Malaysian economy beats expectations in first quarter

Yearly GDP growth remained in positive territory despite strong economic and political headwinds in the first quarter. But, a quarterly contraction sets the economy on the road to a deeper recession

| 0.7% |

1Q20 GDP growthYear-on-year |

| Better than expected | |

A pleasant upside miss

Malaysia’s first-quarter GDP posted 0.7% growth from a year ago, a better performance compared to the consensus forecast of a -1% contraction (far better than our -4.2% forecast). This still represents a sharp slowdown from 3.6% YoY growth in 4Q19, and the worst quarterly outcome in over a decade (since the 1.1% fall in 3Q09 induced by the global financial crisis). Moreover, a 2% quarter-on-quarter (seasonally adjusted) GDP fall sets the economy on the path of a recession, probably deeper than the GFC.

A better 1Q GDP performance relative to other Asian countries comes against an adverse economic and political backdrop in the period. First, the political turmoil leading to the end of the Mahathir government in late February depressed economic confidence. Just as the Muhyiddin administration assumed power, it was forced to implement Covid-19 movement restrictions in mid-March, bringing the economy to a standstill. As if all this wasn’t enough, a crash in the global oil price in March made matters worse for Asia’s net oil-exporting economy.

Badly hit external sector

Consistent with the message from the high-frequency data, manufacturing growth stayed in positive territory, although it slowed to 1.5% YoY from 3.0% in the previous quarter. Agriculture and construction were badly hit with -8.7% and -7.9% YoY growth, while services growth halved to 3.1% from the previous quarter.

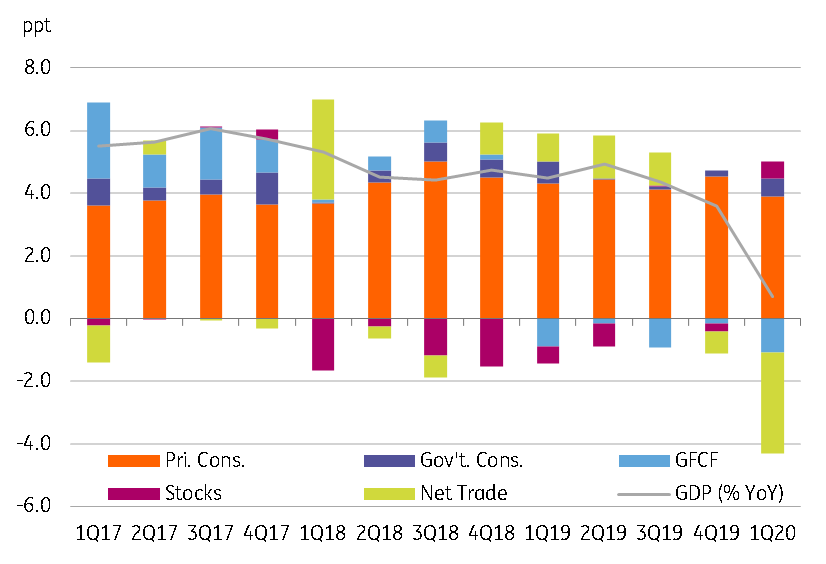

Private consumption remained the spending side GDP driver with a 3.9 percentage point contribution to headline growth, yet smaller than 4.5ppt in 4Q19. Government consumption helped with another 0.6ppt (we doubt it was entirely stimulus). Exports turned out to be the bigger drag, shaving off 4.7ppt from GDP growth (a stark contrast to firmer customs-basis export growth), imports subtracted 1.4ppt, and fixed capital formation got it down by another 1.1 ppt.

Expenditure-side sources of GDP growth

More pain ahead

The first-quarter GDP doesn’t capture the full impact of Covid-19, which will mainly impact the current quarter due to movement restrictions. The authorities have decided to relax restrictions starting 4 May, but the broader control measures remain in place until 9 June. This means a virtually entire quarter of significantly sub-normal economic activity. We aren’t rushing to change our view of as much as 6.6% YoY GDP contraction in 2Q, or 2.9% full-year contraction in 2020.

The new government of Prime Minister Muhyiddin Yassin spared no time in rolling out massive stimulus -- amounting to about 18% of GDP, though mostly including easier credit avenues and early access to pensions. The real fiscal thrust is only 4% of GDP. The Bank Negara Malaysia has also accelerated its easing with a 50 basis point rate cut on 5 May. We doubt aggressive fiscal and monetary stimulus will be effective in preventing a recession.

While already stretched public finances limit the scope of more fiscal stimulus, we believe monetary easing has further to run given falling inflation. We continue to expect an additional 50bp BNM rate cut in this cycle.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

13 May 2020

Good MornING Asia - 14 May 2020 This bundle contains 2 Articles