Key events in EMEA next week

Several releases from Hungary should maintain the optimistic sentiment next week while price pressures in Turkey are likely to remain but GDP data should show strength and Russia is expected to increase FX interventions to US$2.6bn in June

Hungary: Upbeat data across the board

Hungarian manufacturing purchasing managers' index will reflect the recent upbeat global sentiment on the economic rebound, suggesting a significant improvement in manufacturing performance going forward. We'll also get April retail sales data, which will be affected by the low base and the gradual reopening process, which started in April.

Finally, we'll see the details behind the astounding first-quarter economic activity, and we think the main surprise will be from the domestic demand side (mainly from investments).

Turkey: Price pressures remain elevated

We expect pricing pressures to remain high with annual inflation standing flat at 17.1% in May (1.3% on monthly basis), in comparison to a month ago.

This is down to the government’s decision to pass some of the recent energy price increases to consumers, continuing cost-push effects and worsening inflation expectations while risks are on the upside given uncertainties in price adjustments with the reopening in the economy. 1Q growth, on the other hand, will likely be strong at 6.2% YoY including base effects, though sequential growth is expected to lose momentum given the impact of pandemic restrictions, and tightening policy framework.

Russia: Increase in FX interventions and positive activity data

On 3 June, the Russian finance ministry is likely to announce an increase in FX interventions from US$1.7 bn in May to US$2.6bn in June, following an increase in the average monthly Urals price by US$4/bbl. Given the stabilisation of oil prices amid Iranian nuclear deal expectations, the temporary sweet spot for rouble in May, is most likely coming to an end.

In other news, the Russian statistics agency, Rosstat will hopefully release the complete set of activity data for April after the significant delay.

To remind you all, we expect those to be strong, mainly on the back of low base effects, as April - May 2020 were the only two months of strict lockdowns in Russia. We expect retail trade, which may show at least 24% YoY growth, to have benefitted from a lack of foreign tourism and higher leverage, confirmed by the recent banking statistics. Meanwhile, the recently published industrial output data was even stronger than expected, suggesting an upside risk to the forecasts.

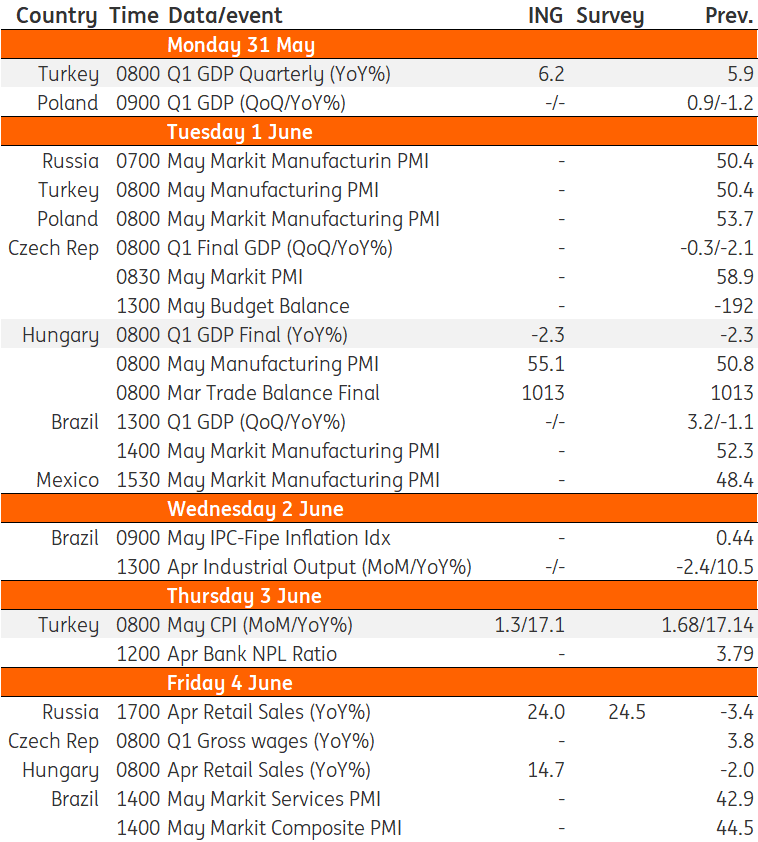

EMEA Economic Calendar

Download

Download article

28 May 2021

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more