Malaysia: Enjoying the lowest inflation in Asia

Inflation missed estimates again in August. But with sufficiently positive real interest rates, the Malaysian ringgit will remain among Asia's top-performing currencies in the remainder of the year, and probably beyond. The risk to our end-2018 USD/MYR rate forecast of 4.25 is tilted more to the downside than to the upside

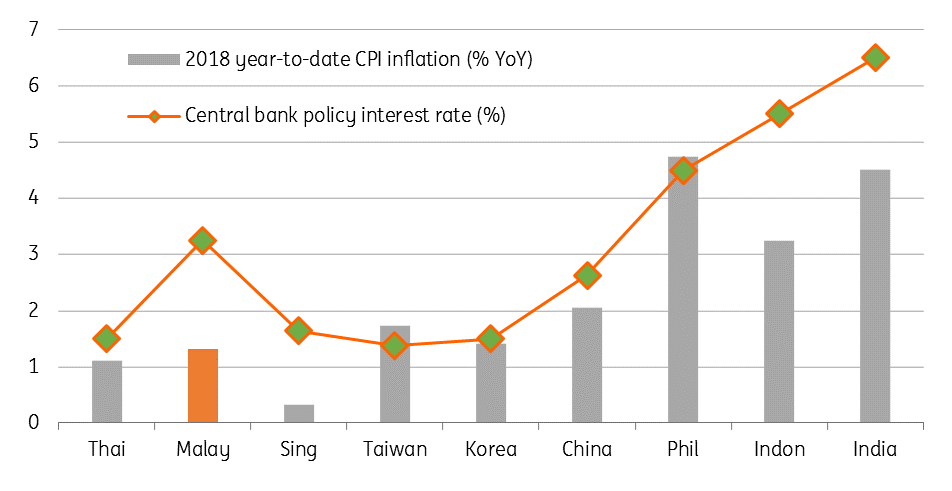

Malaysia continues to enjoy the lowest inflation in Asia. Even though the Goods and Services Tax will be replaced with the Sales and Services Tax from September, inflation isn't going to be a policy concern anytime soon, at least not through most of 2019. Subdued price growth along with the threat to the economy from rising US-China trade tensions suggest the central bank (Bank Negara Malaysia) has a solid reason to keep the 3.25% overnight policy rate unchanged for a prolonged period. Yet we consider the risk to our end-2018 USD/MYR rate forecast of 4.25 being tilted to the downside rather than to the upside (spot 4.14).

| 0.2% |

August CPI inflationLowest since early 2015 |

| Lower than expected | |

Inflation undershoots again

In yet another downside surprise, CPI inflation slowed to a three-and-half-year low of 0.2% year-on-year in August, from 0.9% in the previous month. The consensus was centred on 0.4%. The key factors beneath this steadily falling inflation rate in recent months include:

- The lingering impact of GST removal: month-on-month movements in most CPI components in the last two months have been nowhere near retracing the GST-related declines in June.

- The high base-year effect: the base effect is more pronounced in the transport CPI component, denting the year-on-year increase to 2.1% YoY in August from 6.7% in July. This trend has a further leg to run.

- Nearly two-decade low food inflation: the food component accounts for almost a third of the total CPI basket, and has steadily slowed to 0.4% YoY in August from a recent peak of 4.4% in October last year.

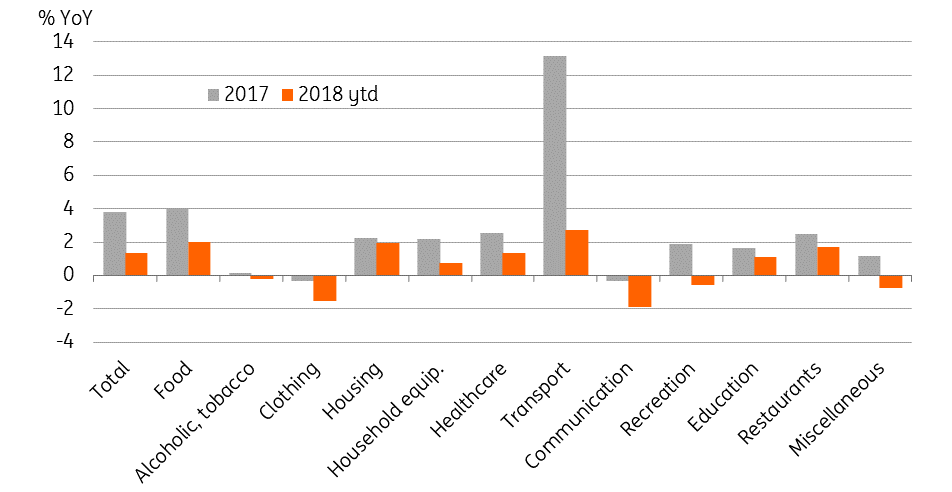

- Well-anchored inflation expectations: the second consecutive monthly fall in core CPI, by 0.2% YoY, reinforces low inflation expectations. The healthcare and education CPI components are good guides to inflation expectations, both showing a sharp slowdown so far this year (see chart).

CPI inflation by components: 2017 vs. 2018 year-to-date

Future inflation and policy outlook

The year-to-date inflation of 1.3% YoY is a significant deceleration from 3.8% a year ago, with a broad-based slowdown in all CPI components. The GST is to be replaced by a less severe Sales and Services Tax, and we share the central bank’s view that any impact will likely be transitory, without significantly reversing the ongoing inflation downtrend.

The impact of the changes in consumption tax policy on headline inflation will be transitory and lapse towards the end of 2019. – the BNM September policy statement

We see inflation remaining below 1% for the remainder of the year, supporting our forecast of full-year average inflation of 1.0% (consensus 1.3%). We believe BNM will be under no pressure to alter the current monetary policy stance until after 2019.

Positive real interest rates bode well for MYR

Real interest rates are sufficiently positive in Malaysia (see chart), thus obviating any need for policies to prop up the currency during external contagion. The outperformance of the Malaysian ringgit (MYR) among Asian currencies in the recent emerging market currency contagion testifies to this. We expect the MYR to remain among Asia's top-performing currencies throughout the rest of the year, and probably beyond. As such, the risk to our end-2018 USD/MYR rate forecast of 4.25 is tilted more to the downside than to the upside (spot 4.14).

Asia ex-Japan inflation and policy rates

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

19 September 2018

Good MornING Asia - 20 September 2018 This bundle contains 4 Articles