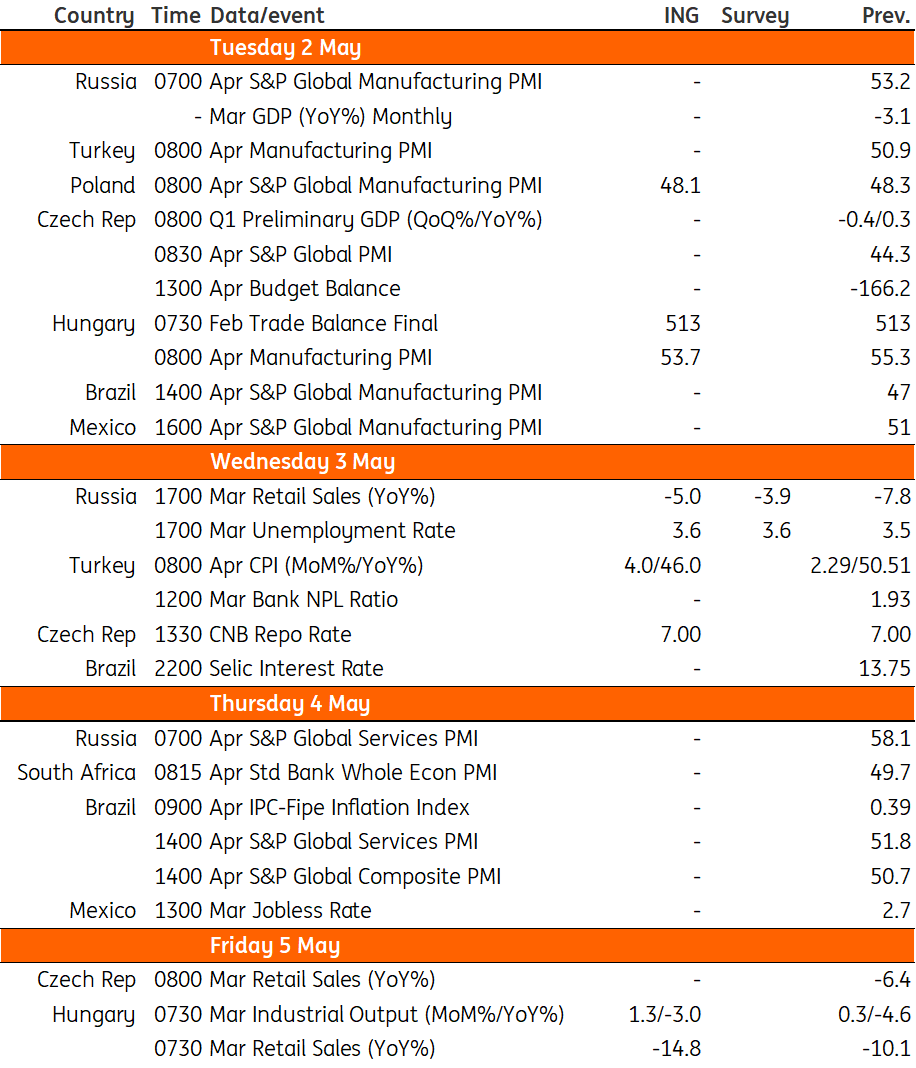

Key events in EMEA next week

Expect the Czech National Bank to keep rates on hold, while activity data in Hungary points to an ongoing technical recession

Czech Republic: CNB to keep rates unchanged

The Czech National Bank will likely keep its interest rate unchanged at 7%. The future development of wages and the government's strategy for fiscal consolidation will play a crucial role in any decision to ease monetary policy. We expect the CNB's statement to remain hawkish, stressing the risks associated with the tight labour market, wage growth increases and deteriorating public finances. On the one hand, CNB can feel more comfortable with the gradual decline of both headline and core inflation. Core inflation has declined gradually from 14.7% in September to 11.5% in March. However we've still seen hefty growth of industry wages at the beginning of the year, exceeding 10% YoY. The lingering tightness of the labour market was also confirmed by a decline in the unemployment rate of 0.2bp to 3.7% in March.

The other issue is the adverse development of the country's fiscal stance. In March the state budget reached a deficit of CZK166.2bn, which was historically the worst March result, jeopardizing the government's plan for this year of a deficit of CZK295bn. Therefore, we expect the CNB to stay vigilant and follow those trends before the looking at rate cuts.

Hungary: Painful retail sales points to continued technical recession

The highlight day in Hungary is Friday, when the Statistical Office will release the March industrial production and retail sales data. We expect industry to remain divided. On one hand, with easing supply chain concerns, we expect a further improvement in the production numbers in car and electronic products, and also in electrical equipment (EV batteries). On the other hand, with domestic demand shrinking at a significant pace, the domestically-focussed industrial sectors will continue to suffer. In total, we're expecting 1.3% MoM growth, but on a yearly basis, this will still mark a 3% drop in industrial production volumes.

The really painful story however comes from retail sales. Given the high base in fuel retailing, we're expecting total retail sales volumes to drop by almost 15% on a yearly basis. But even if we exclude fuel sales, we still think we could get a double-digit dip in retailing turnover due to the evaporating purchasing power of households. With that in mind, we can be sure that the technical recession has continued in Hungary during the first quarter of 2023.

Turkey: Inflation to slip further to 46%

Annual inflation continued its downtrend to 50.5% in March, and will likely do the same in April, slipping to 46% (or 4.0% on a monthly basis). This is attributable to large base effects. While the outlook is quite uncertain for the rest of 2023, a Lira adjustment post-election and potential adjustments in wages and administered prices will likely weigh on inflation momentum.

Key events next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 April 2023

Our view on next week’s key events This bundle contains 3 Articles