Malaysia: Very low inflation is over

As the goods and services tax impact moves out of the base effect, inflation will likely be pushed into a 1.5-2.0% range from June. Even so, we are reviewing our view of stable central bank policy for the rest of the year in favour of more rate cuts, as global headwinds to growth rise

| 0.2% |

May CPI inflation |

| Lower than expected | |

Another downside CPI miss - seventh in a row

Malaysia’s consumer price inflation in May was unchanged from April’s 0.2% year-on-year rate. This was contrary to the consensus view of an acceleration to 0.3%, which makes it the seventh consecutive downside surprise.

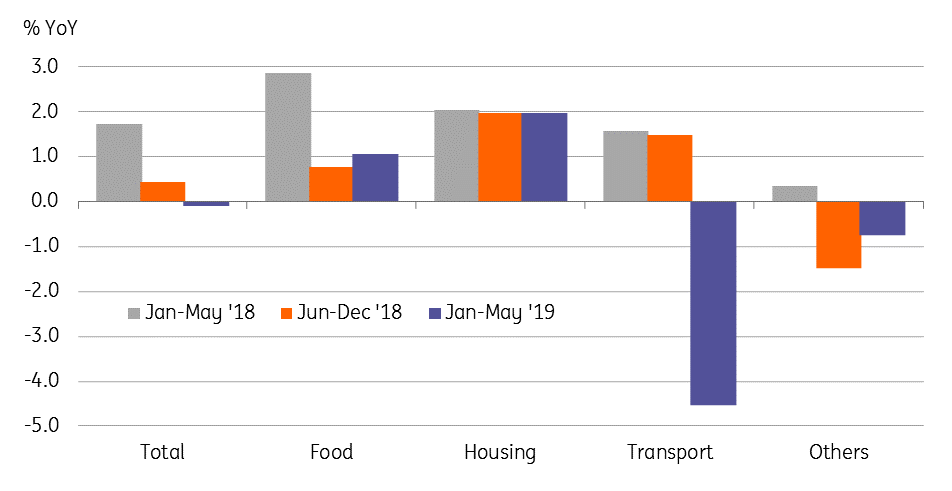

The CPI breakdown showed higher food, beverages, and entertainment prices– all resulting from a seasonal surge in demand during the Ramadan month – being offset by lower housing and transport costs. While food inflation continued to grind higher, transport inflation persisted as the big drag on the headline CPI.

Best is behind us, worst isn’t on horizon

This was probably the last month of the very low inflation trend, which started in June 2018 with the eliminated goods and services tax (GST). As the GST impact moves out of the base effect, inflation is likely to move into a 1.5-2.0% range for the rest of the year.

Not a worry just yet. We don’t see inflation becoming a threat anytime soon. And even if food inflation gets a further boost from a GST-related slump in the second half of 2018, this will likely be countered by weakness in other CPI components such as clothing, healthcare, communication, and miscellaneous goods – all implying well-anchored inflation expectations.

Average inflation in the first five months of the year is still negative (-0.1% YoY). We see downside risk to our full-year 2019 average inflation forecast of 1%, though we maintain it for the time being to see how the GST base effect really pans out. In all likelihood, the annual rate will be closer to the low end of the Bank Negara Malaysia’s (BNM) 0.7-1.7% forecast range for the year.

Consumer price inflation by main components

Doors open for more BNM easing, if needed

We are re-considering our view of BNM leaving monetary policy on hold for the rest of the year as the global easing wave is now getting even stronger than before.

Not that the BNM is behind the curve. As insurance, it cut the overnight policy rate by 25 basis point to 3.0% at the last meeting on 7 May. Unlike most other Asian economies, economic activity here has been relatively firm. Malaysia’s GDP growth probably hit a cycle low of 4.5% in 1Q19, with full-year growth likely to be close to the top end of the central bank’s 4.3-4.8% forecast range for the year.

The next BNM policy meeting is scheduled for 9 July. We believe the central bank will continue to assess economic risks as fairly balanced between growth and inflation but, at the same time, leave the door open for a policy rate cut or two later in the year. Unless inflation gets out of hand due to the higher global oil price, which is not our baseline view, a relatively high real interest rate allows scope for more BNM easing, if needed.

Asian real interest rates

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

26 June 2019

Good MornING Asia - 27 June 2019 This bundle contains 3 Articles