March inflation numbers in Hungary and the Czech Republic may restore rates momentum

Inflation in the eurozone and Poland reached record highs in March, surprising markets massively. The experience of recent months suggests that we can expect a similar story in Hungary and the Czech Republic. Despite the fact that market expectations have shifted significantly upwards in recent weeks, we believe there is still room to grow

Eurozone and Poland see record upside surprise in inflation for March

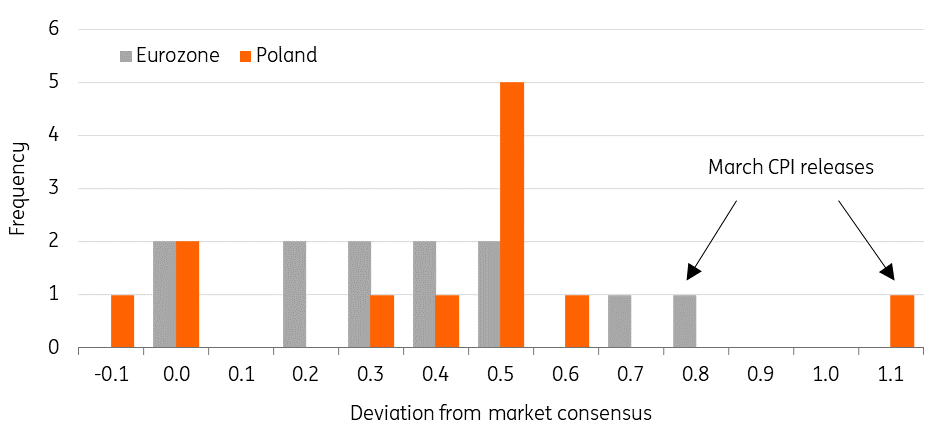

Recently-released March inflation data in the eurozone and Poland showed a massive surprise compared to market expectations. In the eurozone, year-on-year inflation amounted to 7.5% from the previous 5.9%, surprising the markets by 0.8pp. In Poland, March inflation reached 10.9% from the previous 8.5%, beating market expectations by 1.10pp. In both cases, the latest readings and the market surprises reached multi-year, or even all-time highs.

March inflation numbers surprised massively

The same story can be expected in Hungary and the Czech Republic

In the coming days, inflation figures will be published in Hungary (8 April) and in the Czech Republic (11 April). Based on the experience of recent months and the nature of common inflationary pressures, we believe that we may see a significant upside surprise in inflation in these countries as well. March is the first month fully affected by the Ukrainian conflict, higher energy, oil and food prices. Added to this are the Central and Eastern Europe region-specific inflationary pressures in the core component, which together make inflation hard to gauge these days.

In Hungary, the market consensus expects an increase from 8.3% to 8.8%. Our economist Peter Virovacz in Budapest expects 9.1%, but even higher figures are realistic in his view. In the Czech Republic, the market consensus has not yet been published, but we believe that expectations will be in the range of slightly above 12%. In our view, however, it is not impossible that inflation will be closer to 13%.

Eurozone and Polish figures imply surprises in Hungary and the Czech Republic

Market implied policy rates in Central and Eastern Europe

Market view: still room for market rates go higher

Although market expectations have moved up massively in recent weeks, we still think there is room to go higher. In Hungary, the market currently expects a terminal rate of slightly above 8%, which is within reach of our forecast of 8.25%. In the Czech Republic, the situation is similar with a level of 5.75%. On the other hand, in both cases, a further upward shift in our forecasts cannot be ruled out and for the markets, further surprises in inflation will mean expecting a peak in the tightening cycle at higher levels either temporarily or permanently. More and more we are being asked whether the current levels of the IRS curves in both these countries are already too high and it is time to turn the rudder. We agree that a peak is coming, but we are not there yet and inflation numbers in the coming days may again send a hawkish signal, restore momentum and push market pricing even higher.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more