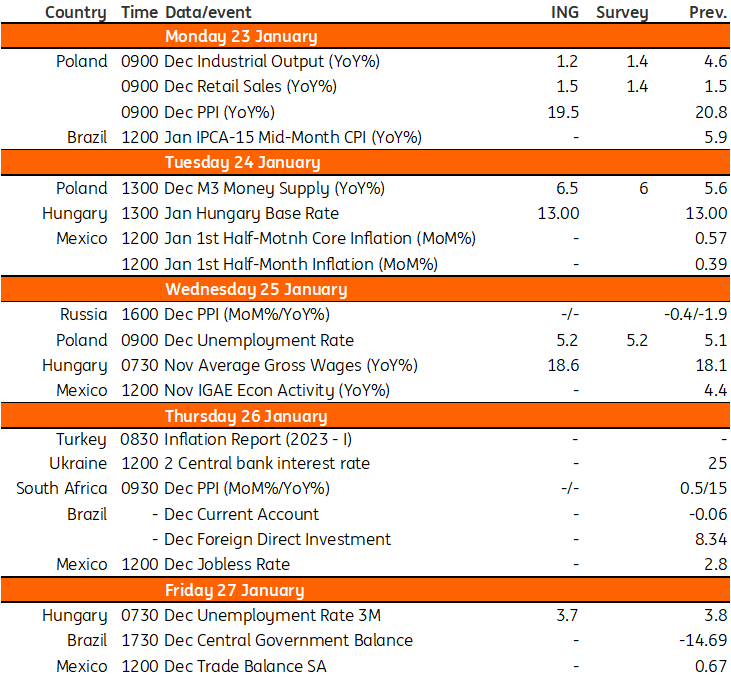

Key events in EMEA next week

In Poland, we estimate that December unemployment inched up to 5.2% for seasonal reasons though the labour market remains strong. Inflationary pressure should continue to moderate, with the December Producer Price Index expected to be at 19.5%. For the first rate-setting meeting in Hungary next week, we expect the base rate to remain at 13%

Poland: Further cooling in economic activity

The final set of monthly data for the fourth quarter is expected to show signs of further cooling in economic activity. We forecast that both industrial output and retail sales expanded only slightly more than 1% year-on-year last month. Retail sales are under pressure from declining real wages, despite additional demand from refugees which has supported sales of necessities (food, clothing). Industry is slowing alongside weaker activity in Europe, however, the improved functioning of supply chains has lifted some sectors (e.g. automotive). We think that inflationary pressures continued to moderate, but PPI inflation remained very high in December. Monetary developments reflect tighter economic conditions. With the main National Bank of Poland policy rate at 6.75%, new housing loans have been some 70% lower than last year in recent months. The labour market remains sound with few signs of any deterioration as a result of slowing growth. The limited availability of workers is keeping unemployment low. We estimate that in December, registered unemployment inched up to 5.2% from 5.1% in November on the back of seasonal factors.

Hungary: No monetary policy pivot yet

Next week’s event calendar in Hungary is dominated by the first rate-setting meeting of the National Bank of Hungary in 2023. The Monetary Council wants to see an improvement in the trend of risk perceptions, along with improving external and internal balances. Regarding the latter, though we’ve seen a downside surprise in inflation in December, the peak is still ahead of us with further upside risks. An improvement in the current account balance is not yet visible. The forint's darkest days may be over but the valuation of the currency remains exceptionally fragile in our view. Any premature hint at a monetary policy pivot (stepping away from the hawkish “whatever it takes” stance) might trigger a renewed sell-off in local assets. Against this backdrop, we see the central bank sticking with its recent playbook, changing nothing. The second half of the week will bring some labour market data, where we might see wage growth accelerating further in November as companies have been reacting to the wage demands of employees in a high-inflation environment amid a tight labour market. The latter might be proven with a broadly unchanged unemployment rate in December.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

20 January 2023

Our view on next week’s key events This bundle contains 3 Articles