Malaysia’s 1Q21 GDP beats expectations

The ongoing third wave of Covid-19 and the nationwide movement control order will mean a significant dent to the economy in 2Q21. We are cutting our 2Q GDP growth forecast to 13.9% year-on-year from 16.7% but maintain our full-year 2021 growth view of 5.3%

| -0.5% |

1Q21 GDP fallYear-on-year |

| Better than expected | |

Exports drive recovery in 1Q21

Malaysia’s 1Q21 GDP report today showed a much smaller contraction of -0.5% year-on-year in 1Q21 than our -2.5% forecast for the period. This is a marked improvement over the -3.4% YoY fall in 4Q20. While part of it was due to the favourable base effects, a 2.7% QoQ (seasonally adjusted) bounce reflects an underlying economic recovery in the last quarter (-1.5% QoQ in 4Q).

Malaysia's exports saw a strong surge due to an upswing in the global semiconductor cycle

However, it was a lopsided recovery led mainly by exports which, as in other Asian economies, saw a strong surge due to an upswing in the global semiconductor cycle as well as the concurrent chip shortage around the world. The 12% YoY surge in total goods and services exports in 1Q, in contrast to the -2% fall in 4Q, bears this out. Strong merchandise exports, in turn, lifted manufacturing GDP growth to 6.6% YoY from 3.0% over the same quarter, though services continue to reel amid the impact of the pandemic.

Everything else continues to be weak

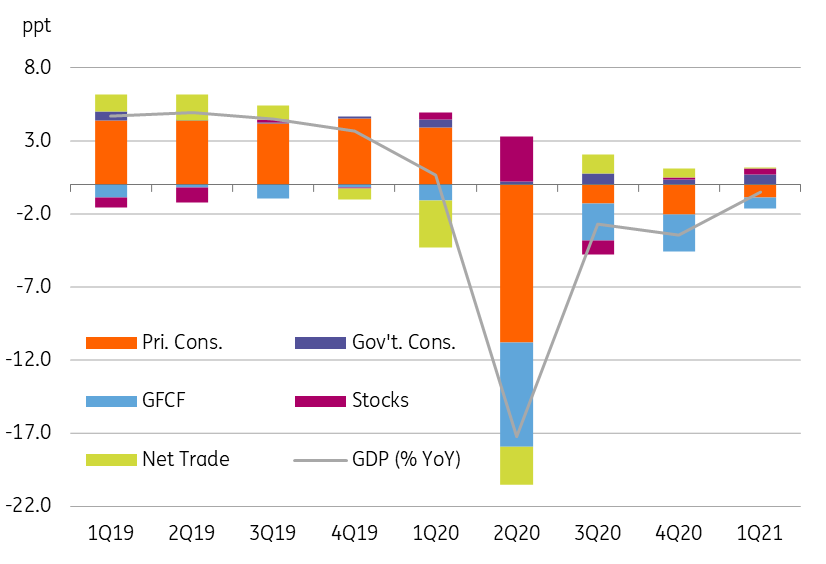

The domestic demand recovery continued to be anaemic, however. Private consumption and investment remained the main drags on headline GDP growth, while firmer government spending reflected additional Covid-19 fiscal stimulus.

The contribution of net trade to GDP growth was reduced to zero after being positive in the previous two quarters. This aligned with 1Q21 balance of payments data showing a sharp narrowing of the current account surplus to MYR12.9 billion from MYR19 billion in 4Q20.

Expenditure-side sources of year-on-year GDP growth

Resurgent pandemic clouds prospects

Indeed, the third wave of the Covid-19 outbreak underway currently clouds the economic outlook ahead -- daily new infections have jumped from about 1,000 a month ago to over 4,500 last weekend.

While a month-long ban on inter-state and inter-district travel kicked off on Monday, 10 May, the government further stepped up containment efforts with an announcement of a nationwide movement control order (MCO-3) from 12 May until 7 June, which prohibits social gatherings of all sorts, closes schools, and also imposes a significant curb on Muslim prayers as the holy month of Ramadan draws to a close this week.

All economic sectors are allowed to operate with an emphasis on working from home and significantly trimmed down workplace capacity.

But central bank remains hopeful

Undoubtedly, the tighter restrictions will cause a significant dent to the economy in the current quarter, which leads us to cut our GDP growth forecast for 2Q21 from 16.7% YoY to 13.9% YoY. The double-digit year-on-year growth mainly stems from a huge 17% YoY plunge a year ago rather than any underlying recovery.

We maintain our full-year 2021 growth forecast of 5.3% YoY, which is below the central bank’s (Bank Negara Malaysia) 6% to 7.5% forecast range for this year.

The BNM’s optimistic view of recovery combined with accelerating inflation supports our forecast of stable BNM policy throughout this year.

In the statement released today, the BNM anticipates a less severe impact from the latest Covid-19 restrictions than a year ago, with the recovery benefiting from better global demand and continued policy support domestically. It also sees average inflation heading higher to an average of between 2.5% to 4.0% this year from -1.2% last year, led mainly by the transmission of higher global oil prices to domestic fuel prices.

The BNM’s optimistic view of recovery combined with accelerating inflation supports our forecast of stable BNM policy throughout this year, and possibly next year too. We forecast no change to the 1.75% overnight policy rate over the rest of this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article