Lower gas prices offer rare good news for squeezed UK consumers

Persistent falls in UK retail sales are another reminder that the UK is still entering a downturn. The good news is that lower gas prices mean the Treasury can afford to do away with April's planned increase in household energy bills, a move that would lower headline inflation by 1-1.5pp through the latter half of the year

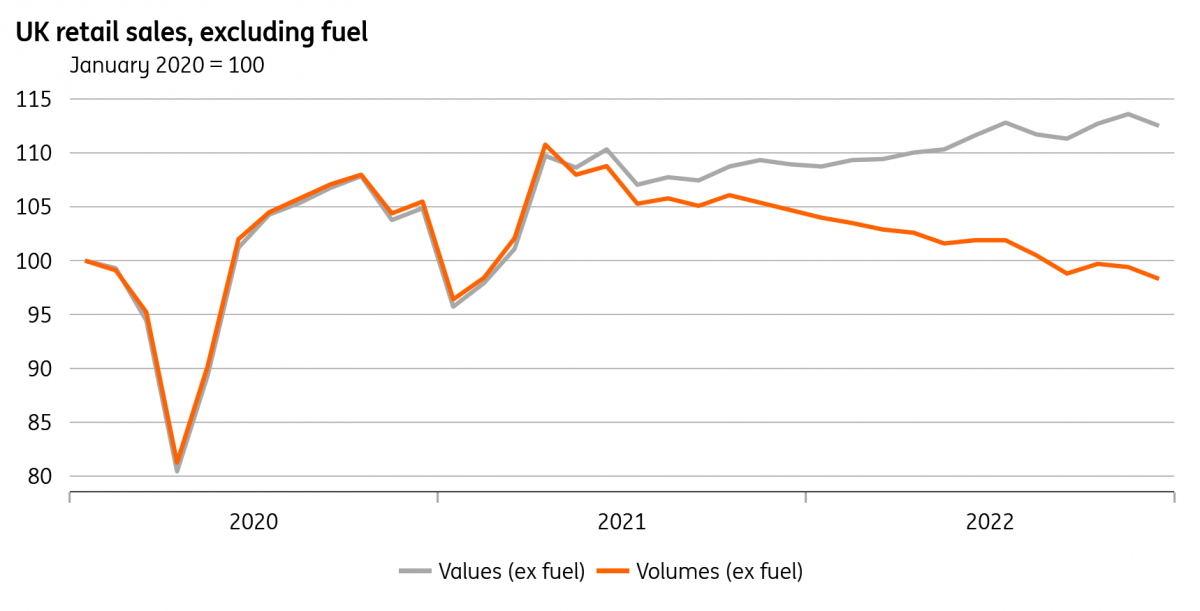

Retail sales have fallen - again

British consumers spent almost 4% more on retail spending last year, but received almost 6% less for their money, accounting for the surge in UK inflation through 2022. That’s according to the latest year-on-year retail sales figures, which also showed that real-terms spending has fallen in 12 out of the last 14 months, and that December alone saw a 1% drop in expenditure. Coupled with another dip in consumer confidence released overnight, recession still looks like the base case for the UK economy.

Admittedly, fourth quarter GDP is likely to come in flat, which is partly down to an artificial bounce-back in activity during October following the Queen’s funeral last September. But assuming ongoing weakness in consumer spending, coupled with some potential declines elsewhere (construction and manufacturing look vulnerable), we think first quarter GDP could see a fall in output in excess of 0.5% (Read more).

UK retail sales are down 6% year-on-year in real terms

The fall in gas prices is welcome news for consumers

The good news, at least, is that the squeeze on household incomes looks like it won’t be quite as bad as first feared. The recent fall in gas prices means the Chancellor can probably do away with his planned increase in energy bills in April, or failing that, can lower them again in July. Current plans would see a less generous household ‘price guarantee’ take the average annualised bill from £2500 currently (or £2100 accounting for an extra discount), to £3000 from April.

When that change was envisaged last November, the average energy bill was projected to be well above that level until early 2024 in the absence of any government support. But recent falls in wholesale prices suggest that will only be the case during the second quarter. Our latest estimates, based on the regulator's pricing methodology, suggest the average annualised bill will have fallen back to roughly £2200 in the third quarter, without any government intervention at all.

Energy bills should have fallen to £2200 in 3Q, without any government support

As well as improving the outlook for consumers, this is also good news for the Treasury. Suppose the government caps the average bill at £3000 in the second quarter and allows them to return to a level determined by market prices in the third. In that case, the cost in FY2023 will fall from almost £13bn to £1.5bn (excluding additional benefits/pensions payments the Treasury has committed to). If the Chancellor does away with the planned increase in unit prices altogether and keeps the average bill at £2500 in 2Q, the cost would be £4.5bn in FY2023, still well below November’s projections.

Treasury looking at £11bn saving even if price guarantee is scrapped in 3Q

Headline inflation should also be lower as a result. If household bills return to the default price level set by the regulator Ofgem, then we’d expect CPI to come in 1-1.5pp lower than currently forecast. For the Bank of England that’s a double-edged sword – lower headline inflation would undoubtedly please the hawks most worried about inflation expectations de-anchoring. But lower gas prices mean a less pronounced hit to economic activity, potentially justifying tighter policy.

In reality, the Bank will probably lean more towards the former argument, and we still think we're close to the peak in terms of Bank Rate. That said, it looks like the combination of persistent wage pressures and higher core services inflation will unlock one more 50bp hike at the February meeting, potentially followed by a final 25bp move in March.

UK inflation set to be 1-1.5pp lower if bills below £3000 government guarantee

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article