Malaysia: A pleasant surprise from April trade data

Our view of the USD/MYR exchange rate hovering around the 4.2 level for the rest of the year remains at risk from the havoc that an escalation of the global trade war could wreak on emerging market currencies

| 1.1% |

Export growth in AprilYear-on-year |

| Better than expected | |

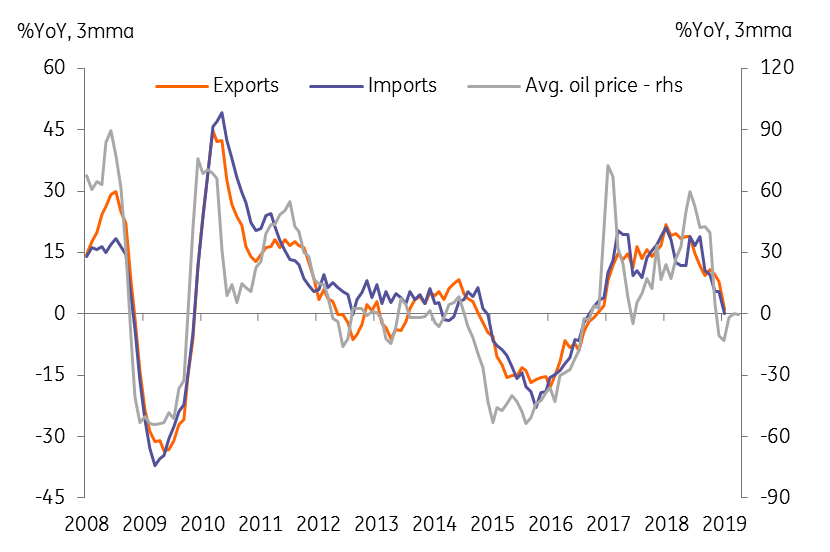

Trade growth turns positive

Contrary to expectations of a continued contraction, trade growth turned positive in April.

Reported in local currency (Malaysian ringgit, or MYR) terms, exports grew by 1.1% year-on-year in April after two consecutive months of declines in February and March. The consensus was centred on a 2.1% fall. Electronics and oil-related exports were the sources of firmer headline export growth. By destination, shipments to the US stood out positively.

Outpacing exports, imports grew by 4.4% YoY in April, which in turn resulted in a narrower trade surplus of MYR 10.9 billion from March’s MYR 14.4 billion.

Still widening trade surplus

Cumulative exports and imports in the first four months of the year are nearly flat at their respective levels last year. Yet, the trade surplus is widening – at MYR 47.8bn it was 1.4bn higher than a year ago. Surprisingly, electronics exports are holding up well in the face of a downturn in global tech demand and this is helping exports and hence the trade surplus.

We also surmise some domestic demand weakness now kicking in, as the fiscal policy support that the economy enjoyed in the last year starts to fade, weighing down imports. Despite this, we don’t expect 2019 to be yet another year of large trade surpluses like the MYR 120 billion surplus recorded for 2018, which was an MYR 22 billion increase over 2017.

Weak global demand and subdued commodity prices are likely to depress trade growth this year.

Commodity-driven trade growth

Under US Treasury's radar for currency manipulation

A steady trade surplus means a steady current account surplus. High current account surpluses, in excess of 2% GDP, and a large bilateral trade surplus with the US pushed Malaysia into the US Treasury’s monitoring list of countries suspected of manipulating their currencies for export advantage. Malaysia dodged the bullet on the third criterion of persistent one-sided currency market intervention.

The ringgit exchange rate is market-determined and is not relied upon for export competitiveness. – Bank Negara Malaysia

This is the first time Malaysia has appeared on the US Treasury’s radar. We don’t see any imminent threat of outright labelling of Malaysia as a currency manipulator which could lead to sanctions. Moreover, Malaysia’s economic history of the last two decades reinforces the government's preference for a stable to stronger ringgit.

That said, our view of the USD/MYR exchange rate hovering around 4.2 level in the rest of the year remains at risk from the havoc that the escalation of the global trade war wreaks on emerging market currencies.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 June 2019

Good MornING Asia - 4 June 2019 This bundle contains 4 Articles