Malaysia: Food, transport to boost inflation in May

Inflation will stay low throughout 2018 due to a cut in the Goods and Services tax (GST). This, along with strong growth and a resilient currency, rules out the need for a central bank (BNM) policy change

| 1.8% |

ING inflation forecast for MayLower than consensus of 1.9% |

Inflation for May is due

Malaysia’s consumer price data for the month of May is due on Wednesday 20 June. Inflation has surprised on the downside in the first four months of 2018 and another such surprise is likely. The consensus forecast is for a rise to 1.9% year-on-year in May from 1.4% in the previous month. But we are below consensus with our 1.8% forecast.

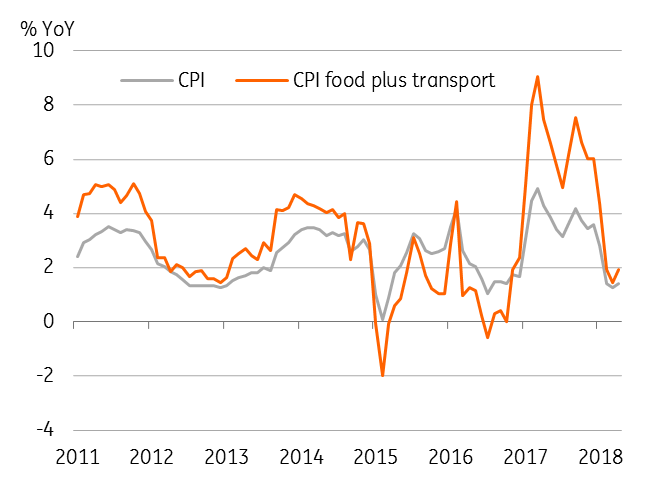

Most of the acceleration in inflation will be from the transport CPI component, which is due to a double whammy of the low base effect and the pass-through of higher global oil prices. Food, the other key CPI component, will also see some upward pressure from a surge in demand during the Muslim holy month of Ramadan, which started on 17 May. Among other seasonal factors in May is the quarterly adjustment in housing rentals, which have been mostly upward.

Food and transport prices drive CPI inflation

GST reduction has yet to kick in

The move by the new government to cut the GST to zero from 6%- effective in June- suggests to us that any inflation spike will be transitory. Following the April CPI data, we cut our full-year 2018 inflation forecast to 1.8% from 2.4%. Benign inflation, steady strong growth, and a resilient Malaysian ringgit (MYR) prevent the need for Malaysia’s central bank (BNM) to follow the Fed's policy tightening. Hence our forecast of no change to policy this year, which we recently revised from a previous forecast of one more 25 basis point rate hike in the third quarter.

We retain our USD/MYR forecast

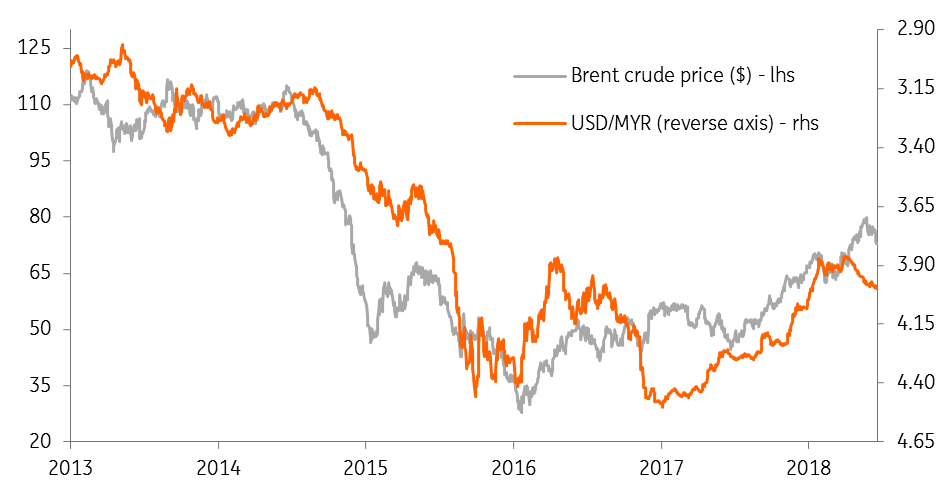

Consistent with our forecast in response to the surprise result of the general election a month ago, the MYR exchange rate per USD has risen to the 4.00 level in one month. The MYR has been among Asia’s best-performing currencies since last year and has remained so during the recent weak spell in emerging markets. It has been a beneficiary of the strengthening global oil price (see figure)- a trend likely to continue in the period ahead. Despite this appreciation, the currency is still undervalued on a real effective exchange rate basis.

We retain our forecast of a gradual move in USD/MYR higher to 4.05 by the end of the year, implying an almost zero percent annual move from end-2017.

MYR is the beneficiary of rising crude oil price

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 June 2018

Good MornING Asia - 19 June 2018 This bundle contains 3 Articles