Eurozone: Low interest rates continue to support real estate

Recovery of housing markets in the Eurozone continues and remains supported by low-interest rates. But we suspect 2018 will be another year of high house price growth

Eurozone

2017 was an excellent year for the Eurozone economy, and so it isn't surprising that house prices grew at the rapid pace of 3.5%. The strong economy lead to higher disposable incomes pushing prices upwards. The low-interest rate environment also maintained the purchasing power of consumers to buy houses.

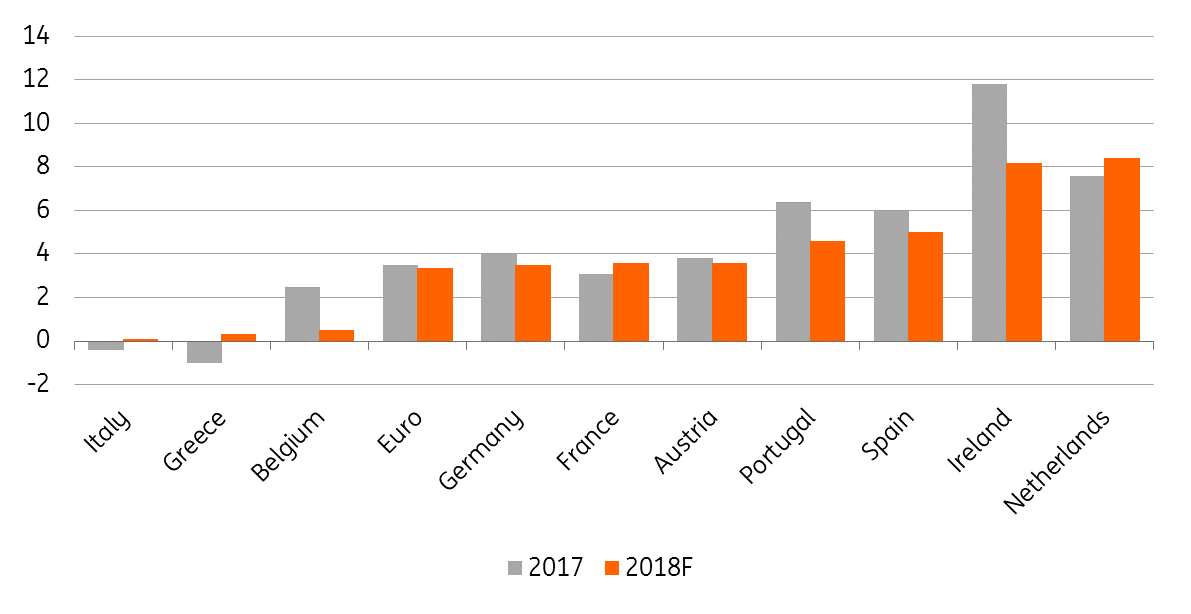

Even though we think the Eurozone economy will cool down towards the end of the year, we suspect 2018 will be another year of high house price growth. Compared to January, our forecast remains constant at 3.3%. But it's worth remembering; the 3.3% expected growth figure is a weighted average of all the constituent countries of the Eurozone that can have very different individual situations.

Housing price growth forecasts across the Eurozone (in %)

France

Real estate prices continued to rebound in 2017, reaching 3.1%, after 0.9% in 2016.

The period of price declines came to an end in 2015, with a 4.5% drop compared to the price levels in 2007. We expect the rebound to continue, fuelled by low-interest rates and declining unemployment. The rebound should reach 3.6% in 2018, but unfortunately, this catch up is not widespread as large urban areas are mainly pushing the average up.

Over the last five years, the ten largest cities saw prices increasing by 5.2% (including Paris +9.2%) while rural zones saw price declining by an average of 6.8%. The trend seems to be confirmed in 2018, with Lyon taking the lead with house price growth nearing 9% YoY in the first quarter of 2018.

Italy

Latest Istat house price data continues to show a divergence between existing homes (still on a YoY decline) and new homes (in 4Q17 flat on the quarter), suggesting that the residential housing market remains patchy and that broad-based price increases are not imminent.

In principle, the ongoing moderate recovery of disposable income, in conjunction with cheap mortgages, should continue supporting house purchases. However, the ample slack in the market should prevent a big short-run showing on prices. We expect house prices to increase only marginally in 2018 and to accelerate slightly in 2019.

Spain

In 2017, the house price recovery was still supported by growing disposable incomes and low-interest rates, reaching 6.2% in 2017 after 4.6% in 2016. House prices, however, are still 25% below the peak of 2007, so there is still room to recover.

For 2018, we expect house prices to ease slightly and forecast a growth rate of 5.0%. As we think the economy will moderate, we forecast a lower rate than in 2017. Nevertheless, this is firmly above the Eurozone average of 3.3%

Netherlands

Demand for housing remains strong in 2018, and new supply is not enough to counter foreseen household growth. Increasing wage growth, continuing employment growth and growing interest in buy-to-let investment also provides upward price pressure.

Interestingly, the Dutch housing market is starting to show changing regional patterns. As a result of supply drying up in urban areas, demand has started to shift to neighbouring regions, where the number of transactions, as well as price, has accelerated. In the largest cities, prices are far above their pre-crisis peaks, but the national average is still 1% below prior records. Nationwide, house prices rose by 9% year-on-year in 1Q18. Probably the rise peaks in the first half of 2019.

While we expect the price increase to decrease during the course of 2018, we project the annual price increase to accelerate from 7.6% on average in 2017 to 8.4 in 2018. Nationwide, existing homes sales have started to decrease in 1Q18, after record levels in 4Q17, and are expected to decrease to an annual number of 224,000 in 2018.

Belgium

Home price growth has been subdued from a historical point of view since 2008: there was a 5.6% price correction between mid-2008 and mid-2009, which was recouped by 2010.

Prices then increased by 3.7% (equal to the inflation rate) in 2011. In 2012 and 2013, nominal prices increased by 2.3% per year, but growth scaled back to only 0.8% in 2014. Exceptional interest rate conditions brought a rebound of almost 4% in 2015 which was not repeated in 2016 and 2017 (respectively +0.8% and +2.6%) despite growing mortgages. Since 2008, the yearly growth average has been 2.6% while it was 9.2% in the decade 1998-2007.

Therefore, if the Belgian real estate market has proven to be resilient during the financial crisis and is continuously seen by many as a safe-haven investment opportunity, risks for the future are on the downside. Especially, for the 2019-2021 period which, we believe, will bring an unfavourable mix of investor discouragement, higher mortgage interest rates and a less favourable fiscal environment. In this context, we don't believe that the 1999-2008 historical price development will be repeated any time soon and that a moderate correction - in real terms – is likely on the current decade (2010-2020).

Portugal

The domestic-demand based recovery of the Portuguese economy continues.

While credit conditions remain favourable for borrowers, lending activity has been hampered by the ongoing private sector deleveraging. In the short run, the real estate market seems strongly supported by the recovery in disposable income and, price-wise, by an insufficient construction rate. As employment growth is proving stronger than originally anticipated, we believe Portuguese house price developments to remain upbeat for most of 2018, and to decelerate after that as the very high elasticity of employment to GDP growth will start proving unsustainable.

Greece

Signals of an economic turnaround are getting more consistent, but the recovery in disposable income is still at an early stage.

Despite the ongoing decline in the unemployment rate, slack in the labour market remains ample, and the delicate position of Greek banks on NPLs is still weighing on house-purchase related mortgage lending. Deleveraging is slowing down though: lending for house purchases was contracting at a 7.6% YoY in 4Q17 while the pace of contraction declined to 4.3% YoY in 1Q18. Nevertheless, in 4Q17 the contraction of house prices decelerated further to -0.3% YoY (-0.6% in 3Q17), signalling that stabilisation is possibly in sight.

We could see the YoY price contraction to end in 1H18 and to turn very marginally positive after that. This will very much depend on how Greece will be able to exit the third programme.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 May 2018

ING’s Eurozone Quarterly: A slower cruising speed This bundle contains 12 Articles