Malaysia’s economy outperforms in 1Q

With growth firmly sitting within the central bank’s 4.3-4.8% forecast range for 2019 there will be no need for more rate cuts this year. And the external payments position remains positive for the Malaysian ringgit

Firmer growth, steady policy ahead

Last week's 25 basis point rate cut by the Bank Negara Malaysia seems to be a timely boost to the economy given the slack in domestic investments, while the latest escalation of the US's trade war with China, and persistent risk of it spreading beyond China, also warrants greater policy support for the economy. This, together with the favourable base effect, should drive GDP growth near the top of the BNM's 4.3-4.8% forecast for this year. Meanwhile, persistently low inflation sustains the scope for more BNM policy easing in the event growth weakens further, though this is not what we expect for the rest of the year.

We maintain our forecast of no more BNM rate cuts this year. And unless we see broad emerging market contagion, we don’t see any reason why the MYR should remain under weakening pressure going forward, especially as the economy enjoys a healthy external payments position. Our year-end USD/MYR forecast is 4.16.

| 4.5% |

1Q19 GDP growth |

| Better than expected | |

Just a modest GDP slowdown

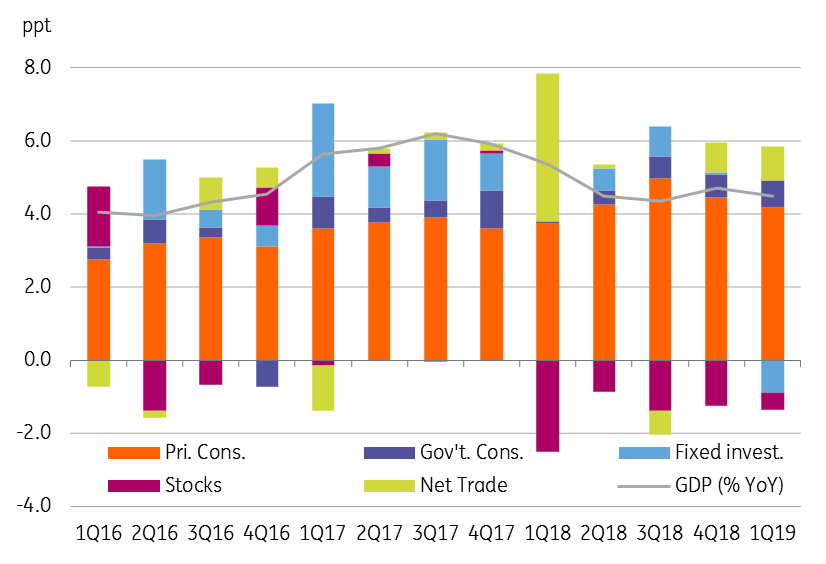

Malaysia’s GDP grew by 4.5% year-on-year in the first quarter of 2019, surpassing the consensus of 4.3% (and ING forecast of 4.2%). A slowdown from 4.7% growth in the previous quarter resulted from weak domestic demand, especially investment spending. A 3.6% YoY contraction in the fixed capital formation GDP component was the worst since the global financial crisis a decade ago and this alone shaved off nearly a percentage point from the headline GDP growth.

Private consumption growth also eased a bit, though this component continued to be the key GDP growth driver. Firmer government consumption and net trade were some of the offsets. On the industry side, all but the agriculture sectors posted a slowdown.

The above-expected first-quarter GDP on its own lifts our full-year growth forecast from 4.6% to 4.7%, putting it close to the top end of the BNM's 4.3-4.8% forecast for this year. We don’t think the government’s expectations of 4.9% growth this year will be unachievable given the accommodative macro policies.

What's driving GDP growth?

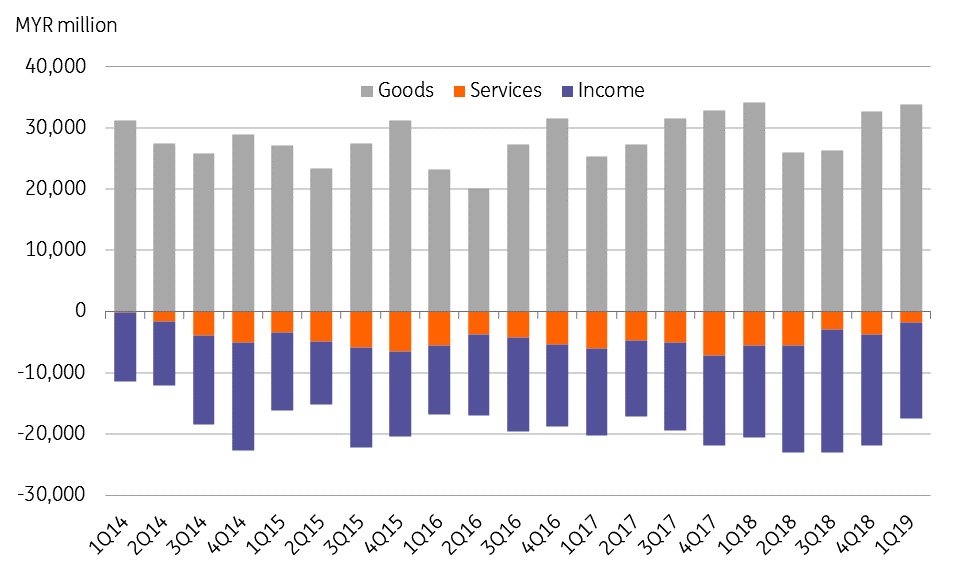

Current account surplus at 5-year high

Consistent with a steady net trade contribution to GDP growth, the current account of the balance of payments posted a 16.4 billion Malaysian ringgit (MYR) surplus in 1Q19, the highest surplus since 1Q14.

We knew from a wider customs-basis trade surplus that the current surplus widened too; the median consensus was MYR 12.8 billion, up from MYR 10.8 billion in the previous quarter. But narrower deficits on services and income accounts drove the current account surplus to exceed expectations.

A strong first-quarter surplus imparts upside risk to our view of an annual current account surplus equivalent to 2% GDP this year (consensus 2.4%, 2018 2.1%).

What's driving current account?

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

16 May 2019

Good MornING Asia - 17 May 2019 This bundle contains 4 Articles