Malaysia’s Mahathir’s resignation comes at the worst time for the economy

Malaysia's prime minister Mahathir Mohammad's surprise resignation means politics looks set to be an added headwind for the economy already reeling under the impact of the coronavirus outbreak. The crisis throws the imminent fiscal stimulus package into disarray and sends the Malaysian ringgit on a steady depreciation path

Surprise resignation

His move back into power was a massive surprise, and his resignation is just as surprising too.

Prime minister Mahathir Mohamad resigned today, leaving the ruling coalition, Pakatan Harapan, formed with the party of his rival-turned-successor, Anwar Ibrahim. It was all surrounding the leadership transition to Anwar, which was supposed to happen by May 2020. But Mahathir had been delaying it until the Asia-Pacific Economic Cooperation Summit in November this year and had lately even been ruling out a transition until all problems inherited from the previous government were resolved.

A new coalition with Mahathir at the helm may be a more likely scenario for the most experienced statesman in Malaysian politics

The political drama had been going on since Sunday when a faction of Anwar’s People’s Justice party reportedly collaborated with Mahathir to reconfigure the ruling Pakatan Harapan coalition and met the King in this regard, although Mahathir was absent at this meeting.

Meanwhile, Malaysian Economic Affairs Minister Mohamed Azmin Ali, who is Anwar's rival within their own party, announced his departure from the party along with 10 other members of parliament, forming an independent parliamentary bloc.

More political uncertainty ahead

It’s hard to determine what course politics will take next.

A possibility includes Mahathir forming a new coalition with other parties in the opposition. He needs 112 out of 220 seats and an alliance with the dominant party in the opposition and the one he led formerly, the United Malays National Organisation (UMNO), isn't being ruled out. Or, Anwar could end up taking that route as he was due to meet the King today.

We can't rule out the possibility of new elections if the political stalemate continues for too long. But a new coalition with Mahathir at the helm may be a more likely scenario for the most experienced statesman in Malaysian politics.

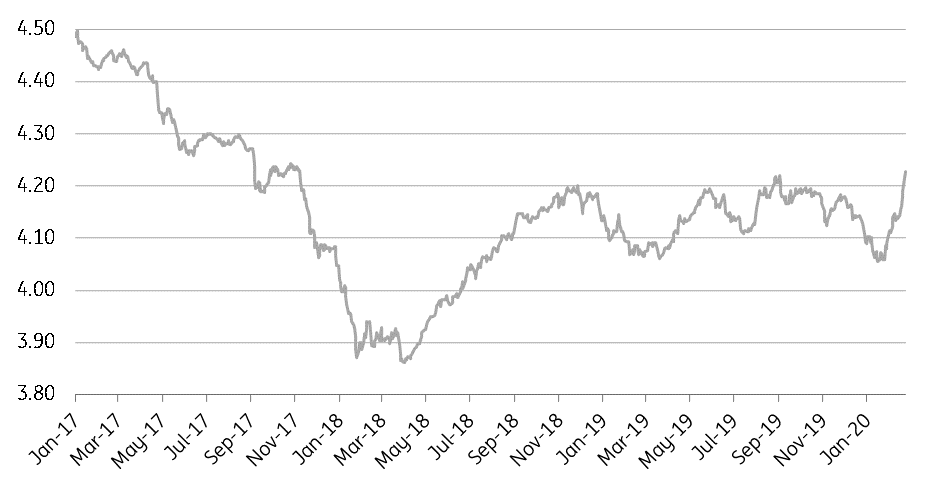

USD/MYR - possibly on a steady weakening path ahead

Not great timing for the economy

The political crisis doesn't come at a great time for the economy already reeling under the impact of Covid-19. While the outbreak is taking a toll on both trade and tourism, the political risk will work to further depress investor confidence. Just recently, we slashed our growth forecast in 2020 to 3.5% from 4.5%, making it the worst year for growth since the 2009 global financial crisis.

Prolonged political uncertainty could see the ringgit depreciating toward 4.50 over the course of the year - a level last seen three years ago

The government was reportedly preparing a stimulus package to soften the impact of the virus but the resignation throws the economic plans into disarray, let alone the extra-budgetary stimulus. As such, the onus lies on the central bank for rate cuts to support growth as there is room for easing due to continued low inflation. We expect a rate cut at the next meeting in March.

The political turmoil has also exacerbated the weakening pressure on Malaysian assets, including the Malaysian ringgit, weakening the exchange rate past 4.20 against the USD - the level we expected for end-1Q20. Prolonged political uncertainty could see the ringgit depreciating towards 4.50 over the course of the year - a level last seen three years ago.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

MalaysiaDownload

Download article

24 February 2020

In case you missed it: Coronavirus creates chaos This bundle contains 8 Articles