Deflation returns in Malaysia after nearly a decade

The deflation spell looks transitory, but we don’t see any significant build-up in price pressures for the rest of the year. But even then, we don’t think the central bank will ease policy in 2019

Will the central bank consider easing policy?

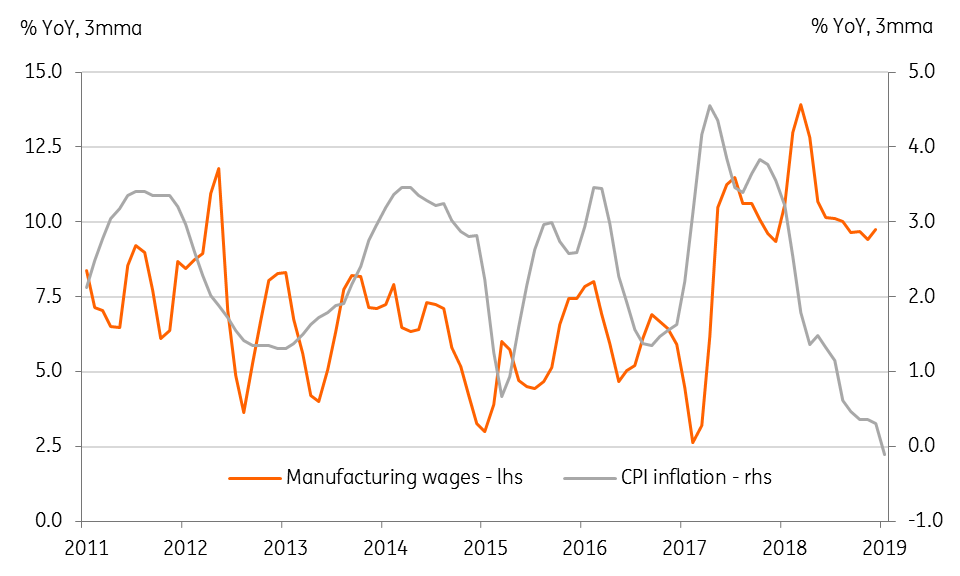

The current negative trend in consumer prices is the result of supply-side factors – such as the administrative cut in domestic fuel prices, so there is little monetary policy can do about this. A counter-argument to ease policy would be the lack of demand-side pressure as can be seen from the wage growth – manufacturing wage growth has been running around 10% year on year on the back of steady employment in the sector.

We believe the central bank will see through the latest CPI data and leave policy on hold this year.

Decoupling of wage growth and CPI

| -0.7% YoY |

CPI inflationJanuary |

| Worse than expected | |

Lower fuel prices dent CPI to deflation

Low fuel prices exacerbated the downward spiral in Malaysia’s consumer price inflation as we started in 2019. The 0.7% year-on-year CPI fall last month was the first negative reading since the 2007-08 global financial crisis, coming off the 7.8% fall in the transport component for which the administrative cut in fuel price was responsible. The authorities adjust domestic fuel prices weekly according to the movement in global oil prices.

Lower transport costs more than offset the uptick in food prices, while most other CPI components changed little from their levels in December. The core-CPI inflation of 0.2% YoY slowed from 0.4% in December.

Pass-through of lower global oil prices to domestic transport prices

Benign inflation outlook ahead

This reinforces a weak start to consumer prices in the year that’s already reeling under the removal of the 'Goods and Services' tax in June 2018. However, we expect deflation to be short-lived and return to inflation within the current quarter. Global oil prices are creeping upwards and will transmit into domestic fuel prices, but there is unlikely to be a significant pick-up in inflation until the GST impact moves out of the base by mid-2019.

We see inflation rising to 2% in the second half of 2019, though the full-year average rate is likely to be shy of the central bank’s 2.5-3.5% forecast for the year. It will take a significant thrust from either the demand or the supply side to hit the central bank's forecast, and neither of these scenarios is our base case.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

22 February 2019

Good MornING Asia - 25 February 2019 This bundle contains 5 Articles