Malaysia: A pleasant surprise from April trade data

Our view of the USD/MYR exchange rate hovering around the 4.2 level for the rest of the year remains at risk from the havoc that an escalation of the global trade war could wreak on emerging market currencies

| 1.1% |

Export growth in AprilYear-on-year |

| Better than expected | |

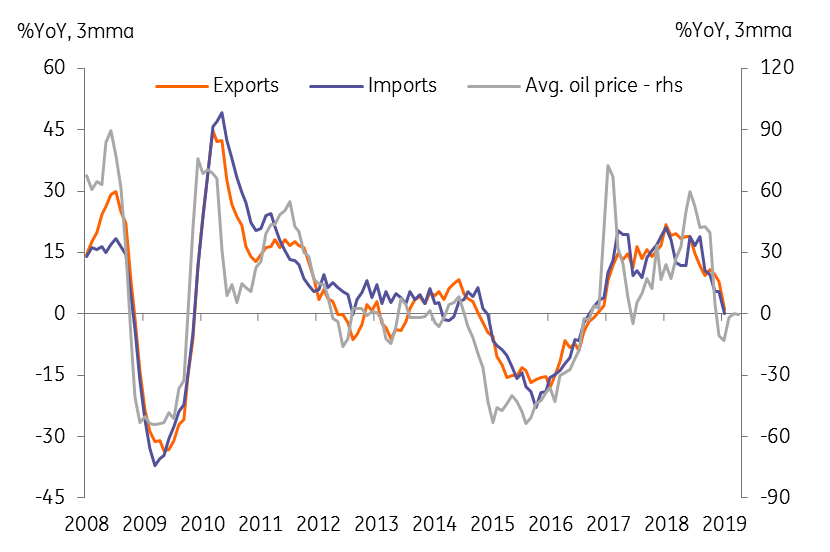

Trade growth turns positive

Contrary to expectations of a continued contraction, trade growth turned positive in April.

Reported in local currency (Malaysian ringgit, or MYR) terms, exports grew by 1.1% year-on-year in April after two consecutive months of declines in February and March. The consensus was centred on a 2.1% fall. Electronics and oil-related exports were the sources of firmer headline export growth. By destination, shipments to the US stood out positively.

Outpacing exports, imports grew by 4.4% YoY in April, which in turn resulted in a narrower trade surplus of MYR 10.9 billion from March’s MYR 14.4 billion.

Still widening trade surplus

Cumulative exports and imports in the first four months of the year are nearly flat at their respective levels last year. Yet, the trade surplus is widening – at MYR 47.8bn it was 1.4bn higher than a year ago. Surprisingly, electronics exports are holding up well in the face of a downturn in global tech demand and this is helping exports and hence the trade surplus.

We also surmise some domestic demand weakness now kicking in, as the fiscal policy support that the economy enjoyed in the last year starts to fade, weighing down imports. Despite this, we don’t expect 2019 to be yet another year of large trade surpluses like the MYR 120 billion surplus recorded for 2018, which was an MYR 22 billion increase over 2017.

Weak global demand and subdued commodity prices are likely to depress trade growth this year.

Commodity-driven trade growth

Under US Treasury's radar for currency manipulation

A steady trade surplus means a steady current account surplus. High current account surpluses, in excess of 2% GDP, and a large bilateral trade surplus with the US pushed Malaysia into the US Treasury’s monitoring list of countries suspected of manipulating their currencies for export advantage. Malaysia dodged the bullet on the third criterion of persistent one-sided currency market intervention.

The ringgit exchange rate is market-determined and is not relied upon for export competitiveness. – Bank Negara Malaysia

This is the first time Malaysia has appeared on the US Treasury’s radar. We don’t see any imminent threat of outright labelling of Malaysia as a currency manipulator which could lead to sanctions. Moreover, Malaysia’s economic history of the last two decades reinforces the government's preference for a stable to stronger ringgit.

That said, our view of the USD/MYR exchange rate hovering around 4.2 level in the rest of the year remains at risk from the havoc that the escalation of the global trade war wreaks on emerging market currencies.

Download

Download article

4 June 2019

Good MornING Asia - 4 June 2019 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).