Lead is not dead: Chinese go long, big time

Open interest on the Shanghai Lead contract has surged almost 50% this month as Chinese speculators pile on long positions. Physical markets are tight but be cautious since lead rarely holds such speculative interest for long

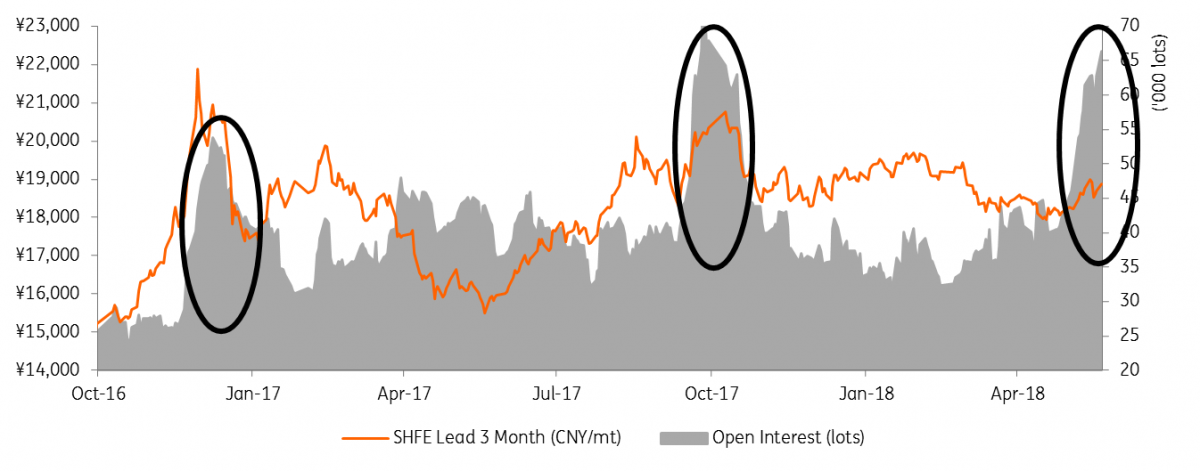

The third jump in SHFE Lead open interest

History suggests it won't last long

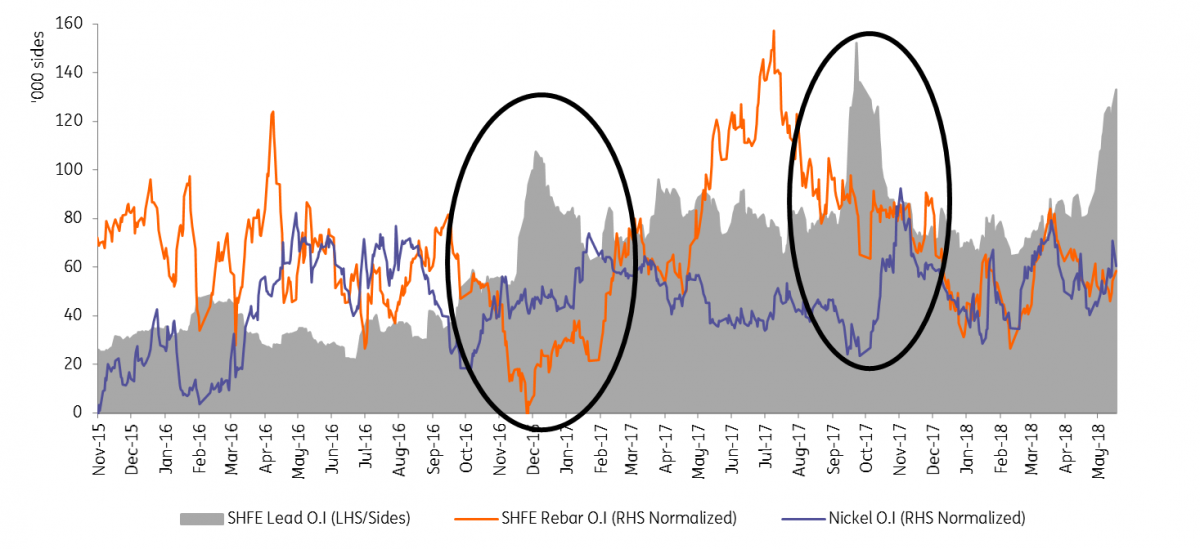

The Shanghai Futures Exchange (SHFE) Lead contract has before now had two other intense, but short, surges in speculative interest. If history repeats then the higher prices and speculation will soon roll over. In November 2016 speculation in SHFE Lead first took off only after activity in the rebar and nickel contracts were curbed through higher fees. Presumably, this diverted some of those assets into the lead contract. As nickel and rebar picked up again, lead’s speculative interest quickly evaporated leaving prices to fall steeply. Those swings in a now more liquid LME-SHFE Lead arbitrage also re-wrote the status quo by encouraging sizable refined lead metal imports into China as physical merchants locked in the differential.

In August 2017, lead positions rocketed once more, hitting even higher levels than currently. This time the drivers were seemingly more lead-specific as Shanghai stocks were drawn to lows, in turn, prompting large backwardations so that the profits to be made on the rolls incentivised traders to go long. That price peak once again quickly rolled over because metal stocks were soon delivered on to the exchange whilst other speculators also capped the rally according to the swings in the various relative value trades: the LME/SHFE Lead ratio had hit a record low and the SHFE Zinc/Lead ratio had dropped suddenly. Like in 2016, a burst of interest in a more active contract (Nickel) also seemed to divert the speculators away.

Shanghai speculators jumped on lead during lulls in nickel/rebar

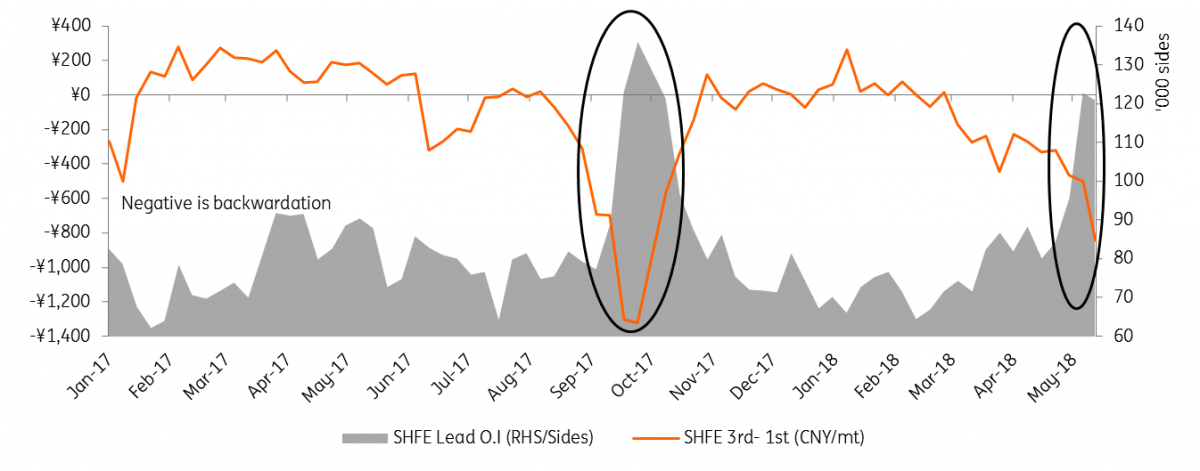

Feels like September 2017: SHFE speculators go long lead amid big backwardation & low stocks

Timing the next speculative exodus

Whilst respecting the physical tightness, like the previous sessions, we don’t think such a quick pace of Shanghai open interest is sustainable. If the exit is as quick as before then Shanghai lead prices are sure to drop which will, in turn, knock on to LME levels. The timing is everything. Here are some key points to bear in mind:

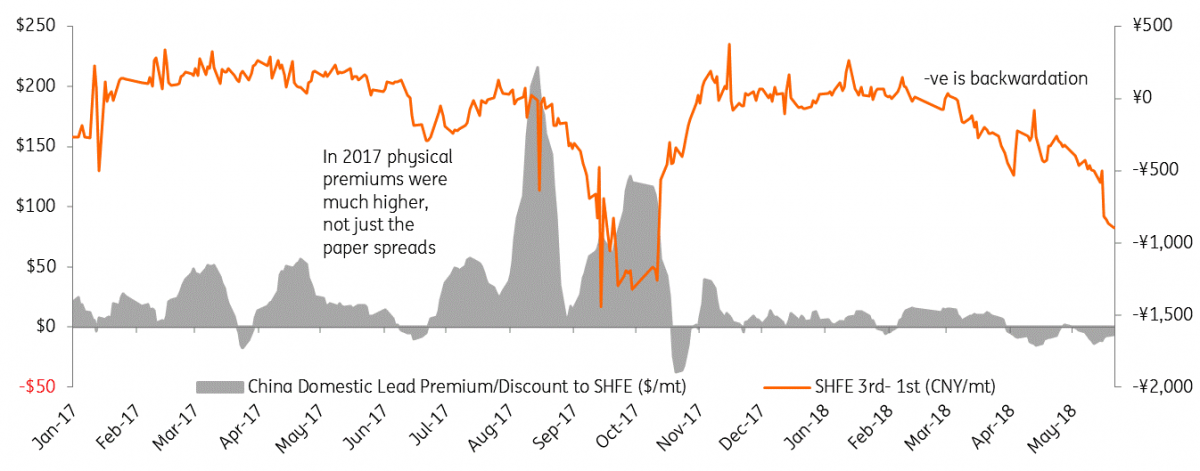

A deep backwardation but only soft domestic premiums

The 3rd-1st month spread on Shanghai has hit 840 RMB/t, deep, but still far to go from the previous highs above 1300 RMB/t in August 2017 when exchange stocks were only slightly lower. Even though the backwardation is less, no doubt it’s starting to get tempting for traders to think about making stock deliveries to the exchange. Especially since Chinese domestic physical market premiums for primary metal are flat whereas the 2017 spike saw those premiums go over $100/mt. So long as the tightness is left to just the paper market then things look vulnerable. Speculators may liquidate on signs of stock deliveries.

Lower domestic premiums make it more temping for traders to deliver to SHFE

Secondary shortage pulls on primary stocks

The latest drawdown in lead metal stocks is intensified by the uncertainty around Chinese secondary lead production (from scrap batteries). In total, secondary accounts for c.60% of Chinese lead production but there have been ongoing reports of intensified environmental checks on small sized smelters across Guangzi, Yunnan, and Hunnan. The price gap between secondary and primary lead has narrowed significantly which is, in turn, encouraging more of those secondary users caught short to turn to the primary market. Primary lead metal stocks might, therefore, be around the levels of where the last backwardation peaked but this additional demand equals a tighter stock cover that could sustain the backwardation for longer.

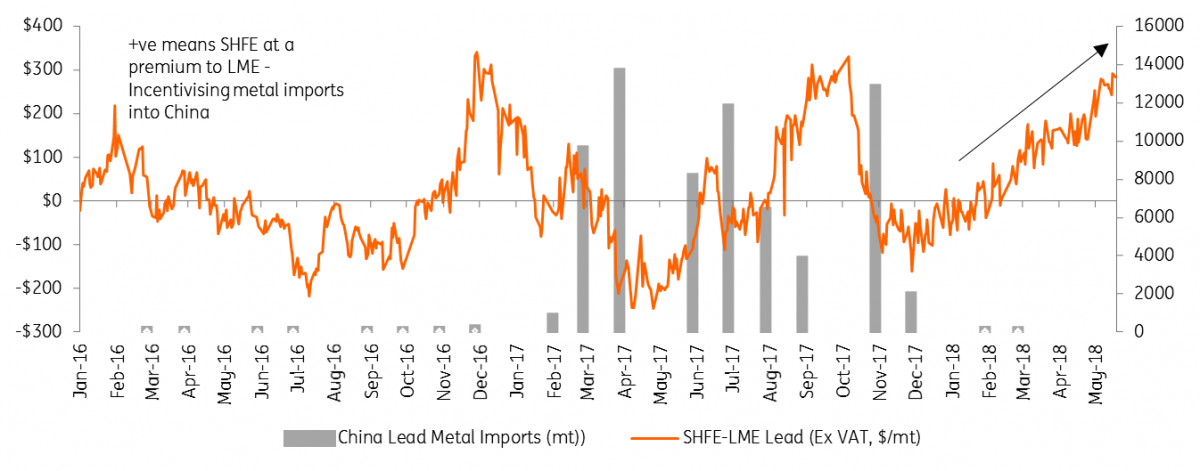

Roll profits could keep the LME-SHFE arb open but imports will crash the party

Shanghai is once again trading at a sizeable premium to the LME. At $290/mt currently, it's around those highs hit last year. Still, arbitrage traders might not take profits yet because the Shanghai backwardation contrasts with a contango on the LME. Arb traders can therefore generate profits by rolling Shanghai longs versus LME shorts, in turn, boosting the arbitrage further. We can, however, expect that price arbitrage will also begin to pull stocks into China. Given looser ex-China markets (ample LME stocks, lower premiums) these flows should alleviate the Chinese situation and give the SHFE speculators reason to liquidate. Such flows can take time however (weeks to months).

SHFE-LME arb will likely restart lead metal imports

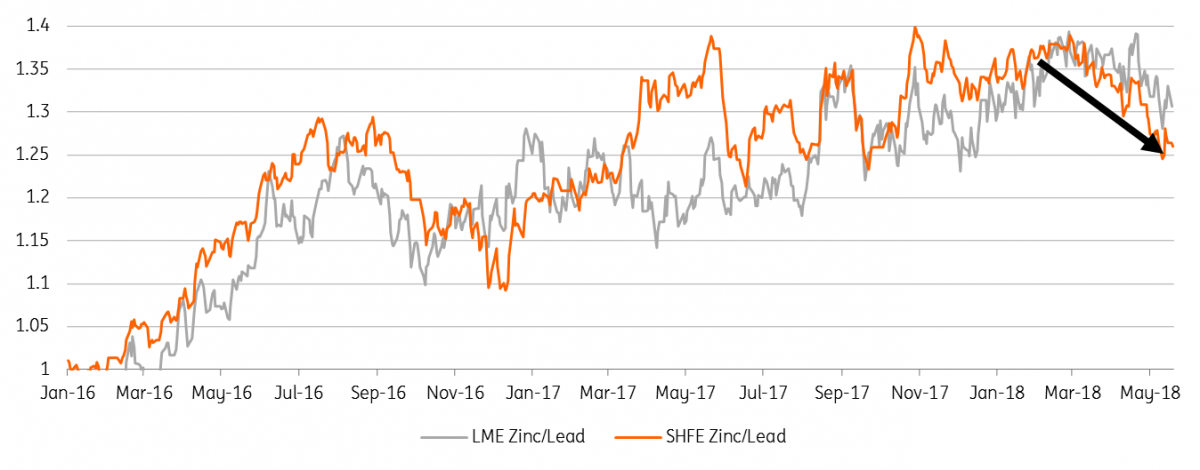

The Zinc/Lead Ratio is on its way down anyway

Amid the recent lead rally, the SHFE Zinc/Lead ratio has gone to 1.26x. But dips below 1.3x have rarely lasted longer than a week since 2Q17. Nonetheless we think the ratio was overstretched for some time and that there is becoming a wide consensus on this. Recent swings in the ratio should therefore pose less of a trigger for the speculators to act against the lead rally. The zinc deficit should ease considerably this year as more zinc-weighted mine supply comes online. Further, we think lead largely lagged zinc through the last two years because of the former's scrap supply contribution, which diluted the cuts in mine supply. But as secondary lead production surged to fill the void, the battery scrap market has now also tightened considerably. Based on LME prices, ING forecast a zinc/lead ratio of 1.25 by year-end, down from 1.31 currently.

The Zinc/Lead Ratio has peaked

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

LeadDownload

Download article