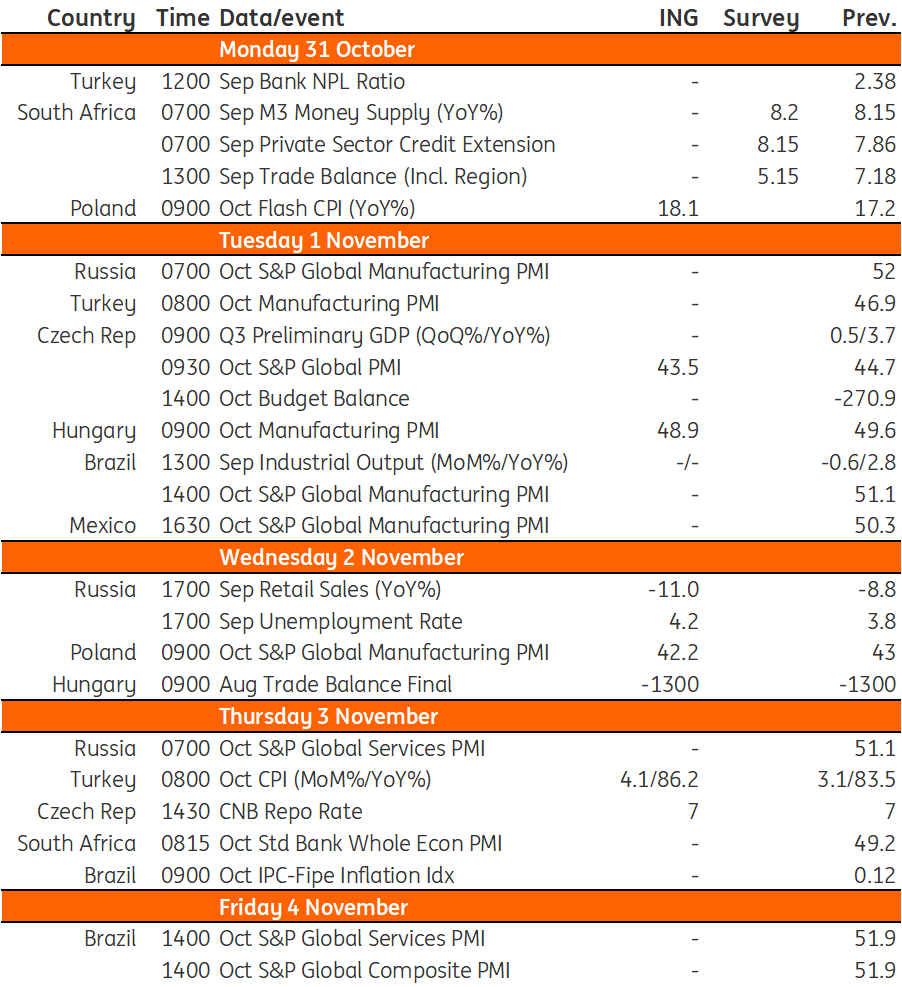

Key events in EMEA next week

The third monetary policy meeting under the new Czech National bank will take place next Thursday. We believe interest rates will remain unchanged, as inflation is expected to be revised downward. On the other hand, Turkish and Polish inflation has continued to trend upward, and we see no signs of it levelling off soon

Turkey: Annual inflation expected to increase further

In October, we expect annual inflation to further increase to 86.2% (4.1% on a monthly basis) from 83.5% a month ago, given continuing broad-based pricing pressures on the back of a largely supportive policy framework along with less gradual currency weakness weighing on TRY-denominated import prices.

Poland: No signs of polish inflation levelling off soon

October CPI: 18.1% year-on-year

Our forecasts indicate that CPI inflation increased further in October and probably slightly exceeded 18% year-on-year on the back of a sharp monthly increase in petroleum prices and further growth of energy and food prices. At the same time, we expect that core inflation continued trending upward. There are no signs of inflation levelling off soon and the momentum of core inflation remains high.

October Manufacturing PMI: 42.2 percentage points

Following a surprising upswing in manufacturing PMI in September, we expect the assessment of conditions in the domestic industry by purchasing managers to deteriorate again in October. Although supply-side bottlenecks eased recently and the energy outlook for the European industry is less challenging, elevated prices and softer global demand (decline in new orders) are projected to continue weighing on manufacturing activity in the coming quarters.

Czech Republic: CNB rates set to remain unchanged, again

The third monetary policy meeting under the new Czech National Bank (CNB) leadership will take place on Thursday. We expect interest rates to remain unchanged. Thus, the central bank's new forecast will be the main focus. Compared to the August forecast, we see the biggest deviation in inflation, which surprised to the downside. In September, this deviation came in at 2.4 percentage points. Therefore, here we can expect the biggest downward revision in the new forecast. Nevertheless, the interest rate forecast can be expected to remain roughly similar to the CNB's summer version, indicating a rate cut in the next quarter due to the nature of the central bank's model.

On the FX side, we don't expect much change in the forecast weakening trajectory of the koruna under the pressure of the declining interest rate differential. However, we don't see much implication for FX interventions, which are fully decoupled from the CNB forecast and depend only on the discretionary decision of the board. But, at the moment, we see the CNB in a comfortable position with no reason to change anything about the current regime. In the long run, we do not expect any further CNB rate hikes. Despite the board's highlighting of the wage-inflation risk, we believe that the stability or decline in annual inflation combined with a weaker economy will be enough in the coming months for the CNB to confirm the end of the rate hike cycle at future meetings. Read our full CNB preview here.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

28 October 2022

Our view on next week’s key events This bundle contains 3 Articles