Malaysia: So far, so good

But it depends on what turn economic policies take in the first 100 days of the Mahathir administration

Although the muted market reaction to last week’s unexpected election outcome lessens our confidence in our forecast that the Malaysian ringgit (MYR) will breach through the 4.00 level against the US dollar in the near term, we are not rushing to revise it just yet.

| 5.6% |

Consensus forecast for 1Q18 GDP growthSlower than 5.9% in 4Q18 |

Steady GDP growth

Malaysia’s first key economic data under the new government- GDP for the first quarter of 2018- is due on Thursday, 17 May. Our forecast is 5.6% year-on-year growth, in line with the consensus. A modest slowdown from 5.9% in the previous quarter is largely due to the high base effect rather than any underlying economic weakness.

Malaysia’s exports outperformed the rest of Asia’s with 20% YoY growth in USD-terms in 1Q18. Industrial production growth, which is closely correlated with GDP growth, accelerated, too. We also think that elections spending supported the strength of domestic demand coming into 2018. The consumer-friendly policies under the new government should keep domestic demand supportive of GDP growth in the period ahead, even if the global trade war threatens exports.

We forecast full-year 2018 GDP growth of 5.5%, the low end of the official 5.5-6.0%.

Critical 100 days

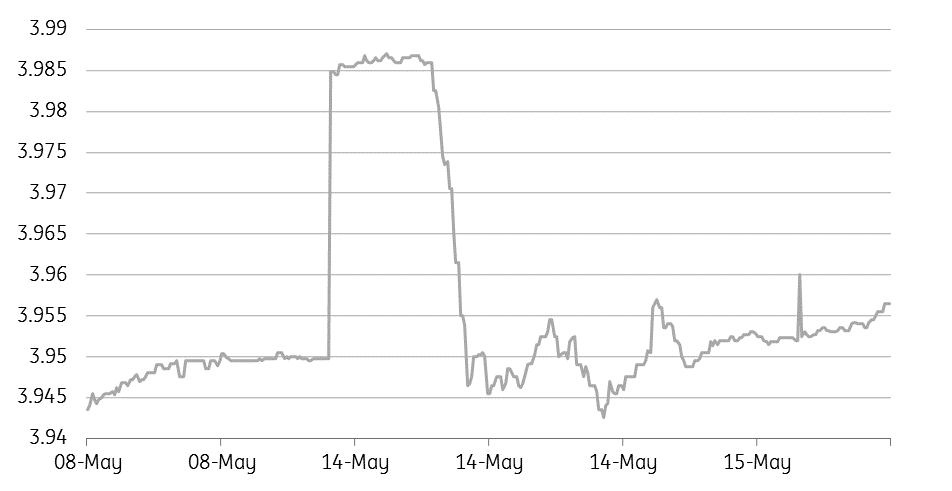

The markets outperformed expectations in the first two days of trading after the election holiday, although there was some weakness of the MYR (see figure) which can be attributed to broad USD strength.

The election holiday allowed market players time to digest the election surprise and adjust expectations of policies under the new administration. A smooth transition of power to Mahathir Bin Mohamad and his swift move to spearhead policy initiatives by getting his economic team (the “Council of Eminent People”) in place, deserve some credit for an almost unshattered market confidence. But at the same time, some differences with the coalition partners on initial cabinet appointments cannot be fully ignored.

The fundamentals are still there. When the fiscal conditions improve, this will be the final factor to have our ratings improved. – Zeti Akhtar Aziz, former central bank governor and a member of Mahathir’s economic team

The resilient markets, by no means, suggest there is no further uncertainty ahead. The big issue for the markets, however, is Mahathir’s plan to eliminate the Goods and Services Tax within the first 100 days of his rule. So far, there are no signs of Mahathir backtracking on this promise. Mahathir's economic team, which is comprised of people from a former finance minister and central banker to corporate leaders, is confident that scrapping the GST will not dent government revenues.

However, backtracking on economic reforms will certainly dent investor confidence, in our view. The current strong growth may help the economy absorb any GST revenue loss now, but that won't be the situation forever.

MYR per USD: A short-lived post-election spike

Download

Download article

15 May 2018

Good MornING Asia - 16 May 2018 This bundle contains 5 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).