Malaysia: Making our case for lower rates

Unlike most Asian central banks whose rate policies have almost reached the easing limit, Bank Negara Malaysia has some room to stay the course. And, there is a strong case for the central bank to do so this week

| 1.50% |

ING forecast of BNM policy rateAfter 25bp cut this week |

The market favours stable BNM policy

It’s policy-making week for Malaysia’s central bank, the Bank Negara Malaysia. The BNM Monetary Policy Committee begins its two-day meeting on Wednesday, 9 September. The decision is expected the next day at 3pm local time.

The BNM reviews policy every two months and has delivered a total of 125 basis points of rate cuts in four meetings through July, including a 50 basis point cut at the meeting in May when the Covid-19 pandemic was at its peak. We have long been calling for a 25 basis point cut at this meeting, taking the overnight policy rate down to a fresh low of 1.50%.

The Bank will continue to utilise its policy levers as appropriate to create enabling conditions for a sustainable recovery. – BNM’s July policy statement

We maintain our rate cut call, although that puts us in the consensus minority for this meeting. Out of 14 forecasters in a Bloomberg survey at the time of this writing, only four expect a 25bp rate cut and the rest forecast no change from 1.75%. Until a month ago, the consensus was almost evenly split between ‘25bp cut’ and ‘no change’ outcomes.

We believe the case for easing continues to be strong.

Making our case for a 25bp rate cut

Here is why we think BNM should cut rates again this week.

Even as Malaysia has been largely immune to the Covid-19 outbreak, its economy has been one of the hardest hit in Asia. The nationwide lockdown to contain the virus dented GDP by 17% year-on-year in 2Q. This was the biggest plunge that the economy has ever seen; the last big drop was 11% at the height of the Asian crisis in 1998.

Things were looking better as we moved into 3Q with a second straight monthly export bounce in July boosting the trade surplus to the highest ever, 25 billion Malaysian ringgit (MYR). While this bodes well for GDP growth, a couple more quarters of negative GDP growth still looks inevitable. Even though a pick-up in exports should support manufacturing, the rest of the economy will continue to be under downward pressure. Mining, construction and services were the worst-affected in 2Q and will remain so over the rest of the year.

Meanwhile, more policy support is required to revitalise domestic demand. The elevated jobless rate (4.9% as of June) is depressing consumer spending and weaker business confidence is delaying investment spending. Reinforcing weak consumer demand is a negative inflation streak that started in March and is likely to prevail through the rest of the year (latest -1.3% YoY in July).

The likelihood of additional stimulus from the fiscal side remains slim. Malaysia’s public finances were already stretched before the Covid-19 outbreak. These are under further duress from record stimulus by the Muhyiddin administration to deal with the fallout of the disease – a total 19.5% of GDP package with about 9% in real or on-budget spending. As elsewhere in the region, the budget deficit is poised to rise significantly this year. As the government sets out to plug the gap with market borrowing, the central bank could help it by keeping borrowing costs low.

A timely dose of easing, while there is room for it, will go some way in helping the recovery.

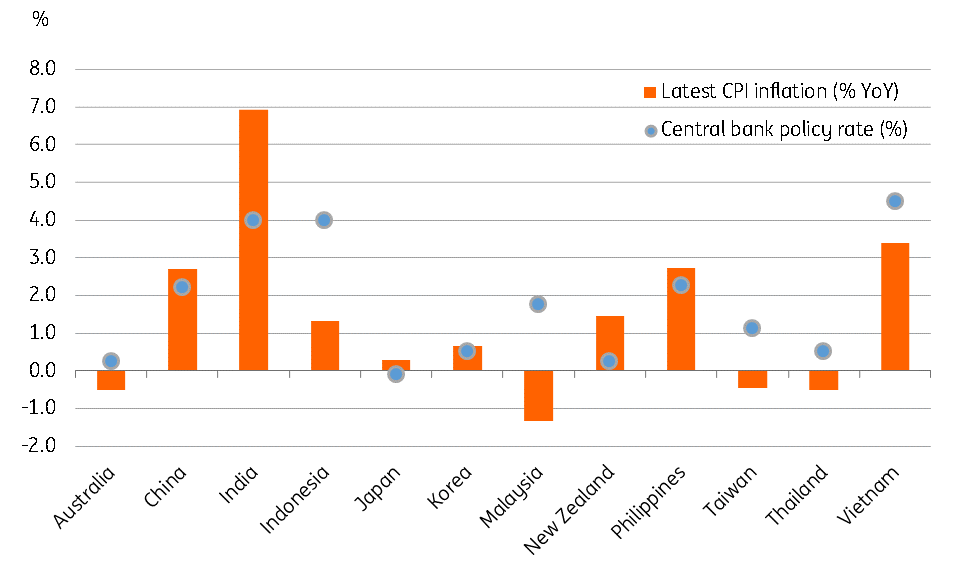

Why not ease when there is room to do so? Unlikely most Asian central banks, for whom the rate policy has reached its limit, with rates close to zero, the BNM’s 1.75% policy rate, coupled with negative inflation, allows its easing cycle to run further. Moreover, negative inflation means the real policy interest rate is one of the highest in Asia (see figure) - not really a good backdrop for economic recovery. We think one more 25bp rate cut at the last meeting of the year in November wouldn't hurt either.

The outperformance of the MYR in the emerging market rally since June should provide more comfort to the central bank in cutting rates again this week. The currency has appreciated 4.8% against the USD since June, the most in Asia. Besides a broad weak USD environment, the firming of oil prices and record trade surplus underpin some of the outperformance – forces which should remain in place during the rest of the year.

While analysts are split on the outcome of this week's meeting, the market seems to be pricing in a 25bp BNM rate cut. The 10-year government bond yield, at 2.56% currently, is down 25bp since the last BNM meeting in early July. This is despite the ongoing supply overhang from a record stimulus.

Real interest rate * in Malaysia is one of the highest in Asia

What this means for the markets

We don’t expect much reaction in bond markets, which has taken the rate cut in its stride, as noted above. We believe the central bank will maintain its accommodative stance for future policy and this should sustain the positive sentiment in the market over the rest of the year.

The next risk event for Malaysian bonds, however, will be the FTSE Russell’s decision on 24 September about retaining these in its global bond market index. These have been on the FTSE’s watch-list for potential exclusion on market accessibility grounds. It’s been this way for a while though, since April 2019. In the last review a year ago, the index provider decided to keep them in. We expect the same this time. Malaysian bonds aren’t performing too badly, judging from the 75bp drop in the 10-year yield year-to-date. Why fix it, if it’s not really broken?

As for the currency market, if you think a rate cut could take the steam out of the ongoing MYR rally, we don’t really share this view. On the contrary, we would view it as a further boost to investors’ faith in the country's countercyclical macroeconomic policy, suggesting the MYR will remain an outperformer in Asia in the remainder of the year.

Bond market is priced in for a rate cut, while currency market allows for it

Download

Download article

9 September 2020

Good MornING Asia - 9 September 2020 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).