Malaysia: A decade-high September trade surplus

Steady current account surplus is positive for the Malaysian ringgit (MYR) but the macro policy mix, an overly loose fiscal policy, and stable central bank (BNM) monetary policy until after 2019, has turned negative. We consider our end-year USD/MYR forecast of 4.20 subject to upside risk

| MYR 15.3bn |

September trade surplusThe highest in 10 years |

| Higher than expected | |

Weak imports boost trade surplus

Malaysia’s trade surplus surged by almost a factor of ten to 15.3bn Malaysian ringgit (MYR) in September from MYR 1.6bn in August. The figure is just shy of the MYR15.4bn record level hit a decade ago in September 2008.

This result stems from unexpectedly weak imports. The 2.7% year-on-year import contraction in September was a sharp negative swing from over 11% growth in the previous month and contrasts with expectations for a 10% increase. Electronics and electricals, machinery and transport equipment, metals, and textiles were the main drags.

After a dismal performance in August, exports bounced back in September with 6.7% YoY growth - spot on the consensus estimate (ING forecast 6.5%) and up from August’s -0.3% decline. Oil-related exports were the main drivers with a 21.1% surge, while electronics growth improved to 6.5% from 3.2% in August.

The cumulative trade surplus of MYR 85.8bn in the first nine months is MYR 15.6bn wider on the previous year, while the year-to-date export and import growth rates of 6.3% and 4.7% respectively have slowed sharply from their year-ago pace.

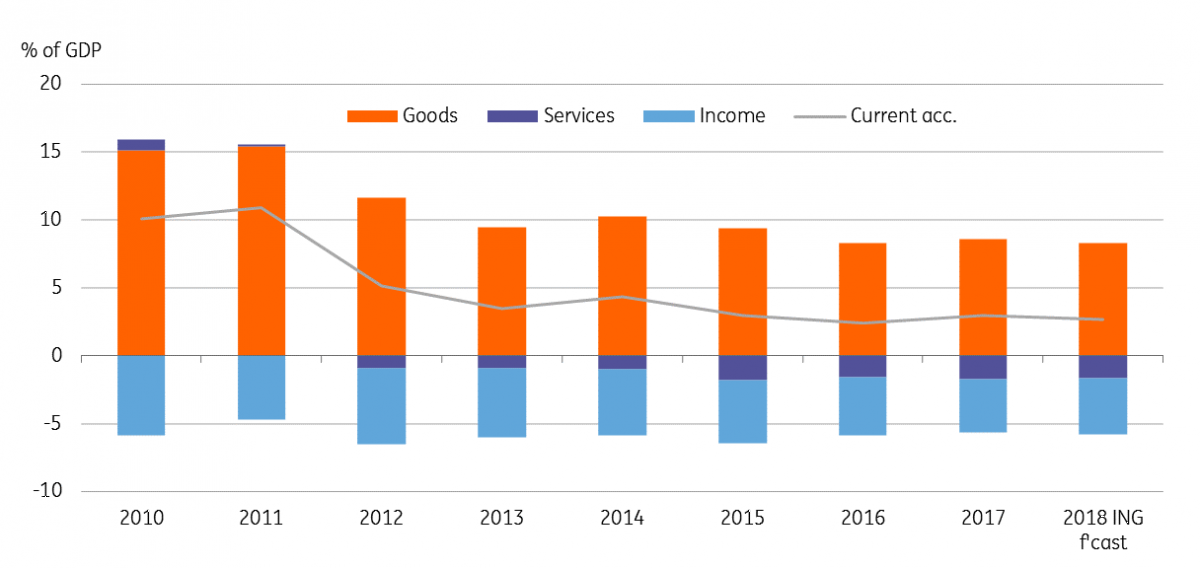

The trade surplus drives Malaysia's current account surplus. The official forecast of the current surplus of 2.5-3% of GDP in 2017 is on track (ING forecast 2.7%, 2017 actual 3%).

Steady current account surplus

The MYR-unfriendly policy mix

A steady current account surplus is positive for the MYR, but weakening public finances are negative. Unveiled in the 2019 Budget last Friday, the government’s projection of unexpectedly big fiscal deficits of 3.7% of GDP in 2018 and 3.4% in 2019 represent a significant U-turn on fiscal consolidation, which will be viewed negatively by investors.

And with slowing GDP growth and persistently low inflation, there is no pressure on the central bank (Bank Negara Malaysia) to change the policy at the upcoming meeting this week (8 November). Nor do we anticipate any change to the 3.25% overnight policy rate until after 2019.

Such a macro policy mix of an overly loose fiscal policy and stable monetary policy is negative for the MYR, even as the currency should continue to benefit from firmer crude oil price and a healthy external payments position. We consider our end-2018 USD/MYR forecast of 4.20 subject to upside risk.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article