Malaysia: Evidence mounts for economic slowdown

Malaysia's economic data for the first two months of 2019 underpins our forecast of a slowdown in GDP growth to 4.2% in the first quarter of the year. This, in turn, supports our view of a 25 basis point rate cut in the next month to pre-empt any further growth downside in the rest of the year

| 1.7% |

February industrial production growthYear-on-year |

| Lower than expected | |

A downside miss on February output

Released today, Malaysia’s Industrial production growth nearly halved to 1.7% year-on-year in February from 3.2% in January. The result was far better than our forecast of a slight contraction, underpinned by a sharp export decline in the month. Yet, it was still weaker than the consensus estimate of 2.2% growth.

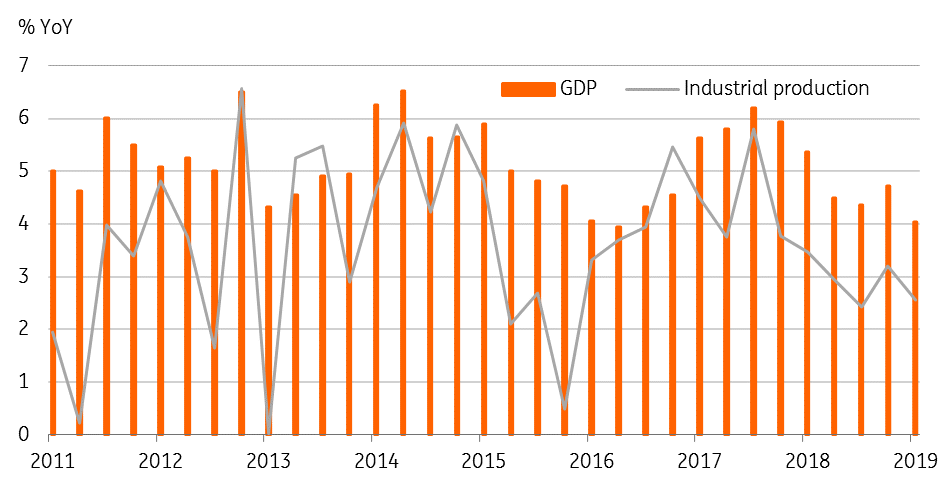

As in much of Asia, economic data for the first two months of the year is typically distorted by the Lunar New Year holiday. But the average for the first two months provides a clear picture of the underlying trend. And it continues to be downward. The Jan-Feb IP growth of 2.5% was down from the fourth quarter average of 3.2%. But the slowdown in export growth over the same period is even worse, -2.1% from 5.0%.

Manufacturing depressed GDP growth in 1Q19

Quarterly data with ING's estimate for 1Q19.

It’s not just an export-led slowdown

We surmise from the rest of the manufacturing sector data – product sales, employment, and wages and salaries in the sector – that domestic demand is slowing too.

Average manufacturing sales growth of 6.2% in the first two months was the slowest in two years. So was the wages and salaries growth of 8%. And employment growth remained stuck in low single-digits; 2% in both January and February. These growth rates compare with their year-ago rates of 7.9%, 15.0%, and 2.4%, respectively – all pointing to weaker domestic demand.

GDP growth poised to slow in 1Q19

The first two months of activity data underpin our view of slower GDP growth in the first quarter of 2019. We don’t think the post-Chinese New Year lifting of activity growth in March will alter this state of affairs. We maintain our 1Q19 GDP growth forecast of 4.2% YoY, a slowdown from 4.7% in 4Q18 (data due in mid-May).

External uncertainties from trade tensions, weak global demand and oil prices will continue to weigh on GDP growth over the rest of the year, amid anaemic investment spending at home. However, the favourable base effect and accommodative economic policies are expected to prevent a sharp GDP slowdown should these risks intensify.

Our full-year 2019 growth forecast remains at 4.6%. We believe the central bank (Bank Negara Malaysia) will use the current low inflation backdrop to provide more policy stimulus to the economy. We have pencilled in a 25bp cut to the BNM’s overnight policy rate to 3.00% at the next meeting on 7 May.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 April 2019

Good MornING Asia - 12 April 2019 This bundle contains 5 Articles