Malaysia: 2018 shaping up to be a better year for inflation

Barring a political uncertainty, the Malaysian ringgit should remain among Asia’s top-performing currencies this year

| 2.7% |

January CPI inflationYear-on-year |

| As expected | |

Inflation slows in January

Malaysia’s consumer price inflation dipped in line with the consensus to a one-year low of 2.7% year-on-year in January from 3.5% in the previous month (consensus 2.8%, ING forecast 2.7%). Food and transport prices were the main sources of lower inflation with both CPI components starting to enjoy favourable base effects.

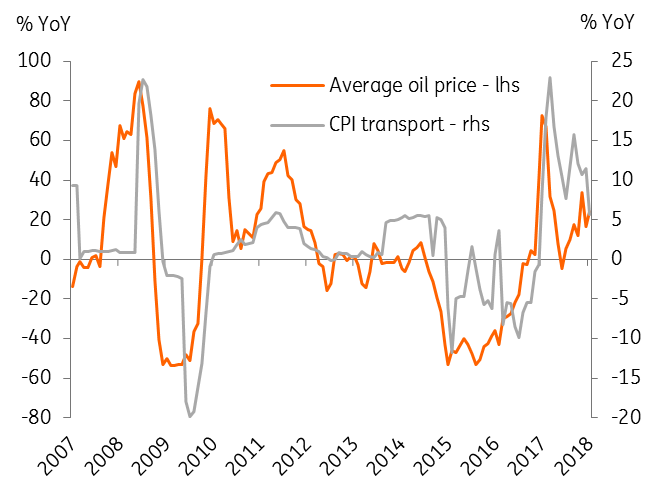

2017 was the worst year for Malaysian inflation in a decade with a near-doubling of prices to 3.9% from 2.1% in 2016. Higher transport costs led by fuel prices were mainly responsible. Higher import prices, as well as factory gate prices, were the other factors. A strong Malaysian ringgit (MYR) last year wasn’t much help to prevent imported inflation. The average 6.1% YoY rise in the import unit value index in 2017 compares with a 1.4% rise in 2016. The corresponding figures for producer prices are 6.7% and -1.1%.

Global oil price vs. Malaysia transport price

2018 a better year for inflation

2018 is shaping up to be a better year for inflation. The high base should continue to dampen year-over-year price increase this year. And the sustained MYR appreciation trend should mitigate the spillover of rising global commodity prices. On the flip-side, strong domestic demand should exert an upward pull on prices. Rapid wage growth (8.6% YoY growth in manufacturing wages in 2017 was the fastest in seven years) and election cash handouts should boost consumer spending.

As things stand, the risk to our 3.0% full-year 2018 inflation forecast appears tilted to the downside. Bank Negara Malaysia (BNM), the central bank, forecasts inflation this year in a 2.5-3.5% range. That said, we expect BNM to continue to normalise monetary policy. BNM raised the policy rate by 25bp to 3.25% in January. We forecast one more 25bp rate hike in the third quarter. Barring a political uncertainty, the MYR should remain among Asia’s top-performing currencies this year. Our USD/MYR forecast for end-2018 is 3.72 (spot 3.91, consensus 3.85).

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 February 2018

Good MornING Asia - 1 March 2018 This bundle contains 5 Articles