Latest positioning in Turkish assets

The latest data shows no meaningful change in bond market holdings by foreigners while residents have continued to bet against the market

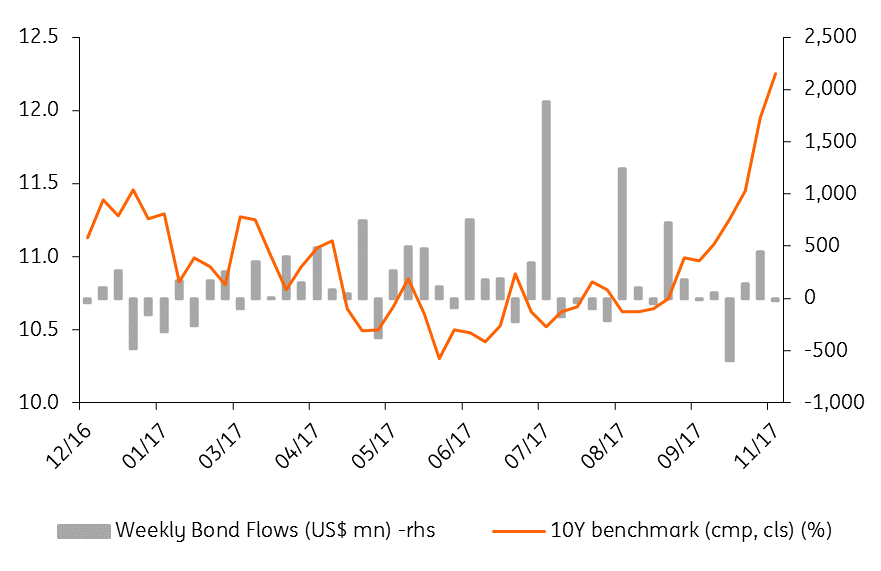

Foreign flows to the bond market remain in positive territory

Turkish assets have recently been under pressure given increased geopolitical risk anticipation, deterioration in the inflation outlook and unfavourable supply dynamics. We've looked at foreigners' holdings in the bond market and investigated the different approaches among residents and there are interesting differences.

Since the start of market volatility in mid-September, foreign investors maintained positions and gradually increased their holdings with the exception of one large USD600mn outflow in the week of October 13. In the last seven weeks, the cumulative inflows into the bond and equity markets were US$185 mn (USD175mn including repos) and US$268mn, respectively, showing some momentum loss in comparison to the flow outlook after the April referendum.

Thanks to a strengthening appetite this year, the share of nonresidents in the local bond market (including repo transactions) increased to 22.8% on Sep 15th from a trough of 19.1% at the end of January. This corresponds to the highest level since mid-August 2015. However, from mid-September onwards, the share has marginally dropped to 22.3% mainly because of continuing expansion in the debt stock with heavy borrowing.

Foreign Flows to Bond Market

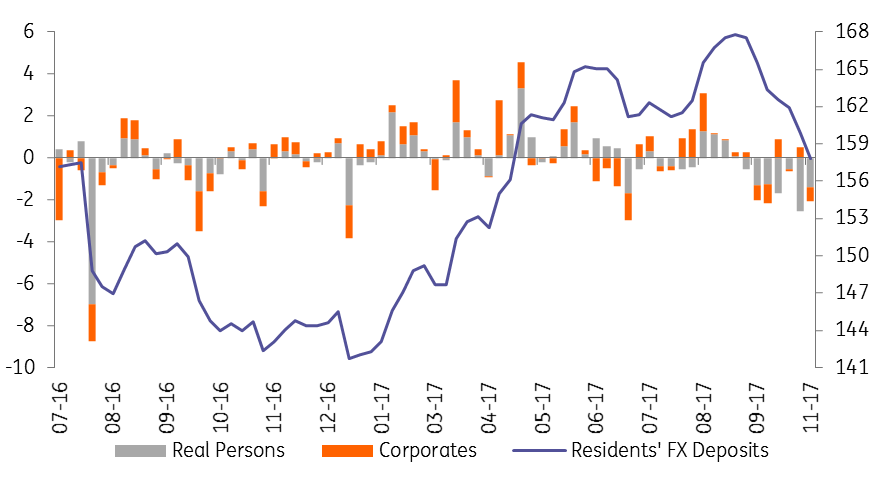

A change of behaviour

Local investors continue betting against the market and smoothing the volatility in the FX market. As the TRY appreciated towards 3.42 against the USD during the course of 2017, local investors increased their FX deposits by a total of USD26.1bn between 6 January and 15 September. The USD15bn of the increase came from the households and the rest from the corporates.

However, we've seen a change in their behaviour recently. Local investors did just the reverse and sold USD10.0bn when the TRY depreciated towards 3.80s against the USD in the previous seven weeks. One thing that attracts attention is the behaviour of corporates as they have not reduced their deposits in the latest turmoil that much, with a mere USD0.8bn, while households have been the major sellers. So, this may be attributable to corporates' FX debt repayments and/or their expectation of further TRY weakness before stabilisation.

Residents' FX Deposits (USD bn)

The CBT stepped in to bolster FX liquidity

- The Central Bank of Turkey made adjustments in reserve option coefficients (ROCs), lowering the upper limit for the FX maintenance facility to 55% from 60% and cutting all tranches by 5bps. The bank sees around USD1.4bn of liquidity to be provided to the financial system, while TRY5.3bn will be withdrawn from the market so as to “support price stability and financial stability”. This step hints that the CBT first opts to provide FX liquidity in order to stabilise TRY, given there is currently limited room to hike the effective cost of funding at 12.0%.

- Rediscount credits that are usually made in TRY and repaid in FX to enable exporters to sell goods and services on deferred payment terms, has been actively used by the CBT to bolster its FX reserves. Last year, the CBT raised the limit on rediscount credits available to exporters to USD20bn, of which USD17bn is allocated to the Turkish Eximbank and USD3bn to commercial banks. As part of the CBT's effort to stabilize the TRY by reducing FX demand from corporates, the Bank announced that it would temporarily allow repayment of rediscount credits available to exporters to be made in TRY at below market exchange rates, as was the case in early this year. The CBT's newly announced scheme is only for those rediscount credits due before February 1, 2018, allowing exporters to make repayments in TRY for the eligible rediscount credits at below market exchange rates (3.70 for the USD, 4.30 for the Euro, and 4.80 for the GBP). In case the FX rate on the date of credit extension is higher than these rates, the FX rate on the date of credit extension will be applicable.

So far the impact of the CBT actions on the currency has been limited, though recovering tension with the US after the Turkish Prime Minister's visit will likely help recovery and support the effectiveness of these moves. Currently, the CBT’s gross FX reserves stand at USD96.3bn, while ~USD22bn of which comes from the reserve option mechanism (USD13.6bn worth of gold also held under this flexibility vs USD41.3bn for banks' FX reserve requirements) which will be a buffer in the case of difficulty in FX liquidity.

FX & Gold held by banks at the CBT

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article