Our three calls for the UK

The Bank of England is set to hike rates by February, though what comes after will be slower than markets expect. Brexit has the potential to get worse before it gets better

Growth to slow on consumer headwinds despite better investment

Growth has slowed in the fourth quarter and it’s likely to moderate further over the winter. Consumers – particularly lower earners – face a perfect storm of lower benefit payments, higher taxes and rising energy costs. The Omicron variant would add further pressure given surveys until now have shown consumers more relaxed about leaving home than earlier in the year. It’s not all bad though. A renewed return to the office and more global travel would lift the still-depressed transport sector. Investment could return, given solid corporate cash levels and rising confidence. Consumers are still sitting on a lot of accumulated savings, albeit concentrated among higher earners who are more likely to save than spend. Annual growth in the 4.5% region looks likely.

Bank of England to move cautiously on rate hikes

A severe Omicron shock aside, it’s clear the Bank of England thinks the days of emergency policy are behind us. QE is about to end and a rate hike is likely by February. After that, policymakers are likely to move more cautiously than markets expect. True, inflation is likely to peak at 5% in April on higher electricity costs. But it’s likely to be much closer to target by the end of the year, and below in 2023 (assuming used car and energy prices begin to ‘mean-revert’). And with modest residual slack in the jobs market, we’re less convinced broad-based wage pressures will become a big enough problem for policymakers to justify taking rates higher than they’ve been since 2008. Two – or at most three- rate rises in 2022 look likely.

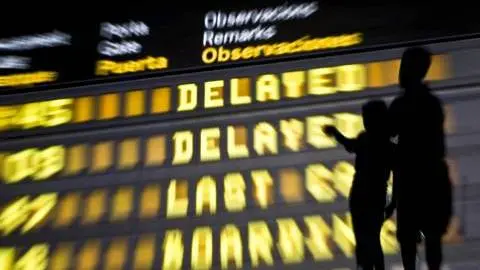

Brexit uncertainty to get worse before it gets better

Brexit is on the backburner again, though recent tensions over migration remind us that UK-EU trust is low. There’s still a fair chance that the UK government will trigger Article 16 in the new year and rewrite parts of the Northern Ireland agreement. The EU would retaliate, and there’s a decent chance Brussels could simply suspend the trade deal – with nine months' notice.

The bottom line is more uncertainty. And even if (a big if, perhaps) we return to ‘no deal’ territory, the economic impact need not be gigantic. After all, the UK left the single market and customs union months ago, and that’s where the biggest economic adjustment costs lay.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 December 2021

ING global outlook 2022 This bundle contains 17 Articles