Low growth expected in Polish construction sector

Polish contractors have made a promising start in 2022. However, the Ukraine war, higher interest rates, soaring prices for building materials and labour and material shortages are putting pressure on production levels. Yet, we think there will be marginal room for construction output growth this year and next

Polish construction sector made a promising start in 2022

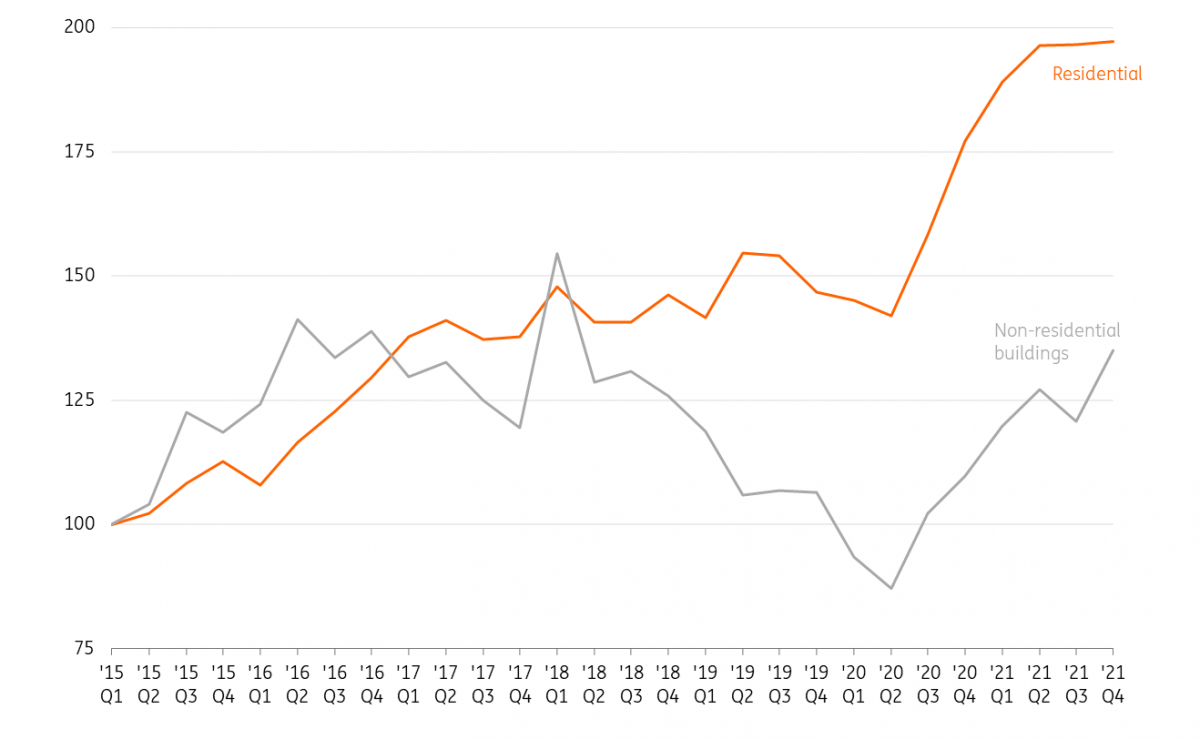

In 2021, the Polish construction sector showed a small decline mainly driven by the pandemic and the additional uncertainty. This resulted in lower investment, mainly in the non-residential sector. Yet, in the first months of 2022, the Polish construction sector got off to a strong start. Construction output grew by 18.4% in January and 21.1% in February. February is the final month of data that does not incorporate the war in Ukraine, and it's therefore debatable how relevant these numbers are. However, preliminary local data shows a high rate of growth for March as well.

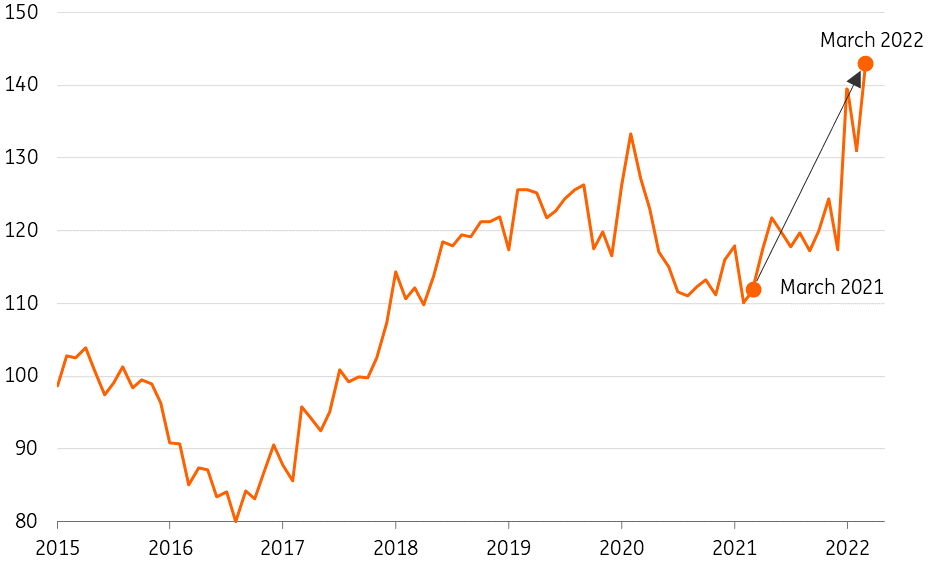

Strong increase in construction output at the beginning of 2022

Construction production volume (Index 2015=100 SA)

Poland: sixth largest construction sector in Europe

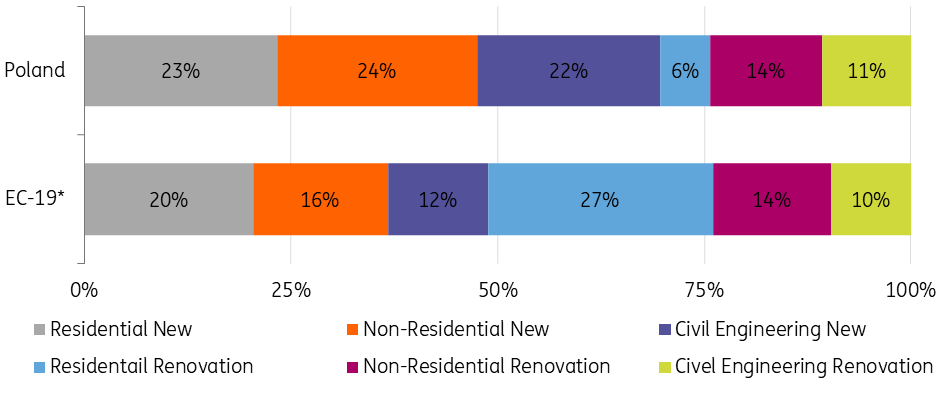

The output of the Polish construction sector was approximately 446 billion Polish zloty (€100 billion) in 2020. It is the sixth-largest construction market in Europe. Poland's total construction production is almost 10% of GDP. New construction activity and the infrastructure sector in particular (civil engineering) are relatively large compared to the renovation sectors. Some 22% of total Polish construction output is related to new infrastructure projects.

Large share of new construction and infrastructure sector in Poland

Production share subsectors of construction, 2020

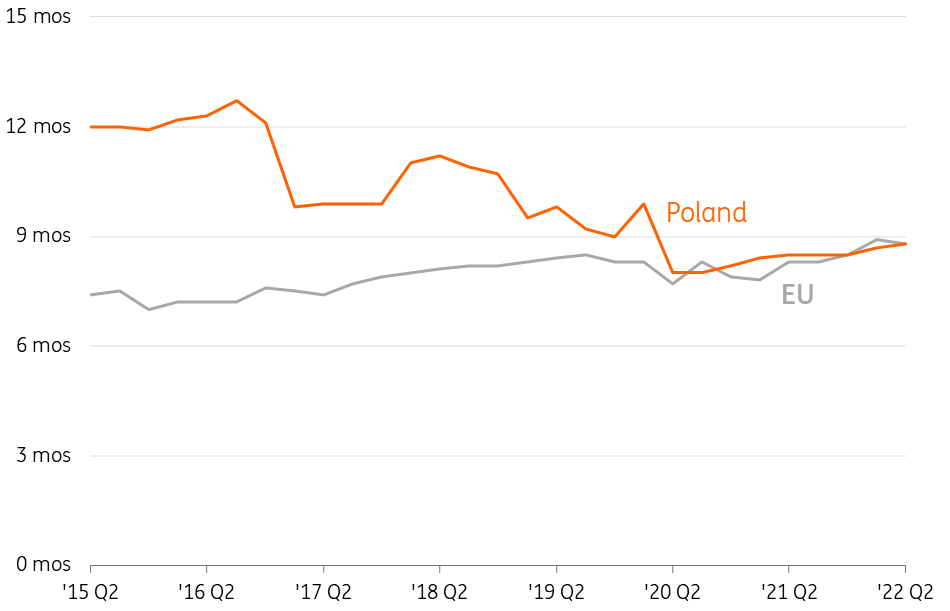

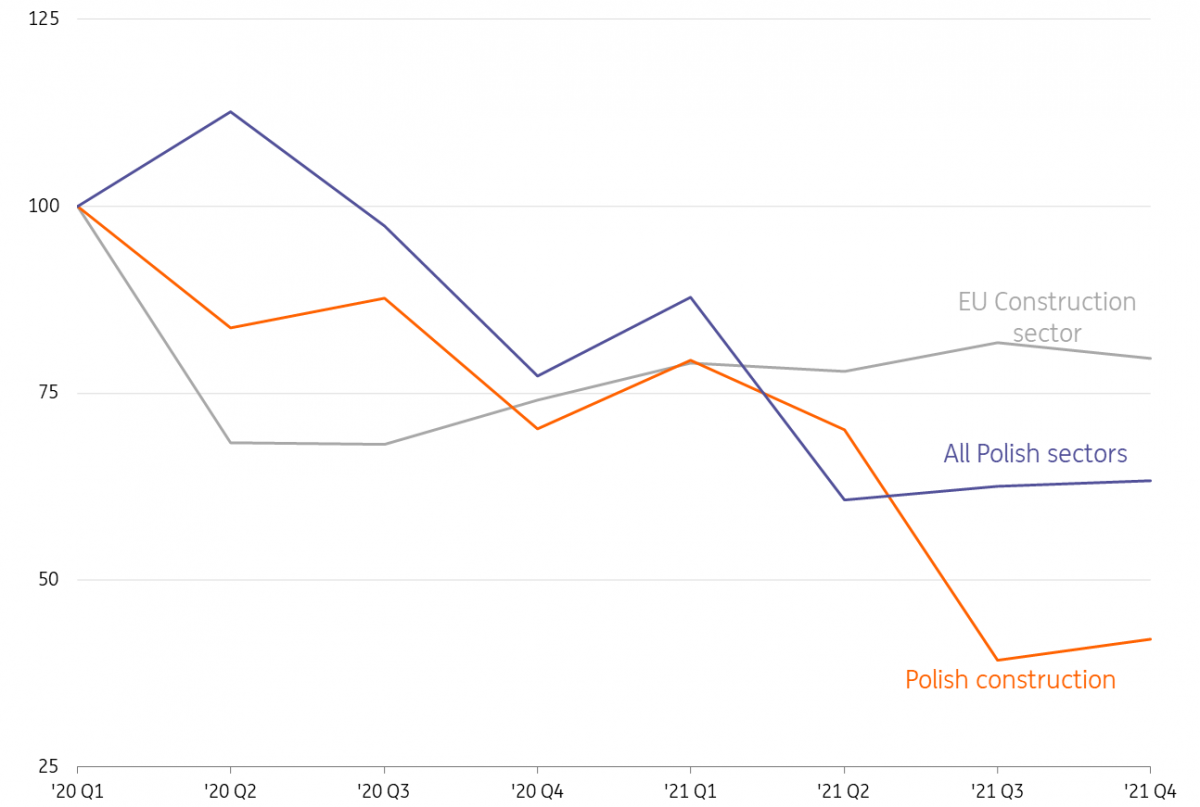

Still well-filled order books

Despite the Ukraine war, Polish contractors still have well-filled order books. In the second quarter of this year, they have in general 8.8 months of ensured work. This is not as high as in the flourishing years of 2015 and 2016. However, it is still approximately at the same level as other contractors in the European Union.

Polish construction companies see stable order books

Operating time in months ensured by current backlogs at construction companies, SA

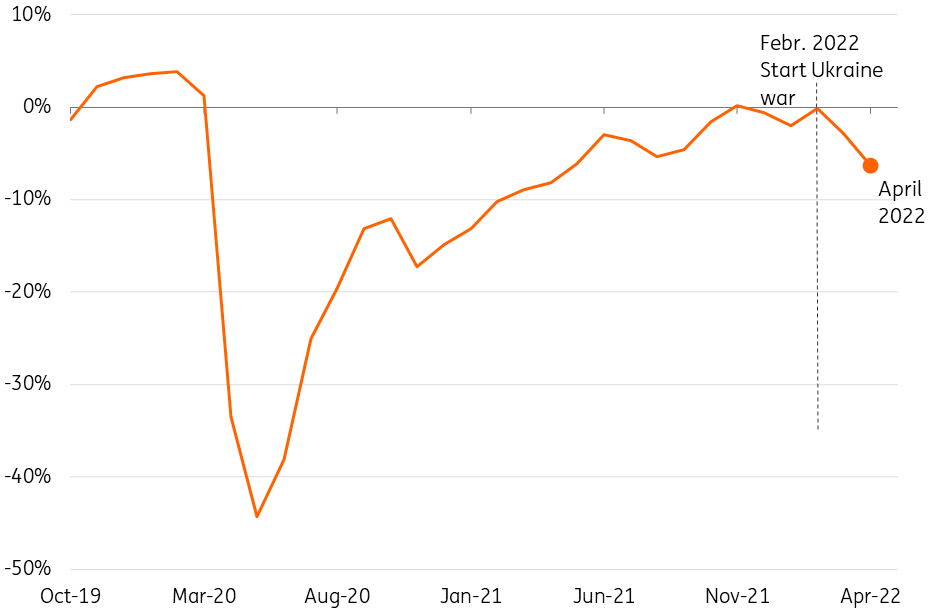

A record number of contractors face material shortages

Supply chain disruptions have increased, first due to the Covid crisis and now the Ukraine War. This has resulted in shortages and price hikes. In April, a record percentage (17%) of Polish contractors indicated their output was harmed due to a lack, or delayed delivery of building materials. We expect that these building material shortages will continue for some time as a result of the war and the new lockdowns in China. The latter will especially affect the supply of more technical products that are mostly used in the installation sector.

Structurally not enough staff

Another factor limiting production, but with a more structural nature, is the availability of sufficient labour. In April, almost 40% of Polish contractors cited this as problematic. Many construction companies have reported an outflow of Ukrainian workers leaving Poland to fight in their home country. A recent Statoffice survey indicates a stronger outflow than inflow of Ukrainian construction workers. However, the percentage of contractors mentioning the shortage of labour didn’t increase that much in March and April, which suggests this may be manageable. Companies can do several things to try to solve the structural labour shortage. For instance, by increasing labour productivity through industrialisation and/or digitalisation and attracting skilled workers from abroad (which is difficult right now as a result of the war), or investing in education for younger employees and trying to commit them to the company for a longer period.

Shortage of labour and building materials

% Polish construction firms that have to limit production because of (cumulative):

Last data point April 2022

Higher sales prices

Supply chain disruptions, higher energy prices and Russia’s decision to cut gas deliveries to Poland have led to higher building material prices. The production of cement, brick and concrete is very energy-intensive. Polish building material firms are using a lot of oil and coal in their production processes and are relatively energy-intensive compared to other EU countries (see: Building material sector challenged by soaring energy prices). Higher procurement prices of building materials are putting pressure on contractors’ profit margins and they are therefore trying to pass the price hikes on to sales prices. This has resulted in an almost record number of building companies planning to increase their prices. On balance, almost 45% of Polish building firms have planned to increase prices in April 2022. This is the highest percentage in the last 10 years.

Building sector: a small majority of companies have witnessed a decline in production

Since the start of the Ukraine war, the number of Polish (non)-residential building companies that have observed a decline in production has remained more or less stable. The balance of firms that have reported a drop in their output values in the past three months was 3% and 6%, respectively in March and April. This is approximately the same as it was in 2021 but still a lot less than in 2020. It looks as though the Ukraine war, higher input prices, and the labour and material shortages have not had a strong effect on building output up till now. Nevertheless, we think that the construction sector will suffer from these issues.

Few building companies seeing production decrease

Balance of Polish (non-)residential building companies with increase/decrease activity over the past three months

Issuance of residential building permits stable

The issuance of residential permits is a strong indicator of future production. The number of approved new home permits in Poland increased strongly in the second half of 2020 and remained stable at a high level in 2021. This could be a result of the “Polish Deal”, which was announced in May 2021 and makes the construction of single-family houses up to 70 m2 (and in the case of houses with an attic, even up to 90 m2) possible without a permit. Only a notification, construction supervision or construction record is necessary. Geographically, demand for houses is concentrated in the larger cities. However, increasing mortgage interest rates, higher building costs and low consumer confidence due to the Ukraine war could slow down the production growth of housing completions.

Increase building permits

Balance of Polish (non-)residential building companies seeing increase/decrease activity over the past three months

Non-residential permits on an upward slope

The non-residential construction market is very sensitive to crises. During the coronavirus pandemic, issuance of non-residential building permits plummeted. As a result of diminishing demand and economic uncertainty, companies stopped or scaled down their investments in new premises. However, in 2021, issuance of new non-residential permits recovered. The rise in e-commerce has increased demand for new logistics centres and the number of issued permits. The office market has remained a risky business. The question is, to what extent the trend of working-from-home will be permanent and how much demand there will be for office space. The increasing trend of hybrid working could also result in demand for the refurbishment of offices to make them suitable for this new way of working. Yet, the Ukraine war fosters new uncertainty for businesses. This could again slow down new property investment.

EU funds could boost the infrastructure sector

The infrastructure sector is more resilient to the economic cycle as investment mainly comes from local or central government. In March and April, infrastructure companies also mentioned in a European Commission survey that their production levels were more or less the same over the past three months. Infrastructure investment is playing an important role in stimulating the Polish economy. An ambitious investment programme, including the EU Recovery Fund, will boost the Polish civil engineering sector. However, the judiciary dispute between the EU and Poland may delay these investments. That said, the government may start some of the projects from the Recovery Plan even with EU funding still frozen. This may require extra local funding through bond issues. In addition, at the beginning of April, EU commission vice-president Valdis Dombrovskis said that the EU would probably approve the Polish recovery plan soon as there has been progress in the negotiations.

Infrastructure building companies still report production growth

Balance of Polish civil engineering companies seeing increase/decrease activity over the past three months

Road, rail and energy transformation investment

The National Road Construction Programme is tasked with completing Polish highways and expressways by 2030. The government allocates PLN 290 billion for this. The aim is to connect all Polish regions by a network of fast roads. For instance, there is a plan to build 100 city ring roads including the A50 Southern Warsaw circular motorway. The 2040 Polish railway investment plan is worth PLN 250 billion. It consists of the construction of new lines and the modernisation of existing lines. Another important goal is the energy transformation which is a direct result of the EC proposal “Fit for 55” to reduce greenhouse gas emissions by at least 55% by 2030.

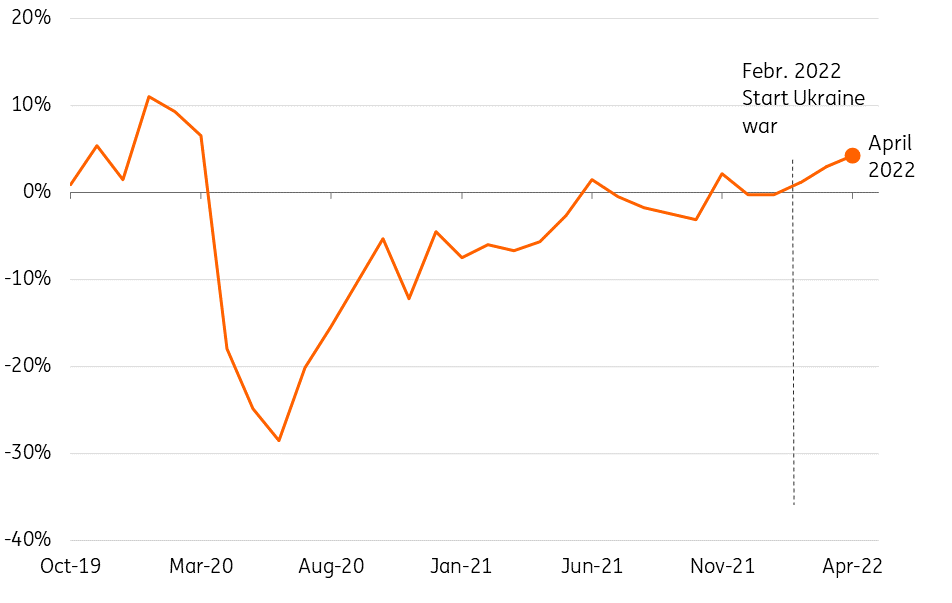

Low number of bankruptcies in Poland

Development of bankruptcies, (index 2020 Q1=100, SA)

Strong decline in Polish contractor bankruptcies

As in many other sectors, the number of bankruptcies in the construction sector has remained surprisingly low. The construction sector was only modestly affected by the Covid crisis in comparison to other sectors, like hospitality and aviation. Therefore, in 2021, there were even fewer contractor liquidations than before the pandemic.

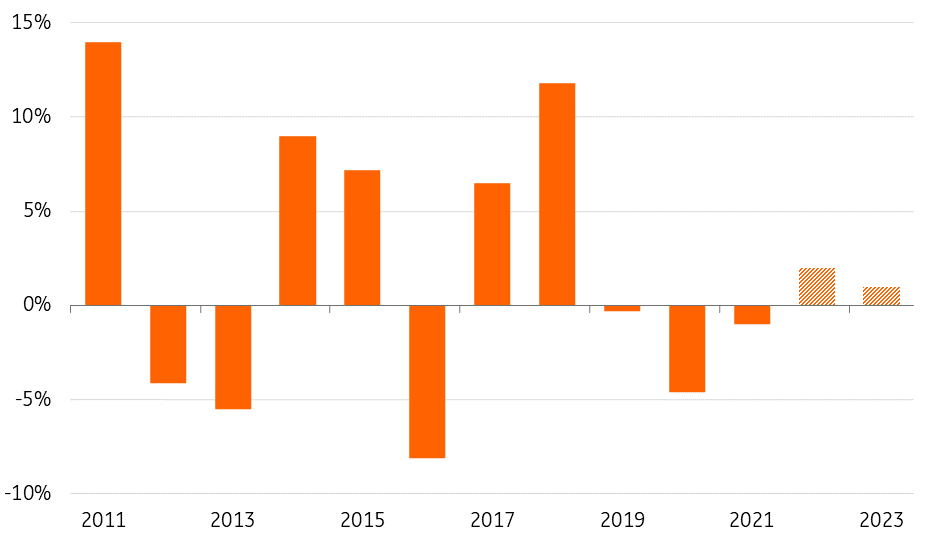

Low construction output growth expected

Development of Polish construction output (volume value-added in % yoy)

Low Polish construction output in Poland in 2022 and 2023

Hence, after a promising start in the first months of 2022, we don’t expect that these high production levels will endure. High building material prices, increasing interest rates, labour shortages and the uncertain situation around the Ukraine war will put downward pressure on construction output. In this period of heightened geopolitical tension, it is extremely difficult to forecast, especially when it comes to such a volatile sector as the construction industry. However, we think that if the Ukraine war does not escalate further there will be room for some marginal growth in Poland's construction output due to the high growth in the first months of 2022, and also driven by the investment from the European Recovery fund.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article