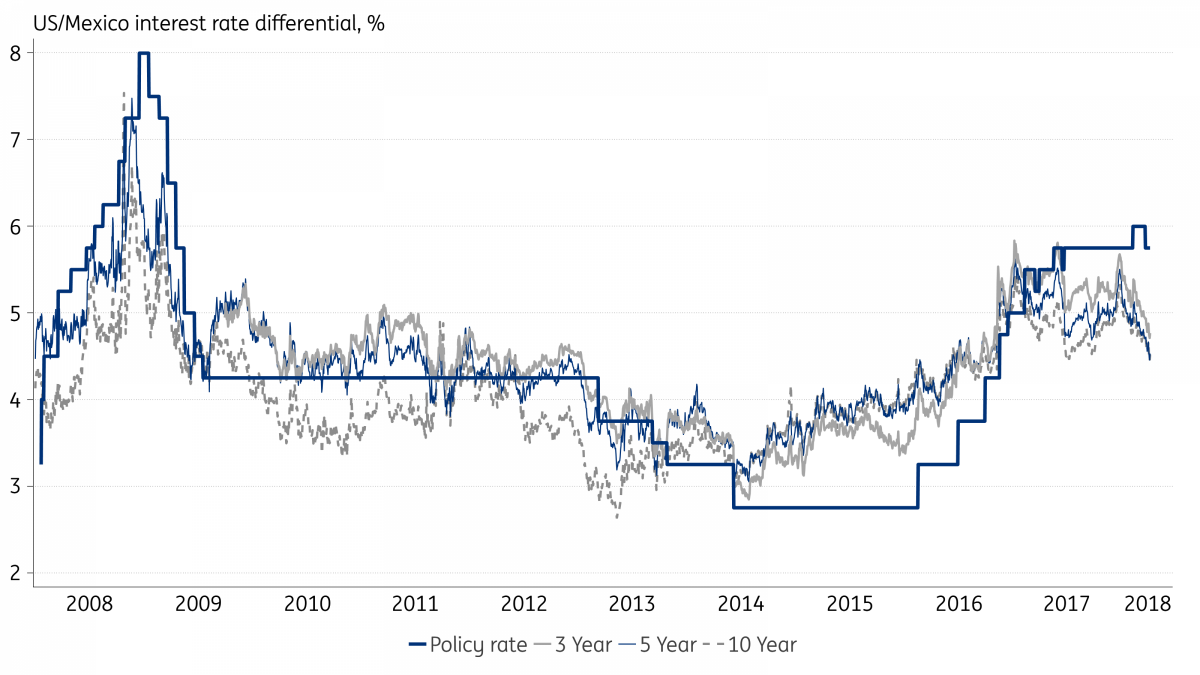

US/Mexico interest rate differentials have risen sharply, but are lower for longer tenors

The issue was never settled among board members however, and at the November meeting, Banxico once again altered the ranking order in its reaction function guidance, with US rate decisions being upgraded from third place to first. The FX passthrough, the output gap and potential wage pressures completed the list of variables that monetary authorities would continue to watch closely.

Economic cycle rationale for hikes seem less persuasive

In principle, the rationale for Banxico to match the Fed would reflect a view of a closely-linked economic cycle between the two countries. Policy decisions made over the past couple of years suggest however that FX market stability, rather than economic cycle arguments, was the crucial consideration when assessing the importance of the relative monetary policy stance between Mexico and the US.

For Mexican policymakers, given the still-challenging short-term inflation and, especially, FX outlook, the assumption is probably that it is still important to match any Fed hikes to maintain the interest-rate differential unchanged. NAFTA negotiations will continue into the new year, with the threat of a possible decision by the US administration to withdraw from the treaty suggesting a weakening bias for the MXN during 1H 18.

Economic cycle arguments to justify additional rate hikes seem less persuasive, in our view. Considering that, according to Banxico, 1) inflation should converge to the 3% target next year, 2) the current level of interest rates is already characterized as “restrictive”, 3) the balance of risk for economic activity is skewed to the downside, considering the typical monetary policy transmission lags, the impact of a rate hike today would peak after inflation is already at the target.

Inflation will drop sharply throughout 2018

The recently announced 2018 calendar for Banxico’s policy meetings, always falling days after the FOMC decisions, suggests that Fed decisions will remain a crucial element in Banxico’s decision-making process. In fact, taken at face value, the bank’s current stance vis-à-vis the Fed suggests that at least one additional hike seems likely, during 1H 18, assuming the FOMC will hike again in that period.

A high degree of data-dependence should persist however. The expected drop in inflation should be partly offset by heightened (NAFTA and electoral-related) FX instability throughout 1H18 and contribute to a scenario in which a Fed hike would again prompt Banxico into a matching move.

After the July 1 Presidential election, with inflation dynamics already consolidated at comfortable levels, and FX dynamics following a strengthening bias (assuming that NAFTA and electoral uncertainties would be by then behind us), Banxico may start considering rate cuts. But prospects for continued hikes by the Fed should keep Banxico cautious and limit the scope of any monetary easing cycle in the foresseable future.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article