Malaysia: Exports end 2018 on a firmer note

Data supports our view of a pick-up in GDP growth in the final quarter of 2018 to 4.6% from 4.4% in the previous quarter, leading to a full-year average of 4.7%. If sustained, the renewed uptrend in global oil prices will be positive for the Malaysian economy and the currency this year

| 4.8% |

December export growthYear-on-year |

| Higher than expected | |

Firmer exports, weaker imports in December

Malaysia’s export growth accelerated to 4.8% year-on-year in December from 1.6% in the previous month. The outcome was better than the consensus of 1.3% export growth but short of our 5.8% forecast. Import growth slowed in line with the consensus to 1.0% YoY from 4.7% in the previous month.

Strong growth in electrical and electronics exports (+14% vs. -1.7% in November) and chemicals (37% vs. 15%) stood out. Meanwhile, a crash in global oil prices in the last quarter is reflected by weak petroleum product and natural gas exports, though crude petroleum export growth remained steady. By destination, weak demand from China continued to weigh on Malaysia’s exports. Weak transport equipment imports pulled total import growth lower.

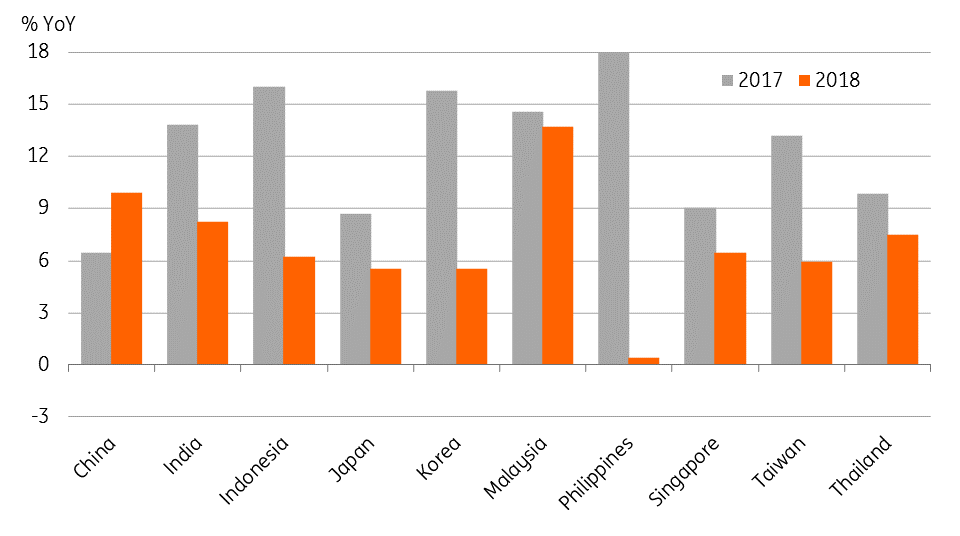

2018 was best year for exports in Asia

Annual export growth of 6.7% in 2018 was down from 18% in 2017. The corresponding figures for imports are 5.0% and 20%.

The authorities report trade data in local currency (Malaysian ringgit or MYR). After converting to US dollars, the 14% export growth in 2018 is, in fact, the best performance among Asian countries, for which we credit improved terms of trade from higher commodity prices. Stripping out the price and exchange rate effect, growth in the volume of exports more than halved to 5% in 2018 from 11% in the previous year.

Asian export performance

Positive net trade contribution to GDP growth

The trade surplus jumped to MYR 10.4 billion in December from MYR 7.6 billion in November. The annual surplus of MYR 120 billion in 2018 was MYR 21 billion higher than 2017, the second consecutive year with a widening trade surplus.

A wider trade surplus means positive net trade contribution to GDP growth. Indeed, that was the case in the first two quarters of last year, although net trade turned out to be a drag in the third quarter. We think it turned positive again in the final quarter; MYR 7.3 billion widening of the 4Q18 surplus from a year ago followed MYR 1.1 billion narrowing in 3Q18. This supports our view of a pick-up in 4Q GDP growth to 4.6% from 4.4% in the previous quarter, leading to full-year average growth of 4.7% (4Q18 GDP data is due on 14 February).

Firmer oil price, firmer currency

If sustained, the renewed uptrend in global oil prices will be positive for Malaysia’s economy and the currency coming into 2019. This, together with a softer dollar, drove the USD/MYR below 4.10 this month, a level not seen since August last year. However, underlying our view of the pair weakening to 4.20 by mid-2019 are expectations of an intensified US-China trade war and strong US dollar. We are reviewing our forecast.

Oil prices driver MYR exchange rate

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

30 January 2019

Good MornING Asia - 31 January 2019 This bundle contains 3 Articles