Malaysia 2019 budget – Where is the fiscal prudence?

A larger-than-expected fiscal deficit of 3.7% in 2018, which wipes out consolidation over the last four years, undermines the government’s commitment to fiscal prudence. This is negative for the local financial markets. We consider our end-2018 USD/MYR forecast of 4.20 subject to upside risk

| 3.7% |

Fiscal deficit as percent of GDP in 2018Widest in five years |

| Worse than expected | |

A significant fiscal deficit overrun

Finance minister Lim Guan Eng presented the budget for 2019, projecting a fiscal deficit of 3.4% of GDP in the next year. However, what's even more striking is the revised programme of 3.7% deficit in the current fiscal year, which was above the consensus estimating only 3.2% deficit and an even lower initial budget forecast of 2.8%.

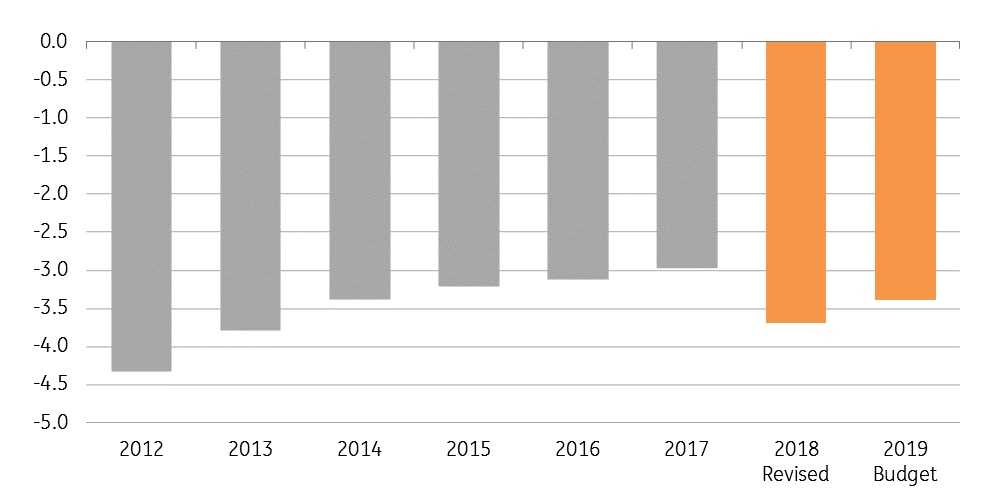

The highest fiscal deficit in the last five years represents a significant derailment of public finance from the path of a steady consolidation it followed on since 2009. The shortfall is projected to ease to 3.4% in 2019, followed by a gradual reduction to 2.8% by 2021. This is keeping with the medium-term Malaysia Plan review of (above) 3% deficit over the remaining plan years, 2018-2020.

The budget clearly undermines the government’s commitment to the fiscal prudence, as what Prime Minister Mahathir pointed out from time to time after his Pakatan Harapan coalition government took over in May this year. Finance minister Lim blamed the previous government for such a huge fiscal slippage, saying that the budget under the previous administration wasn’t a true picture of the financial situation.

Four years of fiscal consolidation wiped out - deficit in relation to GDP (%)

Still steady revenue, oil windfall

The implied 7.3% revenue growth in 2018 over 2017, the fastest growth in the last six years, suggests that the impact from the elimination of a key revenue source, Goods and Services Tax, is still modest. The introduction of the Sales and Services Tax, higher dividend income from the state-owned oil company, thanks to the windfall from much higher crude oil price this year compared to the original budget assumption of $52 per barrel, are some of the offsets to the GST revenue loss.

The revenue growth is projected to quicken to 10.7% in 2019 as the government unveiled some new taxes and levies. The key tax initiatives include higher stamp duty and capital gain tax on real estate, airport tax on passengers, excise duty on sugary drinks, increase in license fees and taxes for gaming companies, and the crackdown on outsized wealth display and unreported incomes.

Firmer GDP growth, little shy of 5%

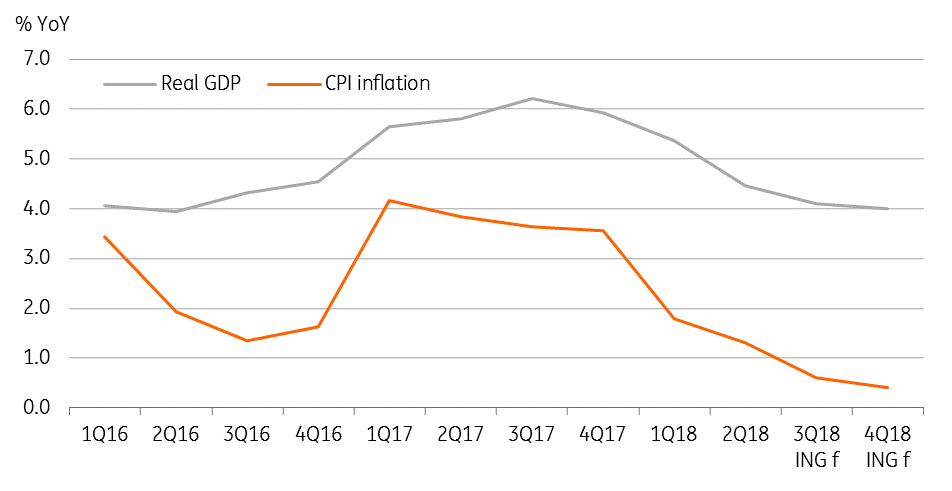

Underlying better-than-expected tax revenue is an assumption of the steady GDP growth, at 4.8% GDP in 2018 picking up to 4.9% in 2019. Growth assumption appears optimistic, at least for this year given a sharp slowdown in the second quarter of the year to 4.5% (from 5.4% in 1Q) and the combination of high base-year effect and slowing external demand leading to a sustained downward trend to close to the 4% pace in the second half of the year. In the event of a significant growth shortfall, the budget shortfall in relation to GDP will undoubtedly be under upward pressure.

However, a wider fiscal gap this year and next also is tantamount to a required stimulus to the economy as external economic risks from the US-China trade war remain elevated. Seeing the opportunity in crisis, the government’s hopes of guiding the economy on a firmer growth path rest on Malaysia’s positioning as ‘safe haven’ for manufacturing investment destination in an environment of an escalated trade war.

Growth and inflation, both are trending down

Not now, but potentially inflationary

Among other assumption, the government anticipates inflation in a 1.5-2.5% range this year and 2.5-3.5% in 2019. Indeed, these forecasts reinforce an extremely loose fiscal policy eventually fuelling price pressure. But we don’t see inflation becoming an imminent threat, at least not until mid-2019 when the impact of GST elimination moves out of the base of comparison. The average inflation in the first nine months of 2018 was only 1.2%. Our forecast for 2019 is 2.0%.

While lower subsidies, higher minimum wage, and tax measures like sugar tax could add to inflationary pressure in 2019, reduction in social assistance works in the opposite direction. The government expenditure on subsidies and social assistance are projected to contract by 20% in 2019 over 2018.

A benign inflation backdrop should allow the central bank (Bank Negara Malaysia) to maintain an accommodative monetary policy to support growth in the period ahead. We aren’t expecting the BNM to move the overnight policy rate, currently 3.25%, until after 2019.

Sovereign downgrade downplayed

All three main rating agencies – S&P, Moody’s and Fitch – currently rate Malaysia’s long-term sovereign debt at the same level. S&P and Fitch have it ‘A-‘, and Moody’s at ‘A3’, the level the rating has been since the last upgrade in the early 2000s. Despite much worse fiscal situation during the 2008-09 Global Financial Crisis, when Malaysia's fiscal deficit swelled to as high as 6.4% of GDP in 2009, the country's sovereign rating was unaffected. We don’t think the situation today is that worse and entails a rating downgrade, although signals of worsening public finances have had rating agencies sounding alarms days ahead of the budget.

Indeed, in its reaction to the budget, the S&P warned against heavy reliance on commodity-based revenues posing an additional threat to the fiscal position in the absence of more structural revenue-raising measures. But S&P also praised the commitment to gradual fiscal consolidation.

The market reaction

The low inflation and stable monetary policy explain resilience of Malaysian government bonds to recent emerging market contagion. A wider fiscal gap and resultant supply overhang will be unsettling for the bond market, though markets didn’t have a chance to react given the timing of the budget announcement towards the end of trading day. The benchmark 10-year local currency bond yield has bounced in a narrow range around 4% since 2017. A higher trading range going forward looks to be a reasonable expectation.

The Malaysian ringgit (MYR) weakened on the knee-jerk reaction to initial budget headlines but quickly pared the loss and appreciated close to 4.16 against the USD. We now consider our end-2018 USD/MYR forecast of 4.20 subject to upside risk.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article