Malaysia: Inflation slows further in March

The data might strengthen Prime Minister Najib Razak's defence against the opposition political agenda emphasising the rising cost of living in the general election next month

| 1.3% |

CPI inflation in March 2018Lowest in 20 months |

| Lower than expected | |

Another downside inflation surprise

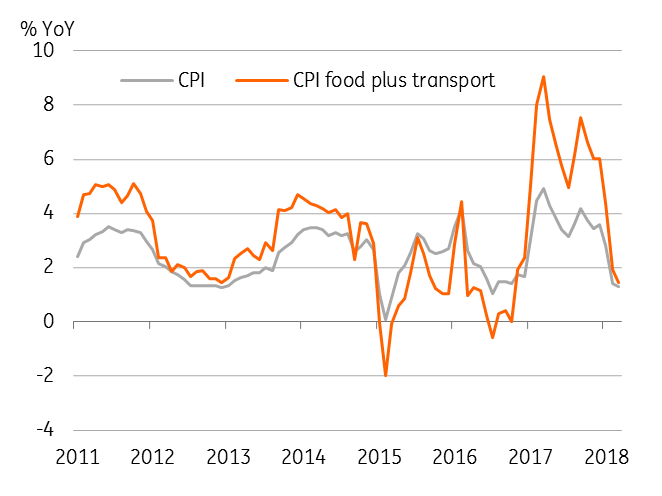

Contrary to the consensus of acceleration, Malaysia’s consumer price inflation slowed to 1.3% year-on-year in March from 1.4% in February. The consensus was centred on 1.6%. This is the lowest print in 20 months. The transport component remained a key driver of lower inflation (-1.5% vs. -0.3% in February), while a lower food component also contributed (2.8% vs. 3.0%). Clothing and communication were the other drags. Core inflation, which strips out food and fuel-related components from total CPI, also slowed to 1.7% in March from 1.8% in February.

Food, transport drag CPI inflation lower

On track to meet BNM's 2-3% forecast

The data puts 1Q18 headline CPI inflation at 1.8%, a sharp dip from 3.5% in 4Q17 and 4.2% in 1Q17, whereas core inflation slowed to 1.9% from the previous quarter. The central bank (Bank Negara Malaysia) forecasts total inflation in the 2-3% range this year. We see inflation rising to the top end of this range by the middle of the year, but retracing back to the low end toward year-end. Our forecast for full-year average inflation is 2.4% (consensus 2.9%).

Good news for PM Najib before election

The CPI data may strengthen Prime Minister Najib’s defence against the opposition political agenda emphasising the rising cost of living in the general election next month (9 May). Malaysia's growth and inflation dynamic remains positive for local financial assets, including the Malaysian ringgit (MYR). However, political uncertainty surrounding general elections is likely to cloud prospects for some time, as reflected by a pause in the MYR appreciation trend since the announcement of elections earlier this month.

No change in our BNM policy view

We reiterate our forecast of one more 25bp hike in Bank Negara Malaysia’s policy rate to 3.50% in third quarter, after the political uncertainty lifts, and our forecast of the USD/MYR ending the year at 3.72 (spot 3.89, consensus 3.85).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 April 2018

Good MornING Asia - 19 April 2018 This bundle contains 4 Articles