FXFX TalkingBrazilMexico

Latam FX: Fiscal fundamentals

When it comes to searching the world for positive real interest rates, investors have increasingly been looking at Latin America, especially Brazil. With the dollar soft across the board, one might have thought USD/BRL would be close to 5.00. But no, fiscal concerns are holding the real back. And we continue to prefer the Mexican peso into 2023

Main ING Latam FX forecasts

| USD/BRL | USD/MXN | USD/CLP | ||||

| 1M | 5.30 | → | 19.75 | ↓ | 900.00 | ↑ |

| 3M | 5.75 | ↑ | 20.00 | ↓ | 1000.00 | ↑ |

| 6M | 5.80 | ↑ | 19.50 | ↓ | 950.00 | ↑ |

| 12M | 6.00 | ↑ | 19.00 | ↓ | 900.00 | → |

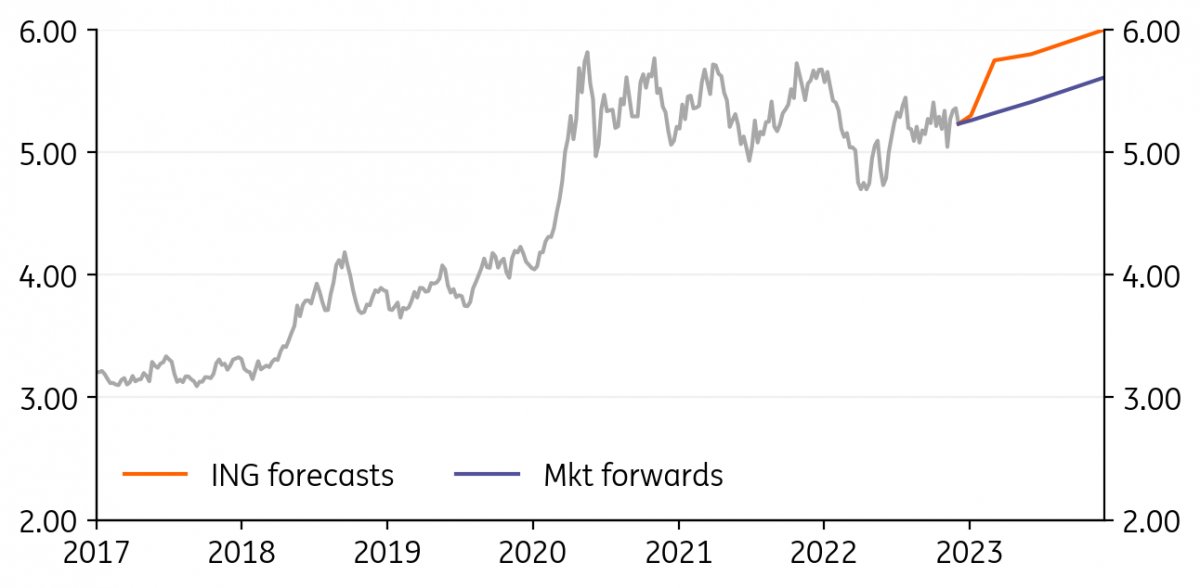

USD/BRL: Real should have been doing better

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/BRL

5.29

|

Neutral | 5.30 | 5.75 | 5.80 | 6.00 |

- Into December, we should be asking why the Brazilian real has not performed better. The dollar is weaker across the board and Brazil’s central bank, BACEN, is keeping the policy rate at 13.75% – well above inflation near 6%. Positive real rates are impressive.

- The concern no doubt relates to fiscal fundamentals. Here the incoming Lula administration is looking to break its fiscal ceiling by some BRL145/176bn in order to deliver on its manifesto of targeted support to the poor. Concerns over a leftward lurch in policy do seem more confined to FX than debt markets so far.

- We think 2023 will be a tough year for emerging markets and any policy missteps will be punished. We see 5.15 as a base and the real weakening through most of next year.

Source: Refinitiv, ING

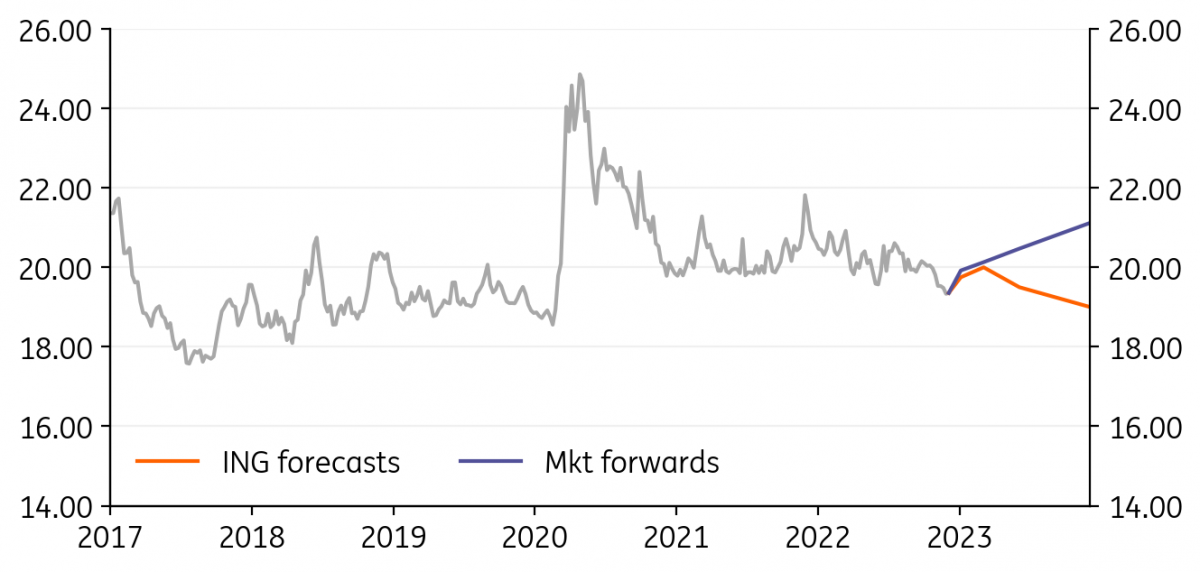

USD/MXN: Banamex sale impacting the market?

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/MXN

19.87

|

Neutral | 19.75 | 20.00 | 19.50 | 19.00 |

- Despite the dollar staying offered against most currencies, USD/MXN has spiked 3% in December. We had thought that it could relate to Banxico not keeping up with Fed rate increases – but consensus and market pricing look firmly set on a 50bp hike. This would take Mexico’s policy rate to 10.50%.

- It is speculation on our part, but we wonder whether investors are cautious about Citigroup’s planned sale of its retail unit in Mexico, Banamex. Reports suggest this could be a $7-8bn proposition, with two local Mexican bidders showing interest.

- We think high rates in Mexico, low expected volatility, and exposure to US growth are relative strengths for the MXN in 2023.

Source: Refinitiv, ING

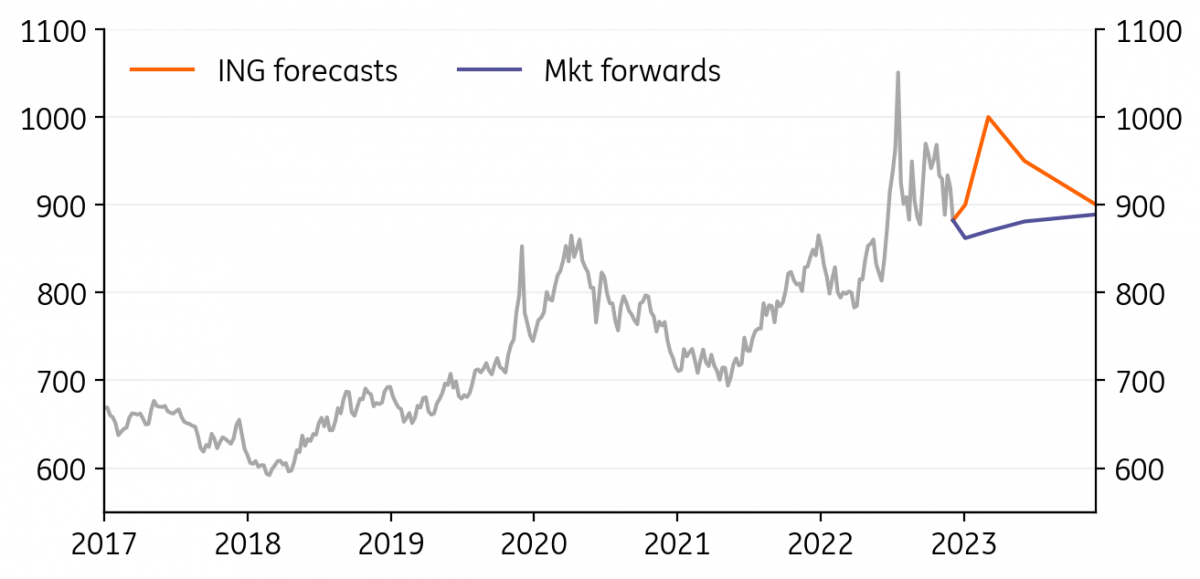

USD/CLP: Delicate balancing act

|

Spot

|

One month bias | 1M | 3M | 6M | 12M |

|---|---|---|---|---|---|

|

USD/CLP

867.60

|

Mildly Bullish | 900.00 | 1000.00 | 950.00 | 900.00 |

- Chile’s peso is doing a little better on the back of the broad correction in the dollar and the bounce in copper back up to $8500/MT. That bounce in copper seems to be down to China’s reversal in its zero-Covid policy – though that trend certainly looks set for a bumpy ride. Our commodities team prefers copper trading back to $7,500 for a large chunk of 2023.

- Chilean central bankers will also have to manage high rates in a downturn. The market looks like it is pricing 150-175bp of rate cuts over the next six months, but high inflation may delay that.

- We are not in the camp looking for big, demand-led rallies in commodities next year and can see CLP handing back recent gains.

Source: Refinitiv, ING

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download articleThis article is part of the following bundle

13 December 2022

FX Talking: Winter wonderland This bundle contains 5 Articles

↑ / → / ↓ indicates our forecast for the currency pair is above/in line with/below the corresponding market forward or NDF outright

Source (all charts and tables): Refinitiv, ING forecast