Malaysia’s export resilience comes to an end

A sharp fall in exports and the widest ever trade deficit suggests the recent relief for the Malaysian ringgit from improving oil prices may not last

| 23.8% |

Export fall in AprilYear-on-year |

| Worse than expected | |

Electronics and oil dent exports

The resiliency of Malaysian exports seen earlier this year has ended.

23.8% year-on-year export plunge in April was steeper than our -19.0% estimate and consensus of -12.8%. This follows -4.7% YoY growth in March. Just like some of its Southeast neighbours’ Malaysian exports held their ground in the first quarter with 1.1% growth but not anymore.

Electrical and electronics - the dominant of all product groups with 38% weight in total exports, remained the main drag with the accelerated decline (-22% YoY vs. -14% in March). And, as we expected, oil and petroleum products exports followed in (-23% vs. +14%), led by a double whammy of global demand slump and low prices.

In terms of destinations, the US and Japan were the weak spots with 31% and 28% fall in shipments, respectively. Bucking the trend, was China with a 4% rise in exports, as a hopeful sign of post-Covid recovery of demand in the biggest export market.

Record trade deficit

Imports also contracted by 8% YoY, though not as bad as consensus expectations of -15.6%. Most product categories posted steeper import falls than in the preceding month, though, oddly enough, transport equipment outshined with 233% jump.

Narrowing trade surplus and weak tourism revenues due to Covid-19 are likely to cause a dent to the current account surplus this year

This produced a trade deficit of MYR 3.5 billion - the highest deficit ever following a surplus of over MYR 12 billion in March. The year-to-date trade balance is still in surplus at MYR 33.4 billion, though that's a sharp narrowing from MYR 48 billion surplus in the same period last year.

Narrowing trade surplus and weak tourism revenues due to Covid-19 are likely to cause a dent to the current account surplus this year.

We anticipate it to be equivalent to 1.5% of GDP as against 3.4% in 2019.

Not good for the currency

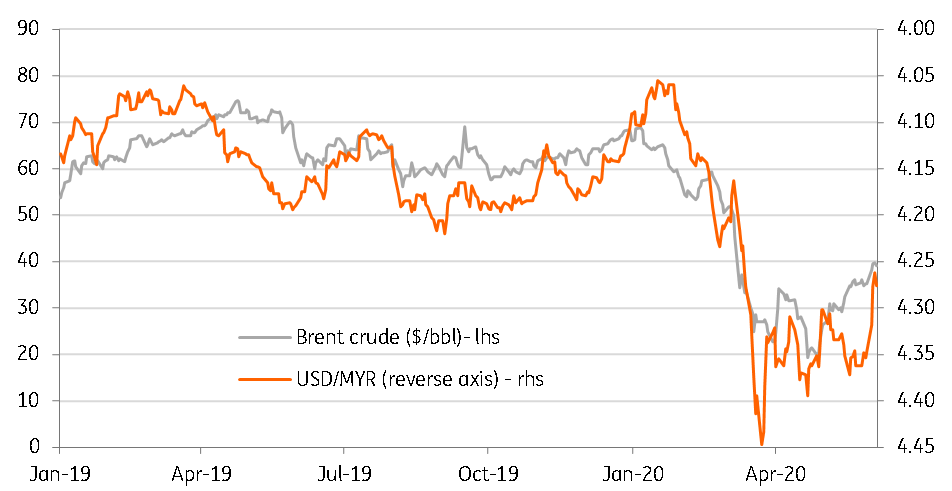

The recent pick up in oil prices has been a relief for the ringgit, helping the recovery from a sharp depreciation to 4.45 in March to 4.28 currently.

However, the trade figures suggest that the relief may not last for long. Besides ongoing weak economic fundaments, continued political risk remains a key headwind for future MYR appreciation.

We continue to see the USD/MYR trading above 4.40 over the next three months.

Oil drives MYR

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 June 2020

Good MornING Asia - 5 June 2020 This bundle contains 4 Articles