Malaysia: Falling prices call for more interest rate cuts

Deep negative inflation in Malaysia has driven the real interest rate to one of the highest in Asia – not a good thing for the post-Covid-19 economic recovery. We are adding a 50 basis point cut to our forecast for the Bank Negara Malaysia's policy rate this year, taking it to an all-time low of 1.00% by end-2020

| -2.9% |

April CPI inflationYear-on-year |

| Worse than expected | |

Movement control dents inflation

Released today, Malaysia’s consumer price index for April posted a steeper than expected fall, by 2.9% from a year ago, beating the previous low of -2.4% at the height of the global financial crisis in 2009. This was a significant disappointment for the consensus of -1.6% YoY and our -1.8% forecast.

Core inflation stayed in positive territory in April and was also unchanged from a 1.3% rate in March, meaning most of the fall in the headline was due to food and oil-related CPI components. This isn’t a surprise though. Food prices typically rise during the month of Ramadan. This year they were weak because restrictions on movement dented the usual festive season demand. Still, despite two straight months of decline in this component, the yearly increase was unchanged at 1.2%.

The controls on movement and unusually weak Ramadan demand also depressed transport costs, which had already been dragged down by lower gasoline prices. A 21.5% YoY fall here surpasses the 20% fall during the GFC. Adding to these negative forces was housing, with a sharp swing from +1.6% YoY in March to -2.2% in April, which has not been seen in the last two decades.

Entrenched deflationary streak

We recently cut our full-year inflation forecast for 2020 to -1% from -0.2%. This now appears to be optimistic given today’s price report. Indeed, it would take a significant demand recovery for inflation pressure to return – something that’s unlikely to happen at least throughout the rest of this year, with the lingering impact of the disease and persistently weak economic outlook.

We anticipate a deeper fall in prices ahead, as much as 4%, leading to a further downgrade to our annual inflation forecast, to -2.5%.

More central bank rate cuts

Malaysia's central bank doesn’t particularly target inflation in setting monetary policy. But the economy, staring at a deep downturn ahead, is demanding more policy accommodation. Cutting interest rates remains an important option at the central bank’s disposal, while there is space to do so.

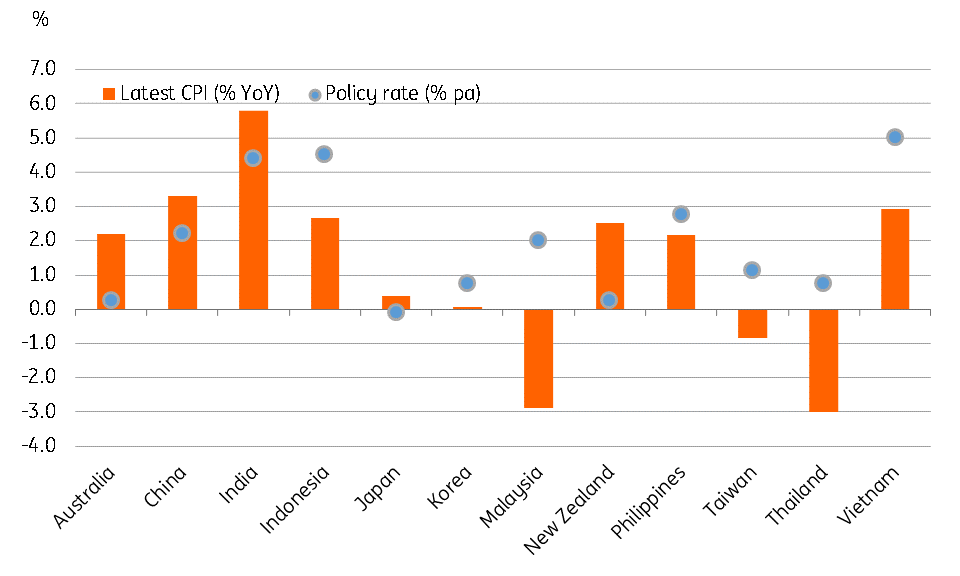

The BNM has cut the overnight policy rate by a total 100 basis point so far this year, including a 50 basis point cut earlier this month (5 May), taking the overnight policy rate to 2.0%. We have an additional 50bp cut forecast for the next meeting in early July. However, with -3% inflation pushing the real interest rate much higher- at 5.0% it is the highest among Asian countries- we don’t see any reason why the BNM policy rate couldn’t fall further.

We now add another 50bp cut to our BNM policy forecast, driving the OPR to an all-time low of 1.00% by the end of 2020.

Inflation and central bank policy rates in Asia

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

20 May 2020

Good MornING Asia - 21 May 2020 This bundle contains 4 Articles