Latam FX Outlook 2024: Holding firm in the face of rate cuts

Disinflation trends have been in force across the region and both Chile and Brazil have embarked on what appear to be aggressive easing cycles. Mexico hints that it wants to follow suit. We have the greatest confidence in the Mexican peso outperforming its forward curve

Lower rates but attractive yields

Policymakers in Latin America will be pleased that disinflation trends look to be firmly in place and inflation expectations for 2024/25 look well anchored. These inflation expectations have been key in allowing both Chile and Brazil to embark on easing cycles this summer. Both would probably like to get their policy rates (Brazil at 12.25% and Chile at 9.00%) down towards the 7-8% area. This would leave them with a real policy rate somewhere near 4% and seen somewhere near neutral. And a real policy rate near 4% is still very attractive for international investors.

The problem has been the international environment, where high US yields and local currency weakness – especially in Chile – have made it difficult to cut rates as quickly as had been hoped. And it seems that Chile is re-prioritising currency stability in cancelling its FX reserve rebuild programme. We have forecasts for USD/CLP largely trading in an 800-900 range next year, with the potential for reserve accumulation to restart should USD/CLP be pressing 800 again.

That said, Chile’s large current account deficit puts its peso in a different class to those in Brazil and Mexico. The latter two have been big winners of the carry trade in 2023 and should again be recipients of those flows in 2024. Certainly, Latam implied yields should remain globally attractive in 2024 and supportive for currencies – unless domestic stories come to the fore.

When it comes to the domestic story, let’s first look at Brazil. Part of the real’s strength this year has been built on fiscal credibility once its new Fiscal Rule was passed in the summer. However, the challenge in 2024 will be that slower growth could see President Lula tempted to bypass the commitment to a zero deficit primary budget balance. That is why we see greater downside risks to the Brazilian real than the Mexican peso. At present, we see USD/BRL trading around 5.00 at end-2024.

When it comes to Mexico, the peso has quickly become the darling of the EMFX universe – offering high yields, stability and the tailwind from its proximity to the US. We still very much like the peso and do not see a threat from elections next June. Indeed, the Mexican government does have the fiscal headroom to boost growth next year. We are starting to wonder, however, if Mexican authorities consider the peso to be too strong.

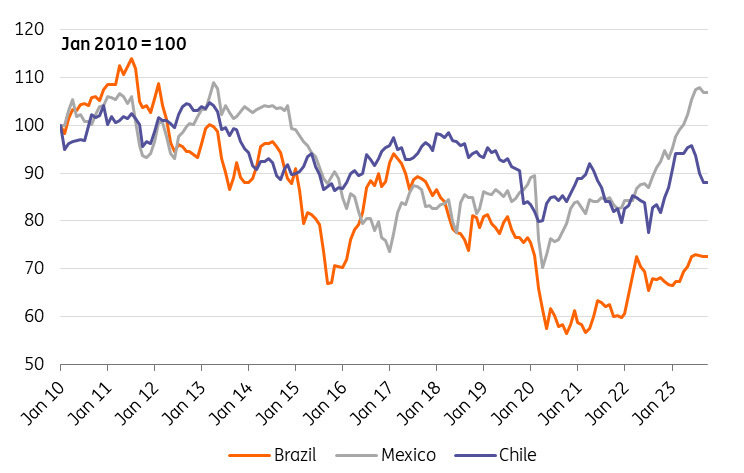

We were not so worried when Banxico in September announced plans to unwind the short dollar position in its forward book. However, its recent decision to soften its forward guidance on restrictive rates suggests it is prepared to cut before the Federal Reserve. Perhaps then, Banxico is a little concerned by peso strength (we present the real, broad trade-weighted measure of the peso below) in an environment of slowing US growth. For that reason, we are paring back our downside USD/MXN forecasts a little – even if the peso remains an attractive carry trade investment.

Latam real exchange rates: Is the Mexican peso too strong?

USD/BRL: The fiscal versus monetary trade-off

| Spot | Year ahead bias | 4Q23 | 1Q24 | 2Q24 | 3Q24 | 4Q24 | |

|---|---|---|---|---|---|---|---|

| USD/BRL | 4.86 | Neutral | 4.90 | 5.00 | 5.00 | 4.90 | 4.90 |

How far will growth slow? Brazilian growth has surprised on the upside this year. This was largely down to some strong commodity prices in Brazil’s key export markets of iron ore and soybeans. Unfortunately, our outlook for those commodities is softer next year, where both could be 10-15% weaker as the energy transition hits the steel market and China’s imports of soybeans stay soft. With domestic demand still hit by prior monetary tightening, most now expect growth to come in closer to 1.5% next year from near 3% this year. Even though Brazil’s current account deficit looks manageable and is covered by Foreign Direct Investment, lower terms of trade may hold the currency back and weak growth may see pressure build on the fiscal side – always Brazil’s Achilles heel.

Will the fiscal rule be compromised? In order to get investors onside earlier this year, the local administration passed a fiscal rule. This was a path to engineer a primary fiscal balance from -1% of GDP to +1% by 2026. The plan for 2024 was a zero deficit. However, President Lula has already started to soften up this target with words to the effect of ‘why should we curtail investment just to satisfy the market’. Weak growth and President Lula’s commitment to welfare spending warn that the fiscal rule could come under further pressure in 2024 – pulling the rug from under the real. It is not all bad news, however. Any progress on a major reform of Brazil’s convoluted consumption tax framework would be seen as a big positive.

Central bank likely to push ahead with easing: Most expect inflation in Brazil to stay subdued in the 4% area next year. While that may be above the central bank’s 3% target, it should not prevent further orderly easing from the Banco Central do Brasil (BCB). It has made clear it hopes to continue easing with 50bp adjustments, which would leave the selic policy rate at 11.75% this year and 9.75% next summer were that pace maintained. However, the market struggles to price the selic below 10% throughout the entirety of 2024. This could change if external conditions were benign (dollar weaker) and the BCB re-iterated a view that a neutral real rate for Brazil was 4.5% – probably equating to 8.5% nominal. In short, it looks like the real will be backed by a decent real rate for most of 2024. We have a conservative set of forecasts for the local currency given the fiscal risks but do acknowledge a second half 2024 scenario where USD/BRL could be trading closer to 4.50.

USD/MXN: Elections both sides of the border

| Spot | Year ahead bias | 4Q23 | 1Q24 | 2Q24 | 3Q24 | 4Q24 | |

|---|---|---|---|---|---|---|---|

| USD/MXN | 17.38 | Mildly Bearish | 17.00 | 17.00 | 16.75 | 16.75 | 16.75 |

US politics poses the greater risk: The Mexican peso has had a strong year and has only been bettered in the emerging markets space by Colombia. All conclude that Mexico’s risk-adjusted carry has been the dominant driver – plus the prospect of being a key beneficiary of nearshoring. While those medium-term factors will remain bullish for the peso, the biggest challenge in 2024 is likely to be the political cycle. Risks probably will not come from Mexico’s elections in June. Here, Claudia Sheinbaum, as President Obrador’s heir apparent, looks set to comfortably win the presidency – according to opinion polls. She represents the continuity candidate. The bigger risk to the peso comes from US elections in November. Presumably, the Republican front-runners will continue their threats against Mexico’s drug cartels and one could not rule out Donald Trump trying to pull the rug from under nearshoring strategies for Mexico. The good news is, however, NAFTA has already been re-negotiated under his prior administration.

External position is manageable: Despite strong domestic demand which has helped Mexico to grow around 3% this year, the current account position is manageable. This is expected to remain in deficit at around 1.5% of GDP over coming years and should easily be financed by FDI. Here, the focus is on whether Tesla’s decision to build a $15bn gigafactory in the State of Nuevo Leon sparks more of the same. Analysts say the government needs to do more to encourage public-private partnerships and the rule of law. However, forecasts from most are for FDI to continue growing, as US companies look to shorten supply chains and foreign companies look to build out EV production facilities – e.g. companies such as BMW and Jetour.

Banxico manages the peso well: The FX regime in Mexico is a free float, but Banxico consistently creates an environment of stability in which the peso can prosper. In what could be a difficult period in early 2024 if the US goes into recession, we doubt Banxico will want to cut rates too aggressively. However, at its November meeting, it shifted its forward guidance on restrictive rates being kept on hold from ‘an extended period’ to ‘some time’. It seems Banxico’s confidence in the disinflation process may encourage it to ease before the Fed after all. The ultimate landing path for the 11.25% policy rate may be somewhere in the 7-8% area, though we doubt Banxico would want to see the policy spread to the US narrow from its current 575bp to inside of 400/425bp. This potentially opens up 150bp of easing pre-Fed. That would still leave MXN implied yields above 10% and if we are right with our call for a weaker dollar next year, 16.50 levels for USD/MXN should be in reach.

USD/CLP: Reserve rebuild Take Two

| Spot | Year ahead bias | 4Q23 | 1Q24 | 2Q24 | 3Q24 | 4Q24 | |

|---|---|---|---|---|---|---|---|

| USD/CLP | 902.00 | Bearish | 900.00 | 875.00 | 850.00 | 850.00 | 850.00 |

Chile will try to rebuild FX reserves again: Last November in our 2023 FX outlook, we said that Chile would probably need to rebuild FX reserves and USD/CLP would struggle to trade under 900. We had the right call on the FX reserve rebuild, but the threshold proved to be 800 not 900. Unfortunately for the central bank, tough global conditions forced it to abandon plans this October to rebuild FX reserves by $10bn. This was when USD/CLP was close to 950. If we are right with our call for slightly more benign global conditions in 2024 – lower US rates, lower dollar – we suspect the central bank will again try to build FX reserves. We also presume that it will roll its $18bn Flexible Credit Line from the IMF. This was always seen as precautionary, but it seems too early to forgo it.

Policy rate heading for 7.75/8.00%: The same forces which derailed the central bank’s reserve accumulation plan also derailed the easing cycle. The central bank had targeted rate cuts to the 7.75/8.00% by year-end 2023. However, with just a 50bp rate cut in October, that target looks unlikely with just one more meeting to go. With growth potentially contracting by 0.2% in 2024, according to consensus, expect the central bank to use every opportunity to take rates lower. We imagine the central bank’s easing cycle will grow in confidence as 2024 progresses and do not disagree with year-end 2024 pricing of the policy rate at 6.00% versus 9.00% today. That would still leave the real policy rate at around 2.00/2.50% and should help to keep USD/CLP at the lows near 800 in the second half of 2024.

Copper, China, etc: Chile has struggled with copper exports over recent years and copper production is not expected to exceed 2018 levels until 2027. Our commodities team sees copper prices flat to lower next year and in total we suspect Chile’s copper exports will be slightly lower in 2024. Obviously, the copper story will also be driven by the outlook for Chinese demand, where any calls for a V-shape recovery are conspicuous by their absence. As to whether Chile’s deposits of Lithium can present a very welcome alternative to Chile’s export portfolio, our team has its doubts. Lithium prices are down drastically this year and fast-changing designs for EV batteries question whether Lithium demand endures.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

15 November 2023

FX Outlook 2024: Waiting for the tide to come in This bundle contains 7 Articles