Key events in EMEA next week

Look out for increased FX purchases in Russia, signs of strong economic activity in Hungary, and persistent inflation in Turkey

Russia: Important data releases for FX and rates markets

On Wednesday, the Russian Finance Ministry is likely to announce an increase in monthly FX purchases from US$4.0 bn in July to US$4.3-4.5 bn for August, reflecting higher oil prices. Higher FX purchases combined with the possible conversion of corporate dividends, an acceleration of merchandise imports, and the reopening of outward tourism could make August a difficult month for the ruble. At the same time, some support may come from portfolio inflows into the local currency public debt (OFZ) following the recent Bank of Russia key rate decision. Also, the recent discussion on the potential US$12 bn investment out of the local sovereign wealth fund (NWF) into Gazprom projects in 2021-23, combined with the earlier three-year plans to invest US$19 bn into other local infrastructure projects could potentially lead to a cut in FX purchases by up to $10 bn per year, starting in 2021. This could be a potential catalyst for some improvement in the mood towards the ruble in the medium term.

On Thursday, CPI for July will be reported. We expect a slight pickup in the annual rate to 6.6% year-on-year vs. 6.5% YoY a month prior. According to the weekly data, since mid-July, price growth has stopped due to seasonal factors related to deflation in the fruit and vegetable segment, while upward price pressures in gasoline and other important items remain. As a result, while we do believe that inflation is approaching its peak, the risks of further negative surprises remain for the medium term. For now, the CPI trajectory seems to confirm our expectations of a key rate ceiling in the 6.5-7.0% range, to be reached soon, though upside risks to that view remain.

Hungary: Strong performance expected in retail sales and industrial production

In Hungary, we expect June to show some strong improvement over the previous month in economic activity. On one hand, this is supported by the reopening. On the other hand, the EURO 2020 itself and the fact that Budapest was a host with full stadiums and tourists should provide a huge boost to consumption. We expect this to show up in retail sales, although last year’s high base will mask this improvement. Regarding industry, surveys showed improving optimism, so we expect another strong month in production, but yet again the high base will dampen the year-on-year performance. Industry can build on this strong performance, so we see the PMI showing further improvement ahead.

Turkey: Continued uptrend in inflation

July inflation in Turkey should maintain its uptrend, not only because of broad-based pricing pressures in June amid the easing of pandemic control measures, but also because of recent increases in natural gas and electricity prices which will have significant direct and indirect effects. We expect 1.4% growth month-on-month, translating into 18.4% annual inflation, up from 17.5% a month ago.

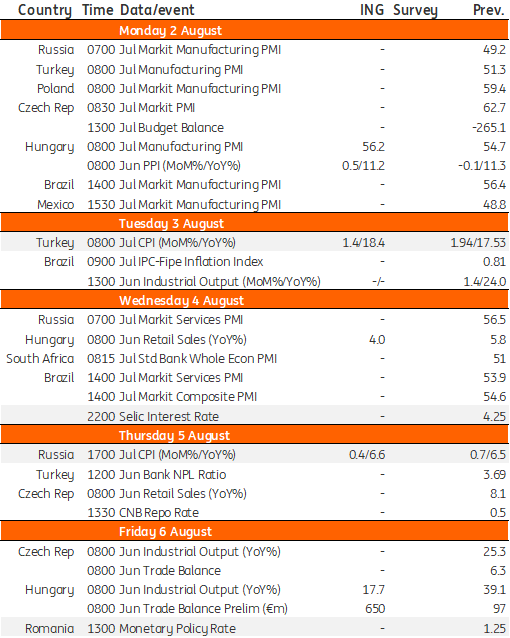

EMEA Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

30 July 2021

Our view on next week’s key events This bundle contains 3 Articles