Malaysia’s central bank cuts policy rate by 25 basis points

Today’s rate cut still leaves Malaysia's central bank with a sufficient interest rate buffer if economic conditions deteriorate further. That may not be required though, as growth is likely to stay firmly within BNM's baseline of 4.3 - 4.8% for the year. That said, we revise our year-end USD/MYR forecast from 4.05 to 4.12

| 3.00% |

Policy rateAfter a 25bp cut today |

| As expected | |

No policy surprise, so little market impact

Malaysia's central bank cut the overnight policy rate by 25 basis point to 3.00% at their meeting today. This was in line with our forecast as well as the consensus median estimate, though the consensus was fairly skewed as nine out of 23 analysts in the Bloomberg survey expected no policy change.

We 're revising our USD/MYR year-end forecast higher to 4.12 from 4.05

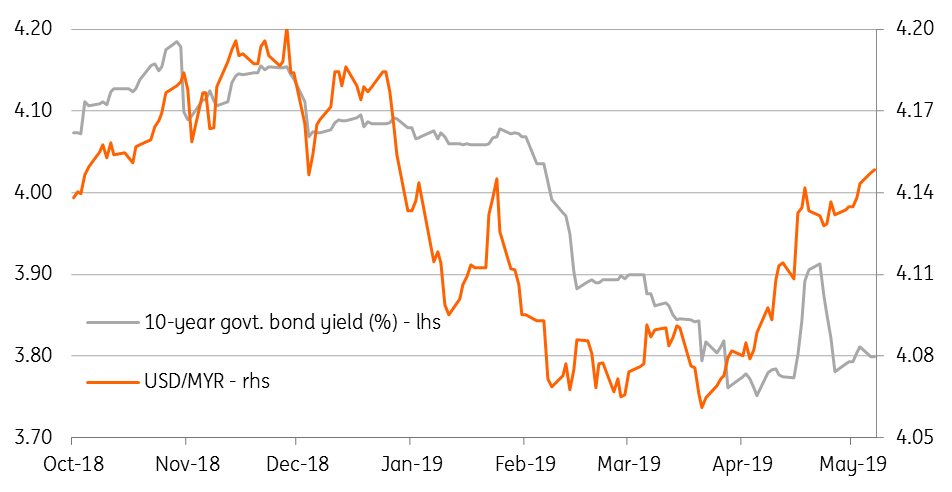

But the markets had priced in a cut, judging from the 30bp year-to-date fall in the 10-year government bond yield and by 0.3% depreciation of the Malaysian ringgit. As we expected, the bonds recouped from their recent sell-off, after the FTSE Russell dropped them from its global bond index. But the currency isn’t immune to the broader weakening pressure on emerging market currencies. We are revising our end-2019 USD/MYR forecast higher to 4.12 from 4.05.

Markets are priced for a rate cut

Increased external headwinds to growth

The ‘unresolved trade tensions’, the key source of risk that BNM’s previous policy statement in March cited at the outset, have indeed materialised to pack the punch of policy easing today.

Today’s statement noted, “Considerable downside risk to global growth remain, stemming from unresolved trade tensions and prolonged country-specific weaknesses in the major economies”. On the domestic side, it cited 'stable labour market conditions and capacity expansion in key sectors as supporting consumption and investment spending going forward, and (GDP) growth staying within the BNM’s baseline of 4.3 - 4.8% for this year. However, it also pointed to heightened external headwind to growth from the trade tensions and extended commodity market weakness.

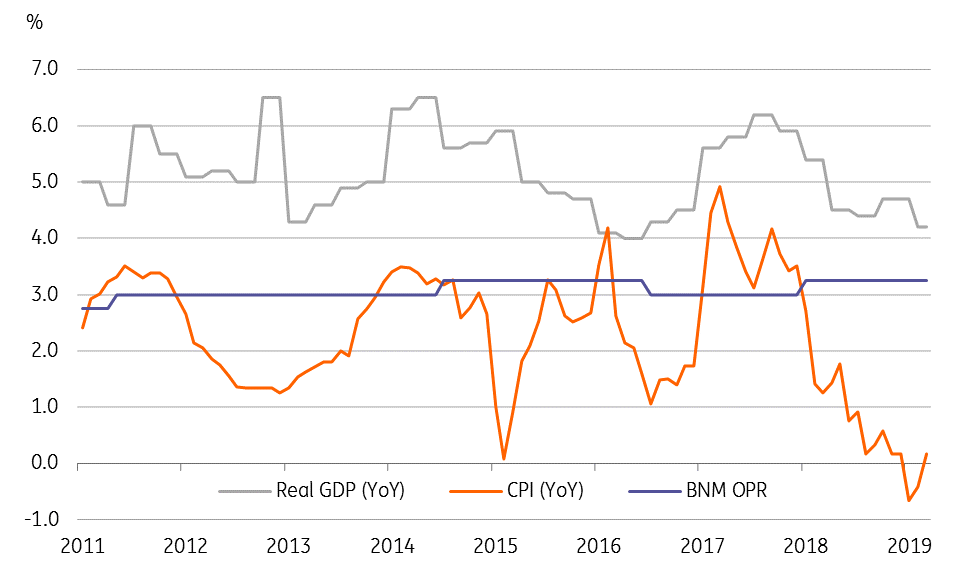

Thanks to the absence of strong demand pressure, inflation isn’t perceived as a major concern this year and the central bank’s forecast is 0.7-1.7%.

Possibly one-and-done move for the year

Today’s rate cut still leaves the central bank with a sufficient interest rate buffer if economic conditions deteriorate further, but this may not be required.

Although the GDP slowdown intensified coming into 2019 – our estimate of 4.2% growth in the first quarter puts it below the BNM’s forecast range for the year. We expect the timely policy boost together with the favourable base effect to shore up growth in the rest of the year towards the top end of the forecast range.

Inflation returned to the positive territory in March after two consecutive months of being negative. With inflation likely to remain close to the low end of the BNM's forecast range, the central bank has room to maintain the current level of policy accommodation going forward.

Our full-year 2019 growth and inflation forecasts remain at 4.6% and 1.0% respectively.

BNM has sufficient policy buffer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

7 May 2019

Good MornING Asia - 8 May 2019 This bundle contains 4 Articles