Malaysia’s new normal

A decent growth rate among Asian countries, 4-5% will be the new normal for Malaysia, and that is where we see it staying in the medium term. Stretched public finances will limit the scope for fiscal stimulus but low inflation has opened doors for monetary easing

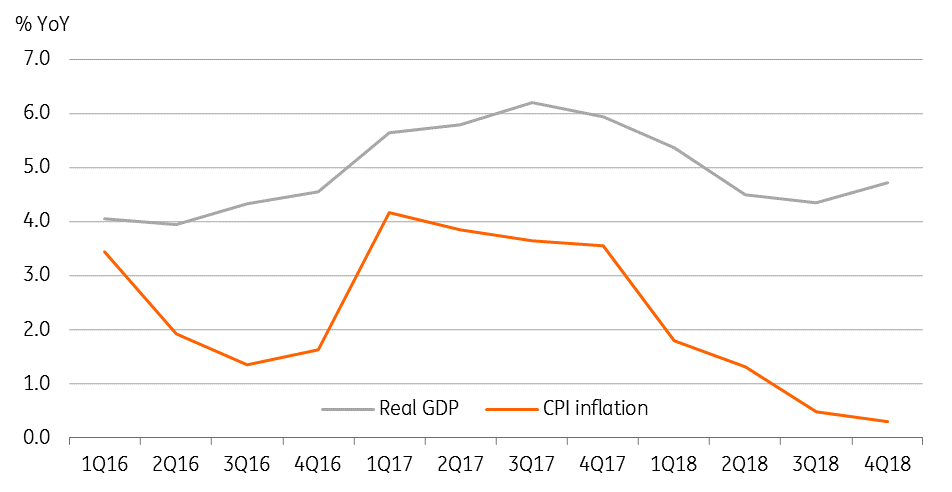

New government policy shift suppressed both growth and inflation

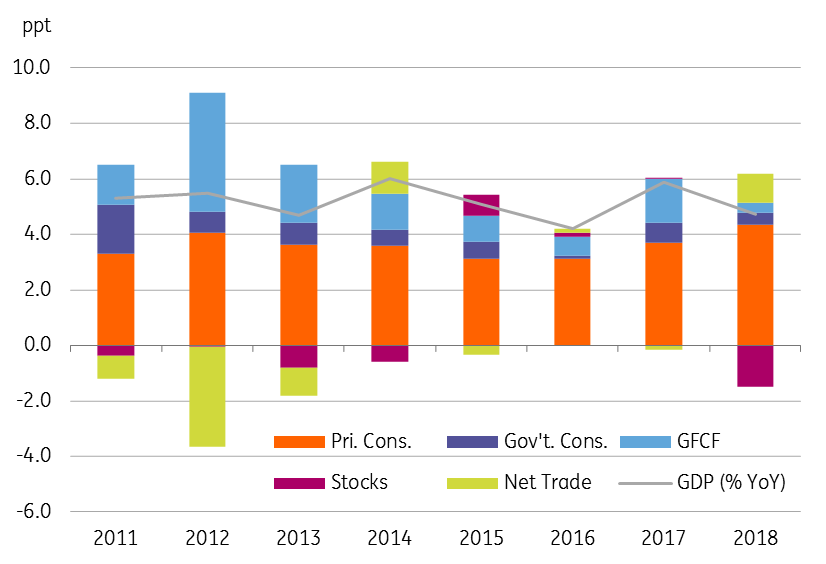

Malaysia’s economy expanded by 4.7% in 2018, but the slowdown in growth from 5.9% in 2017 was the result of domestic and external drags. Domestically, there was an overhaul of economic policy after a surprise change of government in May 2018. And soon after taking office, the new government scrapped the goods and services tax - the key revenue source for the previous government and also suspended infrastructure investments.

While such a policy shift was positive for the economy to an extent, (via a boost in private consumption), it hit investment spending hard. Overall domestic demand shaved off 2.4 percentage points from annual growth in 2018 and was dragged down further by inventory de-stocking among other things.

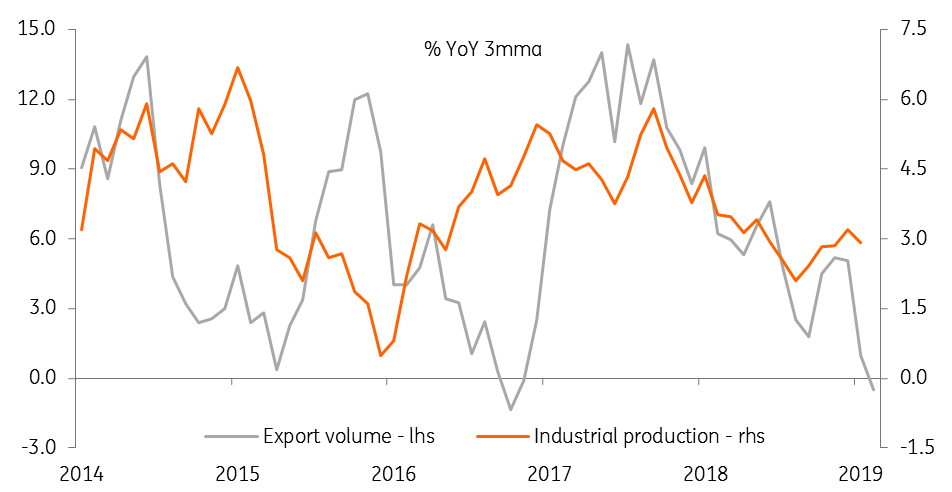

Despite these headwinds, 14% annual export growth was outstanding performance among Asian economies

Externally, firmer commodity prices supported exports in early 2018, but export prospects deteriorated with increased US-China trade tensions and the renewed oil price slump in the second half of the year. The silver lining in all of this was electronics exports managed to ride out the 'tech slump' observed elsewhere. Despite these headwinds, 14% annual export growth was outstanding performance among Asian economies.

The removal of the goods and services tax in June 2018 was a godsend for consumers as it brought inflation below 1%. The re-introduction of a more benign sales and services tax didn’t do much to lift prices either. The average annual inflation of 1% last year was a sharp dip from nearly a decade-high of 3.8% in 2017.

Growth and inflation - both heading downwards

Macro policy has been relatively tight

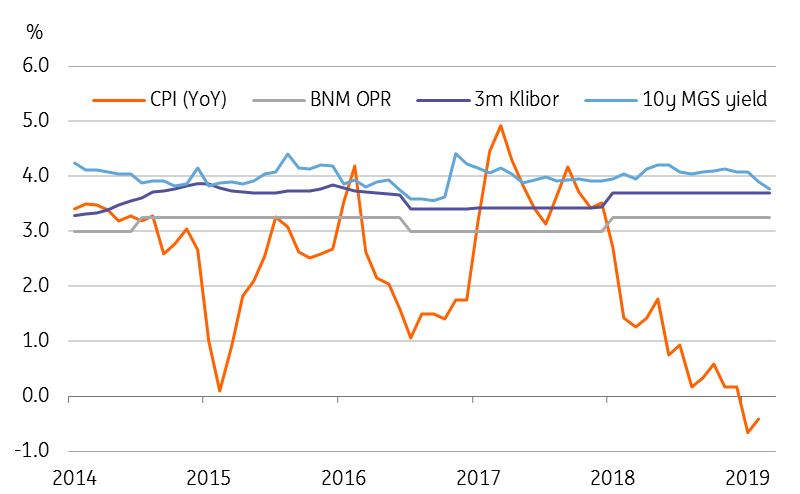

Malaysia's central bank’s efforts to normalise policy after a prolonged accommodative spell was short-lived. In a one-off move, they hiked the policy rate by 25 basis point to 3.25% in January 2018, before low inflation and intensified growth risks stalled the normalisation.

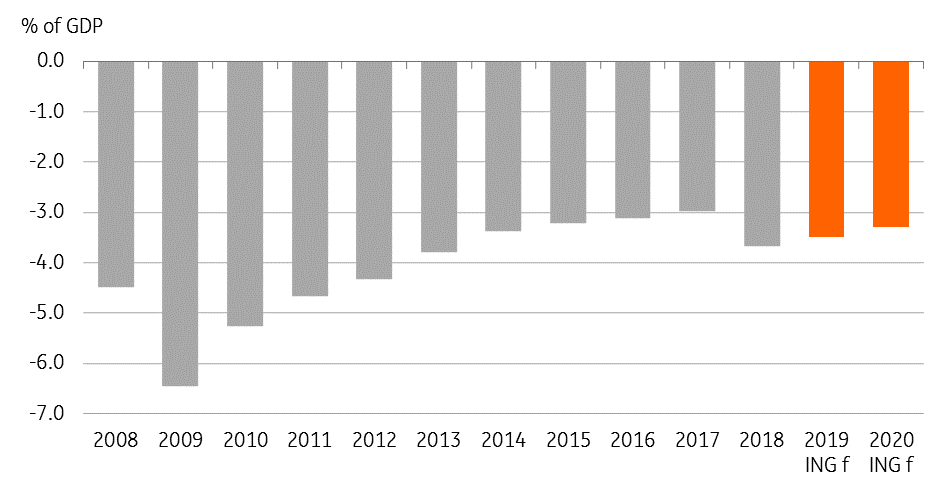

In our view, the new government's initial fiscal policy response to the economy lacked clear direction. The elimination of GST was stimulatory via a boost to consumption but suspending public investments was restrictive. Moreover, a significant spike in the fiscal deficit to 3.7% of GDP in 2018 erased the consolidation of the last four years and ruled out the scope of a stimulus to the economy from this side.

Surprisingly, international rating agencies overlooked this significant fiscal slippage because of the country's sound external payments position with a sustained 2-3% of GDP current account surplus. Despite the political jitters, the Malaysian ringgit came out among Asia’s outperforming currencies in 2018 and 2019 too.

Exports and manufacturing, both seem to be slowing

Balance of risks tipped towards growth, not inflation

2019 kicked off on the softer side led by a continued slowdown in exports and manufacturing keeping GDP growth on a slowdown path. We expect GDP to grow by 4.2% year-on-year in the first quarter of 2019 - the slowest rate in almost three years and down from 4.7% in 4Q18. We also expect this to be the trough in the current cycle, at least the low base effect should push growth higher for the rest of the year.

Our full-year GDP growth forecast of 4.6% for 2019 is within the central bank's forecast range of 4.3 - 4.8% for the year, which they recently downgraded from 4.9%. The good news is that domestic demand will remain the principal growth driver this year, softening the impact of external uncertainties including the trade war, commodity price volatility, and the tech slump.

| 4.6% |

ING GDP forecastFor FY19 |

Domestic demand - principal driver of growth

Don't fret about negative inflation

Low inflation should help private consumption remain in the top spot of GDP growth drivers. The administrative curbs in fuel prices produced negative inflation in the first two months of 2019 for the first time in nearly a decade, which prompted us to cut our annual inflation forecast to 1.0% from 1.4%.

The price decline is not pervasive. This is different from a severe drop in spending such that firms generally have to cut prices to attract consumers. – BNM Governor Shamsiah Yunus

We see the current negative inflation as a transitory spell as global oil prices are creeping up and will eventually filter through to domestic fuel prices. Neither do we see any big build-up of price pressures anytime soon, at least not until the impact of GST removal moves out of the base by mid-2019.

Even then, the annual average inflation rate won't be far from 1% seen in 2018, or close to the low end of the central bank’s 0.7-1.7% forecast range for this year. It will take significant policy thrust to consumer spending, or large supply shocks, for inflation to hit the central bank's medium-term policy target of 2-3%, but we don't see that happening anytime soon.

Low inflation opens doors for monetary stimulus...

Negative inflation also prompted us to revise our view on the central bank policy from no change this year to one 25bp rate cut in the current quarter, possibly at the next policy meeting scheduled for 7 May.

Recognizing the downside risks to domestic growth, the thrust of monetary policy in 2019 is to remain accommodative to ensure supportive conditions for sustainable economic growth amid the subdued inflation outlook. - BNM Governor Shamsiah Yunus

There are no forceful arguments for easing just yet, but pre-emptive easing to support future growth won’t hurt when there is room. Besides growth and inflation influence policy and the following factors substantiate our rate cut view:

- High real interest rates: The recent falling inflation trend has pushed real interest rates higher. As noted earlier, investment spending has been a weak spot in GDP growth, and high real interest rates are a further deterrent to investor sentiment.

- Better now than later: Being ahead of the curve should allow sufficient time for the impact of monetary easing to trickle down to the real economy, thus preparing the economy to ride the slowdown trend. It won’t hurt given there is scope for easing now.

- Mature tightening cycle: Based on recent BNM policy history the current tightening cycle appears to have matured. Previous BNM tightening cycles have sometimes been short-lived, and we think this could be another short one, particularly given current growth-inflation dynamics.

- Market re-pricing for easing: We infer from the 30 basis point drop in the 10-year local government bond yield so far this year to 3.77%, the market has been re-pricing for a rate cut. Meanwhile, a sound external payment position is keeping the currency among Asia’s outperformers this year. In a soft USD environment, this supports BNM easing now, rather than waiting to cut later.

Falling inflation leads to higher real interest rates

... as the fiscal restraints prevail

Just as 2018 was a turning point for Malaysian politics, marking an end to the 60-year old Barisan Nasional coalition regime, it also was a turnaround year for the country's public finances. Sweeping policy changes under the new government of prime minister Mahathir were associated with a sharp spike in the fiscal deficit up to 3.7% of GDP - a significant slip above the initial target of 2.8%.

The highest fiscal deficit ended the steady fiscal consolidation the public finances had followed since 2009. With slower growth ahead, curbing the deficit to something below the 3% comfort level will be a challenge for the government in the medium term. The official projection has the shortfall easing to 3.4% in 2019 and then a gradual reduction to 2.8% by 2021, keeping with the medium-term Malaysia Plan review of (above) 3% deficit over the remaining plan years, 2018-2020.

Fiscal deficit - a decade-long consolidation comes to an end

Oil price and public finances

Two key factors likely to determine the course of public finances in the coming years will be oil price trends and progress on reducing the public debt.

- Rising oil prices are positive for the economy and public finances. They won't only soften the impact of the global trade war on Malaysian exports but also will increase the petroleum revenue for the government. But high oil prices also mean higher government spending on fuel subsidies for the public.

- We believe the 2014 crash was a permanent shock to the global commodity prices. Global oil prices are creeping up this year, though the potential slowdown in global demand could stall the recovery, but it's unlikely we're going to see $100/barrel.

- High level of public debt, estimated over MYR 1 trillion (80% of GDP), will keep the operating expenses on interest payments elevated, while the plan to significantly cut down on debt over this and next year faces headwinds from slower revenue growth. The cancellation costs of some of the infrastructure projects undertaken with other countries might as well blunt the debt reduction efforts.

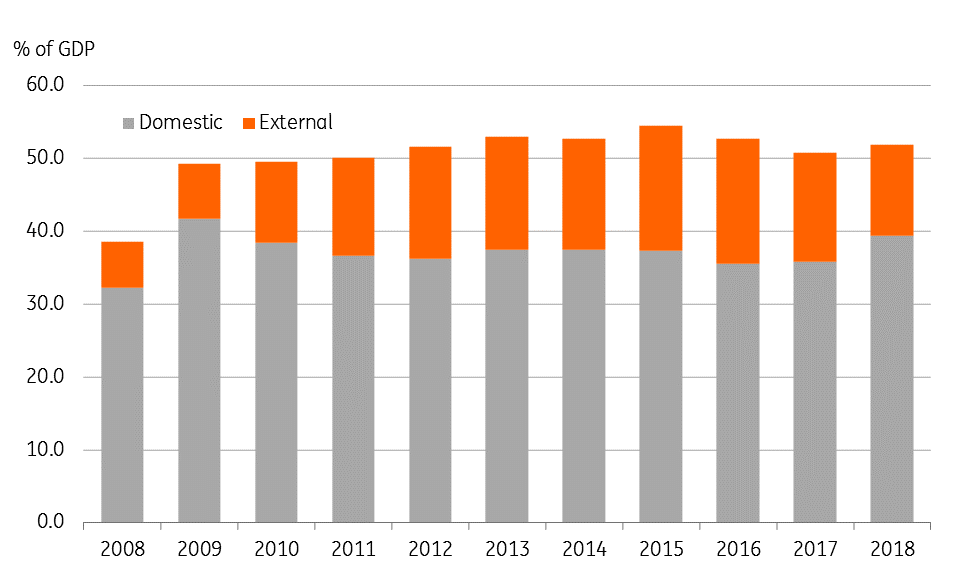

High public debt

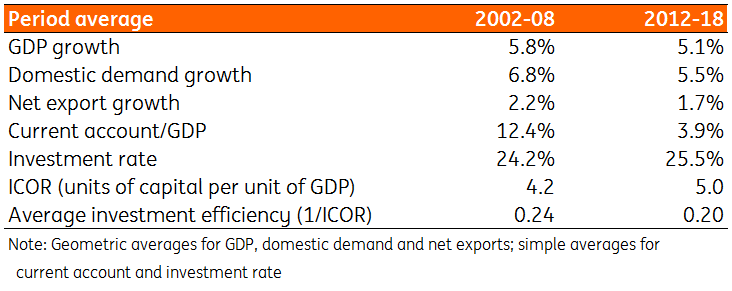

Structural investment weakness

We consider Malaysia more of 4-5% growth economy than 5-6% - the range that prevailed before the 2008-09 global financial crisis. Like most Asian economies, the crisis permanently stunted growth lower and the 2014 global commodity price collapse caused further damage to the net oil exporter.

Going forward, the downside GDP growth risk also stems from weak investment demand. Aside from the ongoing suspension of public projects continuing to depress investment into the medium-term, we observe a structural downward shift in both the investment rate as well as efficiency. Having peaked above 26% just before the 2014 global commodity price crash, the share of gross fixed capital formation in GDP – the investment rate – dipped below 25% last year.

Although the 25.5% average investment rate in recent years (2012-18) was an improvement over 24.2% average a decade ago (2002-08), average GDP growth slowed to 5.1% from 5.8% over the same period, with an even steeper slowdown in domestic demand growth to 5.5% from 6.8%. The contrast of firmer investment rates and yet slower GDP growth may be explained by falling investment efficiency evident from more capital required to produce one unit of GDP (incremental capital-output ratio, or ICOR).

Falling investment rate (fixed capital formation as share of GDP)

Falling investment efficiency

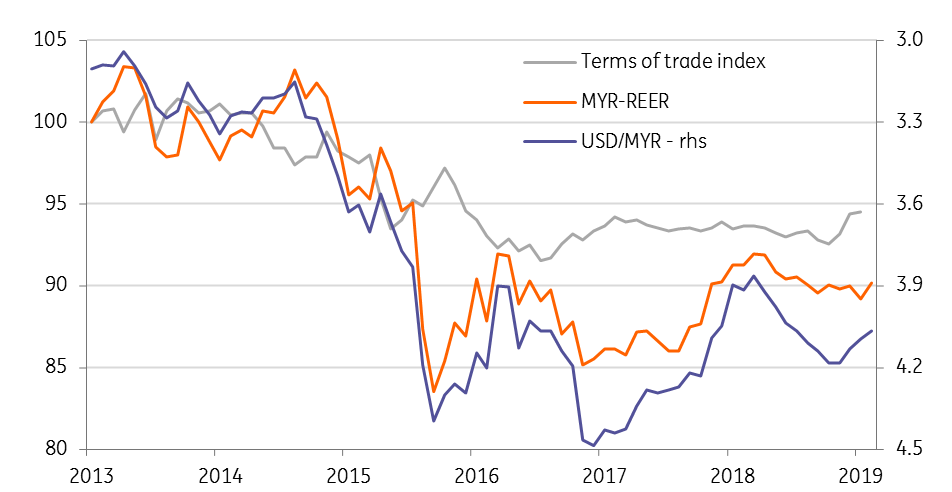

Narrowing external surplus, yet resilient ringgit

Weak global demand combined with subdued commodity prices suggest the recent trend of narrowing trade and current account surplus will continue to be a drag on GDP growth in the coming years. On our forecast, the current surplus falls to 2% of GDP in the current year and further below 2% next year, from 2.3% recorded in 2018.

Despite a narrowing current account surplus, the external payments position remains sound enough for the currency’s performance going forward. Maintaining its position as an outperforming Asian currency in the last two years, the MYR has gained 1.3% against the USD so far this year. Despite this, the MYR real effective exchange rate continues to indicate some undervaluation, which is positive for the competitiveness of Malaysia's exports even as Malaysia's terms of trade appear to stagnate.

Moreover, potential USD weakness from easier Fed policy should continue to sustain the emerging currency strength in the period ahead. Barring any adverse domestic economic factors, we don’t think the MYR will be an exception to the broader emerging market currency appreciation trend.

We are revising our end-2019 USD/MYR forecast to 4.05 from 4.10 (spot 4.08).

Stagnated terms of trade, undervalued currency

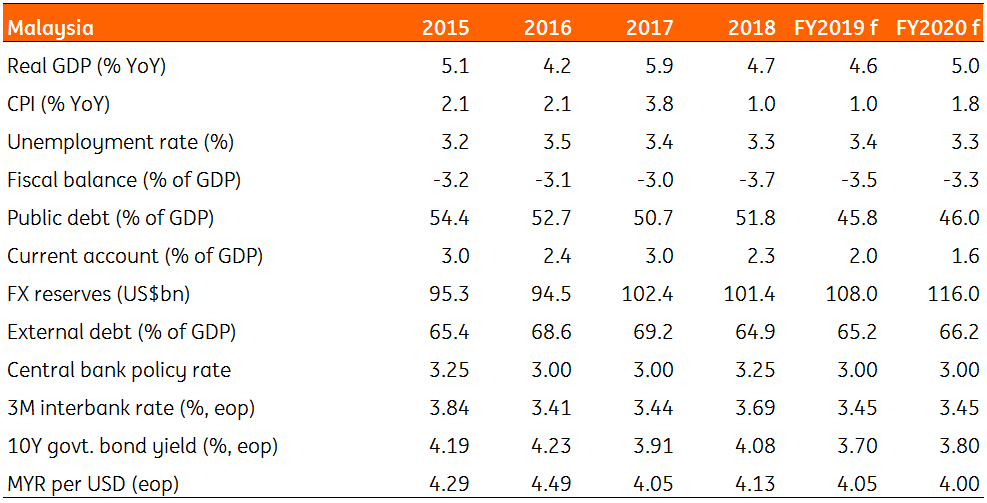

Key economic indicators and ING forecasts

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 April 2019

What’s happening in Asia ? This bundle contains 9 Articles