Malaysia: Wider external surplus is positive for ringgit

A continued widening in external trade and current account surpluses this year is positive for the Malaysian ringgit (MYR), but the persistent global trade uncertainty is negative. The positives may outweigh the negatives to sustain the scope of the continued MYR outperformance

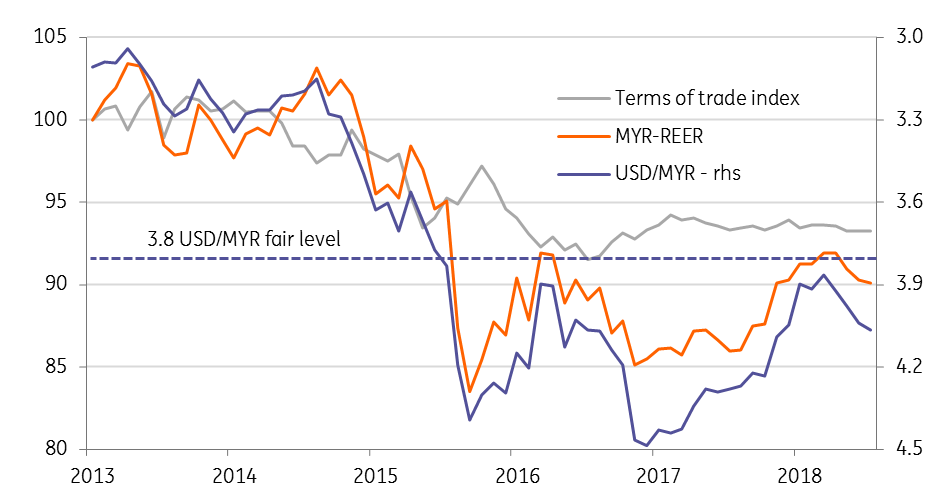

The Malaysian authorities, especially Prime Minister Mahathir, view 3.8 as the fair level for the USD/MYR exchange rate. Just as the pair was going to get there earlier in the year global trade war tensions started to escalate. That persistent uncertainty will undoubtedly remain a forceful tailwind for higher USD/MYR going forward, which is driving our view of USD/MYR trading toward 4.35 by the end of the year. However, Malaysia’s positive external payments situation sustains the scope for the currency outperformance which imparts a downside risk to our end-year USD/MYR forecast (spot rate 4.08).

| 7.6% |

Malaysia exports growth in JuneYear-on-year |

| Lower than expected | |

Downside trade surprise in June

Malaysia’s trade growth in June surprised on the downside, with MYR-denominated exports rising by 7.6% year-on-year and imports by 14.9%. While these were slower than the consensus forecasts of 10.3% and 15.3% respectively, the pace was still faster than 3.4% for export growth and 0.1% for import growth in May.

In the exports category, the commodities cluster (crude petroleum, petroleum products, liquefied natural gas, and palm oil) slowed sharply to a 3.4% YoY fall from over 10% growth in May. Acceleration in electronics exports led by the semiconductors, which was up 21% YoY from 13% in May, saved the day. Imports of electronics, most of which are processed for re-exporting, and chemicals helped the acceleration of total import growth.

| 61bn |

Malaysia trade surplus in 1H 2018 (MYR)Up by MYR 18bn from year ago |

Widening trade and current account surpluses

The outpacing of import growth over export growth was associated with a lower trade surplus in June of MYR 6.1bn than MYR 8.1bn surplus in May. Yet the cumulative trade surplus in the first half the year of MYR 60.6bn was MYR 18bn higher than the level a year ago. This came on the back of a sharp slowdown in the year-to-date export growth to 7.0% YoY and import growth to 3.4% from 21% and 23% respectively 12 months ago.

The wider trade surplus boosted the annual current account surplus to MYR 40bn in 2017 (3.0% of GDP) from MYR 30bn (2.4% of GDP) in the previous year. We forecast a further widening in the current surplus this year to about MYR 50bn (3.5% of GDP). The higher trade and current account surpluses are positive for MYR, and together with relative undervaluation (see figure) these underpin the MYR’s continued outperformance this year; the 0.7% year-to-date depreciation against the USD was the least among Asian currencies.

USD/MYR's recovery toward 3.8 fair level is stalled

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 August 2018

Good MornING Asia - 6 August 2018 This bundle contains 2 Articles