Malaysia: A huge downside GDP miss in the second quarter

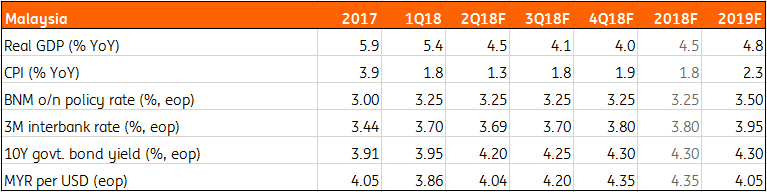

We have cut our 2018 growth forecast to 4.5% from 5.2%. Slowing growth and low inflation reinforce our view that the central bank (BNM) will keep monetary policy on hold over the remainder of the year. Things are slowly turning sour for the Malaysian ringgit, keeping USD/MYR on track to meet our 4.35 forecast for end-2018

| 4.5% |

GDP growth in 2Q |

| Lower than expected | |

Net exports dent GDP growth in 2Q18

Malaysia’s GDP growth slowed sharply to 4.5% year-on-year in the second quarter from 5.4% in the first. We expected 5.2%, only a modest decline and in line with consensus.

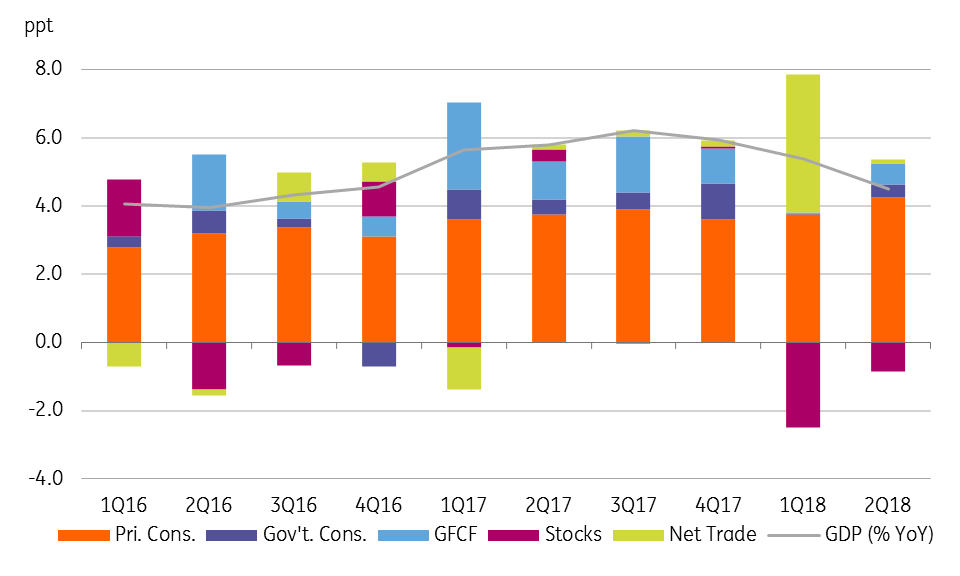

Looking at the breakdown, weak net exports were the main source of downside GDP surprise, contributing only 0.1 percentage point (ppt) to GDP growth as against 4ppt contribution in the previous quarter (see figure). As such, domestic demand returned to the driving seat, led by a 4.3ppt private consumption contribution, up from 3.7ppt in 1Q, while government consumption and fixed capital formation also contributed more than in the previous quarter. This left inventory as a net drag on GDP growth of 0.9ppt.

On the industry side, strong exports supported manufacturing growth, but services remained the main force behind GDP growth. Finance Minister Lim Guan Eng sees 2018 GDP growth at about 5%. The central bank (BNM) cut its forecast today to 5.0% from 5.5-6.0%.

Sources of year-on-year GDP growth

Downgrade of 2018 growth forecast

The weak 2Q GDP report dents our full-year growth forecast. A month ago we revised it to 5.2% from 5.5%. We are now revising it still further to 4.5% as the global trade war will weigh on exports for the rest of the year, and the tight fiscal stance will limit government spending. On the flip side, the GST removal, low inflation, and improved real incomes of households should support consumer spending.

| MYR 3.9bn |

Current surplus in 2QDown from MYR8.8bn a year ago |

Weakening external payments

Reinforcing the weak external sector contribution to GDP growth, the balance of payments data for 2Q (also released alongside GDP data today) showed a significant narrowing in the current account surplus to MYR 3.9bn from MYR 8.8bn a year ago. The goods trade surplus remained strong though, as was evident from the monthly customs trade data. We have also cut our current account surplus forecast for the year to 2% of GDP from 3.5%, which will be a narrowing from 3% in 2017.

Policy implications

Slowing growth and low inflation reinforce our view that the central bank (BNM) will keep monetary policy on hold over the remainder of the year. Things are turning sour for the Malaysian ringgit (MYR), Asia’s outperforming currency so far. The contagion-effect of the US-China trade war is behind our view of the USD/MYR rate rising up to 4.35 by end-2018 (spot 4.10). Until today we were uncomfortable about our view due to continued MYR outperformance in the recent emerging market currency rout. But today’s data raises our confidence in our forecast.

Economic forecast summary

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 August 2018

Good MornING Asia - 20 August 2018 This bundle contains 3 Articles