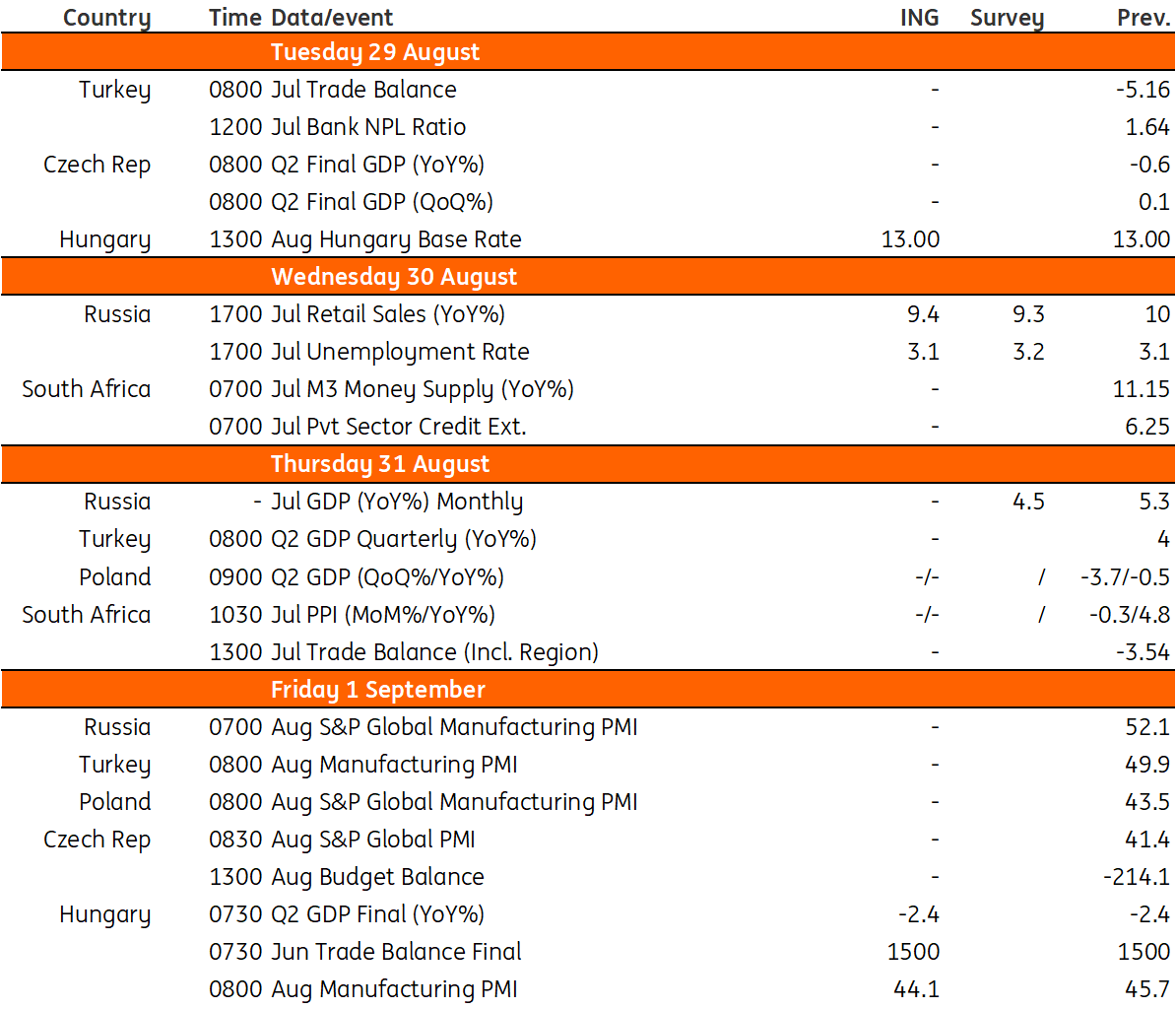

Key events in EMEA next week

We expect the National Bank of Hungary to cut the effective rate again next week by 100bp while giving hawkish forward guidance to manage market expectations. All eyes are on Poland as slowing growth in food and energy prices is expected to ease up CPI dynamics in August

Hungary: Expectation for central bank to cut the effective rate by 100bp

Next week the National Bank of Hungary (NBH) will hold its August meeting, in which we expect it to cut the effective rate by 100bp. But what the central bank changes in its forward guidance will be more interesting than the rate decision itself. We see the NBH using the meeting to manage market expectations for monetary policy in the fourth quarter and we expect a lot of hawkish flavour.

After a few days of rest, events pile up on the last day of the week. We expect the Statistical Office to reveal in its detailed data release that weaker-than-expected second-quarter GDP growth was due to a disappointing performance in services and a weaker positive contribution from agriculture. The August manufacturing PMI will be in line with the disappointing European figures, in our view, suggesting further weakness in industry during the third quarter.

Last but not least, Moody’s scheduled sovereign rating review comes on 1 September. As the rating agency skipped the past two occasions to release a review note, we expect one this time in parallel with an outlook downgrade from stable to negative, but affirming the Baa2 grade.

Poland: CPI dynamics expected to slow further in August

We expect the Central Statistics Office to confirm the flash second-quarter GDP print of -0.5% year-on-year, following -0.3% in the first quarter. Data available since the flash reading show that investments likely came even stronger than in the first quarter. Large companies reported robust capital outlays in the second quarter, which is usually a very good proxy for private investment.

At the same time, public investment was likely strong as well, driven by the completion of EU-backed infrastructure projects in the final year of the ‘old’ EU budget. This in turn suggests that other parts of internal demand became weak, particularly private consumption. A lacklustre global environment (i.e. dismal German industry performance), as well as signs of weakening in the Polish labour market suggest that the GDP recovery will be slow later this year and we will not see a markedly better economic performance before the final quarter of the year.

We expect CPI dynamics to slow further in August, to around 10% YoY from 10.8% a month earlier. This mainly reflects slowing growth in food and energy prices. Even if August inflation remains in double digits, we believe that the Monetary Policy Council will decide to cut rates in September. CPI is set to slow further in the following months, given strong base effects, PPI deflation (driven by lower energy prices and trends in global supply chains), as well as still lacklustre household consumption.

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

25 August 2023

Our view on next week’s key events This bundle contains 3 Articles